Tempest (TPST) Up as First-Line Liver Cancer Study Meets Goals

Tempest Therapeutics TPST stock skyrocketed 2879% after it announced positive new data from its global phase Ib/II first-line liver cancer study, evaluating TPST-1120, in combination with the standard-of-care (SOC) therapy.

The phase Ib/II study evaluated TPST-1120 plus Roche’s RHHBY standard-of-care combination therapy, Tecentriq (atezolizumab) and Avastin (bevacizumab), in the first-line treatment of patients with unresectable or metastatic hepatocellular carcinoma (HCC).

The updated findings confirmed the clinical superiority of TPST-1120 in multiple study endpoints when combined with Tecentriq and Avastin in the early-mid-stage HCC study, as indicated in the initial results from the same study reported by the company in April 2023. Tempest and Roche expect to jointly present the study findings at an upcoming medical conference.

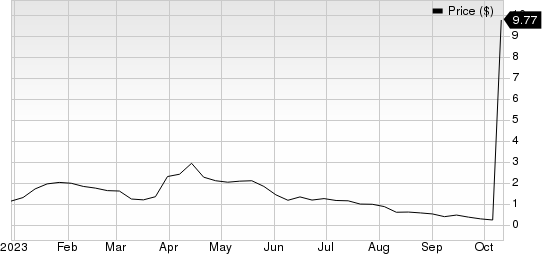

Tempest Therapeutics, Inc. Price

Tempest Therapeutics, Inc. price | Tempest Therapeutics, Inc. Quote

TPST-1120, a PPAR-alpha antagonist, is being developed in collaboration with Roche. The phase I/IIb HCC study is part of RHHBY’s MORPHEUS program, comparing the efficacy of the triple combination therapy of TPST-1120, Tecentriq and Avastin (triplet arm) with the current SOC Tecentriq and Avastin (control arm) therapy in HCC treatment.

Per the terms of the collaboration agreement, Roche manages the operations for the global study while Tempest retains all product rights to TPST-1120.

The phase I/IIb study enrolled a total of 70 patients, who were randomized into the triplet arm and the control arm in the ratio of 4:3, with a median follow-up of 9.2 and 9.9 months, respectively.

Per the data readout, the triplet arm achieved a confirmed objective response rate (cORR) of 30% compared with 13.3% in the control arm of the phase Ib/II study. The study has yet to reach the duration of response (DoR) endpoint.

Furthermore, the triplet arm observed a median progression-free survival of seven months compared with 4.27 months in the control arm. The median overall survival endpoint was not reached in the triplet arm. However, in both these key survival endpoints, the hazard ratio favors the TPST-1120 arm.

Additionally, new biomarker findings in a subpopulation of patients with a beta-catenin mutation in the study demonstrated the superiority of the triplet therapy compared with the SOC therapy for cORR (43%) and disease control rate (100%).

TPST also reported that the investigational candidate was well tolerated in the study, with safety data comparable between the two arms.

Per Tempest, the secondary endpoints of DoR, PFS and OS are not yet mature as of the freeze data for the phase Ib/II HCC study data analysis.

Based on the impressive efficacy of TPST-1120 in the phase Ib/II MORPHEUS study, the company is gearing up to move TPST-1120 into a pivotal study in the first-line treatment of HCC. TPST is looking to hold discussions with other key players in the oncology market to partner up for the advancement of the TPST-1120 program.

Tempest is also currently evaluating TPST-1120, as monotherapy or in combination, in other oncology indications in separate early-mid-stage studies.

In a separate press release, Tempest also announced adopting a limited-duration stockholder rights plan, effective immediately. Per the company, the purpose of this rights plan is to ensure that the company’s shareholders can realize the long-term value of their investment.

The rights plan safeguards the company and its shareholders from any third party gaining control of Tempest by poaching its shares in the open market without paying all stockholders an appropriate control premium or by depriving the board of sufficient time to make informed decisions and take actions that are in the best interests of all stockholders.

Zacks Rank and Stocks to Consider

Tempest currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are Dynavax Technologies DVAX and Corcept Therapeutics CORT. Currently, DVAX sports a Zacks Rank #1 (Strong Buy) and CORT carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 24 cents to 23 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 3 cents. Year to date, shares of DVAX have gained 36.5%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

In the past 30 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has remained constant at 78 cents. During the same period, the estimate for Corcept’s 2024 earnings per share has also remained constant at 83 cents. Year to date, shares of CORT have gained 35.8%.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Tempest Therapeutics, Inc. (TPST) : Free Stock Analysis Report