TELUS (TU) Updates 2023 Guidance Amid TI's Revised Outlook

TELUS Corporation TU has provided an update on its annual guidance for 2023, influenced by the revised outlook of its subsidiary — TELUS International (TI).

TI's updated outlook reflects a lower-than-expected demand from certain clients in the technology industry, resulting in revised revenue projections ranging from $2.7 billion to $2.73 billion and adjusted EBITDA estimates between $575 million and $600 million. As a result, TELUS has adjusted its targets.

TELUS holds the controlling share in TI and consolidates its financial results through TELUS' DLCX operating segment. TELUS is now aiming for consolidated operating revenue growth of 9.5% to 11.5% (previously 11% to 14%) and adjusted EBITDA growth of 7% to 8% (previously 9.5% to 11%).

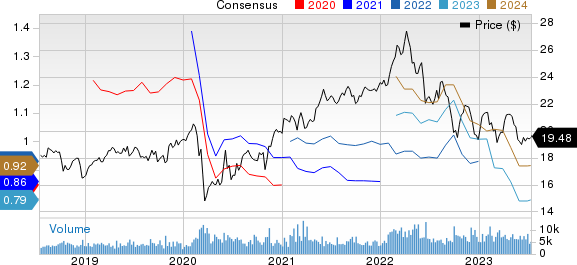

TELUS Corporation Price and Consensus

TELUS Corporation price-consensus-chart | TELUS Corporation Quote

Despite the near-term challenges, TELUS expects TI to benefit from digital transformation, GenAI adoption and differentiated digital customer experience solutions. Notably, the financial guidance for its TTech operating segment remains unchanged for 2023.

In addition to the guidance update, TELUS shared positive operating metrics for its TTech business segment, demonstrating strong customer growth in the second quarter of 2023. Total mobile and fixed customer additions reached 293,000, indicating an increase of 46,000 compared with the previous year, representing the segment's strongest second quarter to date. This growth was fueled by high demand for TELUS' extensive portfolio of mobility and fixed services, supported by a superior customer experience and leading wireless and wireline broadband PureFibre networks.

TELUS' TTech segment experienced robust net additions in mobile phone customers, with 110,000 new subscribers, representing a rise of 17,000 year over year. The company will release its second-quarter results on Aug 4.

TELUS is one of the largest telecom carriers in Canada (the largest in western Canada), covering 95% of the country’s population. TU provides wireless, wireline and Internet communications services for voice and data to businesses and consumers.

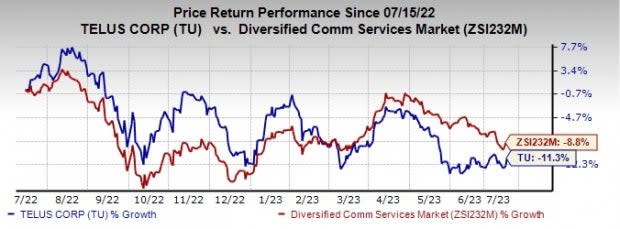

At present, TELUS carries a Zacks Rank #3 (Hold). The stock has lost 11.3% compared with the sub-industry’s decline of 8.8% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are InterDigital IDCC, Badger Meter BMI and Woodward WWD. InterDigital and Woodward sport a Zacks Rank #1 (Strong Buy), while Badger Meter carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for InterDigital’s 2023 earnings per share (EPS) has increased 62.6% in the past 60 days to $8.08. The company’s long-term earnings growth rate is 13.9%.

InterDigital’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 170.9%. Shares of IDCC have rallied 52% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 1.1% in the past 60 days to $2.72.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 81.3% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 3.8% in the past 60 days to $3.58.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 12% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TELUS Corporation (TU) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report