Tempur Sealy's (NYSE:TPX) Posts Q4 Sales In Line With Estimates

Bedding manufacturer Tempur Sealy (NYSE:TPX) reported results in line with analysts' expectations in Q4 FY2023, with revenue down 1.4% year on year to $1.17 billion. It made a non-GAAP profit of $0.53 per share, down from its profit of $0.54 per share in the same quarter last year.

Is now the time to buy Tempur Sealy? Find out by accessing our full research report, it's free.

Tempur Sealy (TPX) Q4 FY2023 Highlights:

Revenue: $1.17 billion vs analyst estimates of $1.18 billion (small miss)

EPS (non-GAAP): $0.53 vs analyst expectations of $0.54 (2.6% miss)

Free Cash Flow of $59 million, down 68.6% from the previous quarter

Gross Margin (GAAP): 43.8%, up from 42.1% in the same quarter last year

Market Capitalization: $8.83 billion

Chairman and CEO Scott Thompson commented, "We are pleased with our fourth quarter and full year 2023 financial performance, especially in light of the soft demand within the bedding category. We believe the Company outperformed the category."

Established through the merger of Tempur-Pedic and Sealy in 2012, Tempur Sealy (NYSE:TPX) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

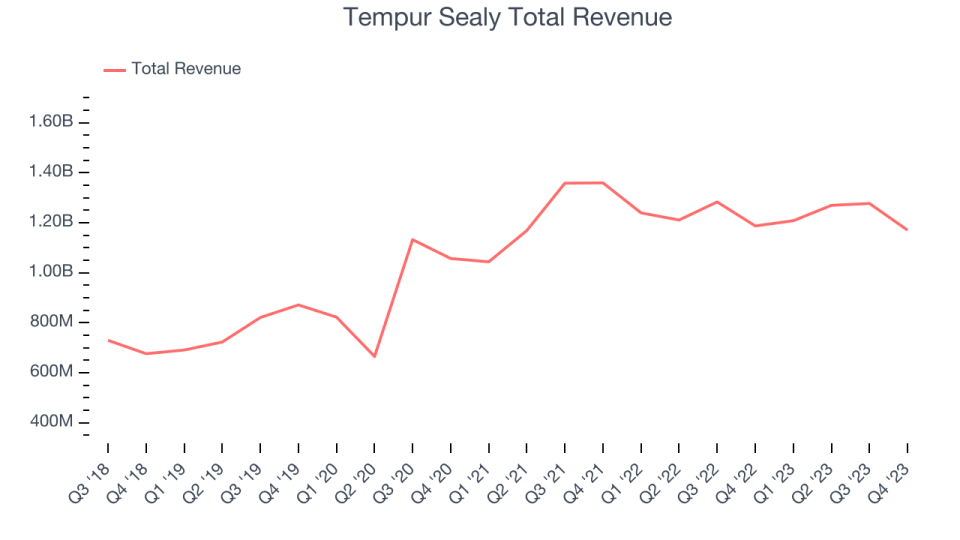

Exploring a company's long-term performance can offer valuable insights into its business quality. Any business can experience brief periods of success, but distinguished ones maintain steady growth over time. Tempur Sealy's annualized revenue growth rate of 12.8% over the last 5 years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Tempur Sealy's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years.

We can understand the company's revenue dynamics even better by analyzing its most important segments, Wholesale and Direct, which are 74.3% and 25.7% of revenue. Over the last 2 years, Tempur Sealy's Wholesale revenue (sales to retailers) averaged 3.4% year-on-year declines. On the other hand, its Direct revenue (sales made directly to consumers) averaged 21.3% growth.

This quarter, Tempur Sealy reported a rather uninspiring 1.4% year-on-year revenue decline to $1.17 billion of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

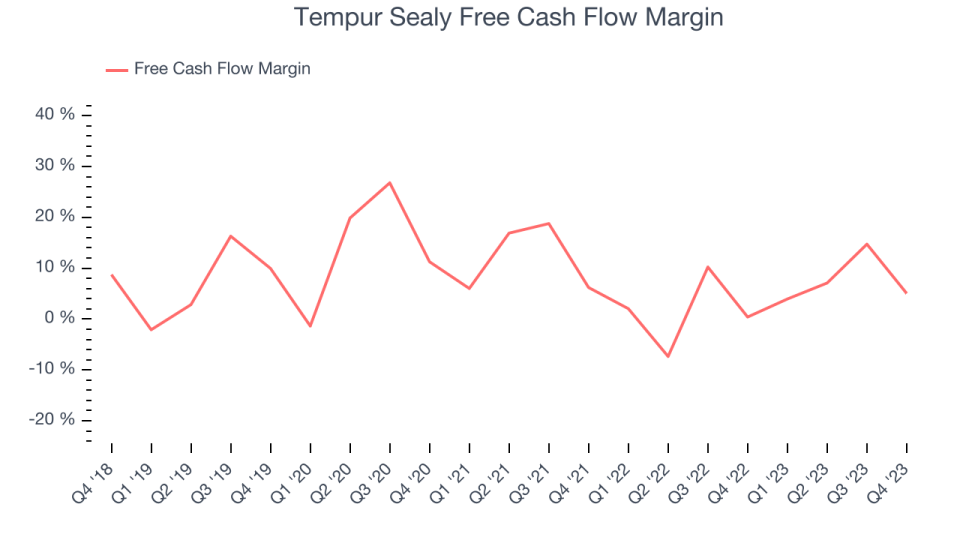

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Tempur Sealy has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.5%, subpar for a consumer discretionary business.

Tempur Sealy's free cash flow came in at $59 million in Q4, equivalent to a 5% margin, up 1,129% year on year. Over the next year, analysts predict Tempur Sealy's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 7.8% will increase to 10.1%.

Key Takeaways from Tempur Sealy's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS missed analysts' expectations, driven by sales declines in North America. The company's international growth clocked in above estimates, but its outperformance wasn't enough to move the needle.

Tempur Sealy also increased its quarterly dividend to $0.13 per share, which will be payable on March 7, 2024 to shareholders of close on February 22, 2024. The company's dividend has roughly doubled since its 2021 initiation. Looking ahead, management's full-year 2024 EPS guidance underwhelmed in light of soft demand within the bedding category.

Overall, this was a mixed quarter for Tempur Sealy. The company is down 2.1% on the results and currently trades at $50.22 per share.

Tempur Sealy may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.