Tempur Sealy International Inc: A Strong Performer with Good Outperformance Potential

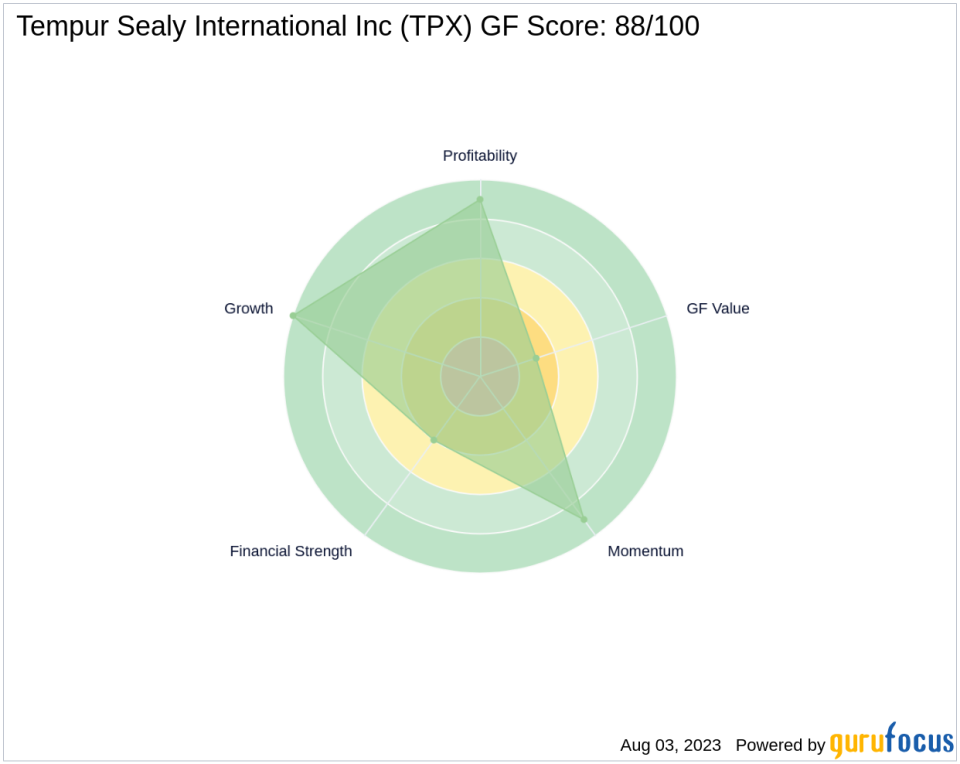

Tempur Sealy International Inc (NYSE:TPX), a leading player in the Furnishings, Fixtures & Appliances industry, is currently trading at $45.39 with a market capitalization of $7.81 billion. The company's stock has seen a gain of 4.34% today and a significant increase of 15.29% over the past four weeks. According to GuruFocus, Tempur Sealy International Inc has a GF Score of 88 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system that considers five key aspects of valuation: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

Tempur Sealy International Inc has a Financial Strength Rank of 4/10. This rank measures the robustness of a company's financial situation, considering factors such as its debt burden, debt to revenue ratio, and Altman Z-Score. Tempur Sealy's interest coverage stands at 5.37, indicating its ability to cover its interest expenses. The company's debt to revenue ratio is 0.71, suggesting a moderate level of debt relative to its revenue. Its Altman Z-Score of 3.55 indicates a low risk of bankruptcy.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its strong profitability. The rank is based on factors such as operating margin, Piotroski F-Score, trend of the operating margin, consistency of profitability, and Predictability Rank. Tempur Sealy's operating margin is 12.61%, and its Piotroski F-Score is 5, indicating a healthy financial situation. The company has shown consistent profitability over the past 10 years, with a 5-year average operating margin of 11.10%.

Growth Rank Analysis

Tempur Sealy International Inc has a perfect Growth Rank of 10/10, reflecting its strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 19.40%, and its 3-year revenue growth rate is 24.90%. Its 5-year EBITDA growth rate is an impressive 27.60%, indicating robust growth in its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 3/10, suggesting that the stock is currently overvalued. The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

Tempur Sealy International Inc has a high Momentum Rank of 9/10, indicating strong price momentum. The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

Tempur Sealy International Inc's main competitors in the industry include Whirlpool Corp (NYSE:WHR), Mohawk Industries Inc (NYSE:MHK), and Leggett & Platt Inc (NYSE:LEG). Compared to its competitors, Tempur Sealy International Inc has a higher GF Score, indicating stronger potential for outperformance.

Conclusion

In conclusion, Tempur Sealy International Inc's overall GF Score of 88/100 suggests good outperformance potential. The company's strong profitability, robust growth, and high momentum rank contribute to its high GF Score. However, its relatively low financial strength and GF Value ranks indicate areas for potential improvement. Investors should keep a close eye on these factors when considering Tempur Sealy International Inc as a potential investment.

This article first appeared on GuruFocus.