Tenable Holdings Inc (TENB) Reports Solid Revenue Growth and Improved Non-GAAP Profitability in ...

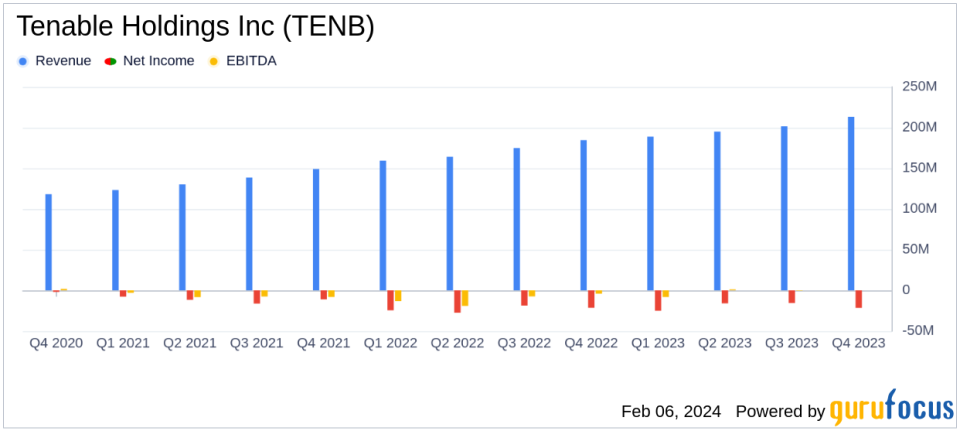

Revenue Growth: Q4 revenue increased by 16% year-over-year to $213.3 million; full year revenue up 17% to $798.7 million.

Non-GAAP Income Surge: Non-GAAP income from operations for Q4 stood at $36.1 million, a significant rise from $19.9 million in the same quarter last year.

Net Loss: GAAP net loss remained flat year-over-year for Q4 at $21.6 million; full year net loss improved to $78.3 million from $92.2 million in 2022.

Earnings Per Share: Non-GAAP diluted earnings per share doubled to $0.25 in Q4 from $0.12 in the prior year's quarter.

Free Cash Flow: Unlevered free cash flow for the full year increased to $175.4 million, up from $128.1 million in 2022.

Customer Growth: Added 597 new enterprise platform customers and 156 net new six-figure customers in Q4.

On February 6, 2024, Tenable Holdings Inc (NASDAQ:TENB), a leader in the cybersecurity industry, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The Maryland-based company, known for its Nessus software, has expanded its portfolio to include a range of exposure management solutions, catering to a broad spectrum of cybersecurity needs.

Financial Performance and Challenges

Tenable's Q4 revenue saw a healthy increase to $213.3 million, marking a 16% growth compared to the same period last year. This uptick reflects the company's successful expansion into cloud security, identity management, and operational technology security. Despite this growth, Tenable reported a GAAP net loss of $21.6 million for the quarter, mirroring the loss from Q4 of the previous year. The consistent net loss underscores the competitive nature of the cybersecurity market and the ongoing investments Tenable is making in research and development, as well as market expansion.

For the full year, Tenable's revenue climbed to $798.7 million, a 17% increase from 2022. The company's focus on innovation and customer acquisition has paid off, as evidenced by the addition of 597 new enterprise platform customers and 156 net new six-figure customers in the fourth quarter alone. However, the company's GAAP loss from operations for the year was $52.2 million, an improvement over the $67.8 million loss in 2022, indicating that while Tenable is growing, it is also facing the challenge of managing its operating expenses to achieve profitability.

Financial Achievements and Industry Significance

Tenable's non-GAAP income from operations for Q4 was a notable $36.1 million, more than doubling from $19.9 million in the fourth quarter of 2022. This significant improvement in non-GAAP profitability is a testament to the company's ability to scale its operations efficiently while continuing to invest in growth opportunities. The non-GAAP diluted earnings per share also saw a substantial increase to $0.25, up from $0.12 in the prior year's quarter, reflecting the company's improved operational efficiency and the strategic value of its expanded product offerings in the software industry.

The full year's unlevered free cash flow stood at $175.4 million, a considerable increase from $128.1 million in 2022. This metric is particularly important as it indicates the company's ability to generate cash while maintaining its capital structure, which is crucial for sustaining growth and potential future investments or acquisitions.

Key Financial Metrics

Examining the income statement, Tenable's full year non-GAAP net income surged to $97.2 million, a significant leap from $44.3 million in 2022. The balance sheet shows the company's cash and cash equivalents, and short-term investments totaled $474.0 million at the end of 2023, down from $567.4 million the previous year. This decrease is likely due to the company's strategic investments in growth and product development.

The cash flow statement reveals that net cash provided by operating activities for the full year was $149.9 million, an increase from $131.2 million in 2022. This growth in operating cash flow underscores Tenable's solid operational execution and its ability to convert earnings into cash effectively.

"We delivered a strong Q4, including better-than-expected results on the top and bottom line," said Amit Yoran, Chairman and CEO of Tenable. "Underpinning our results was strength in Tenable One, driven by strong adoption of cloud and identity, as well as continued traction in OT. We are optimizing the business as we leverage the investments we have made to broaden our offerings and bring greater value to our customers."

Analysis of Performance

Tenable's performance in the fourth quarter and full year of 2023 indicates a robust demand for its cybersecurity solutions, despite the challenges of a competitive market. The company's strategic focus on expanding its product portfolio and customer base has resulted in significant revenue growth and improved non-GAAP profitability. However, the persistent GAAP net losses highlight the need for Tenable to continue refining its cost structure and operational efficiency to achieve long-term profitability.

The company's financial outlook for the first quarter and full year of 2024 suggests confidence in continued growth, with projected increases in revenue, non-GAAP income from operations, and unlevered free cash flow. These projections, coupled with Tenable's solid performance in 2023, position the company as a strong player in the cybersecurity industry, with the potential to deliver value to investors and customers alike.

For more detailed information on Tenable Holdings Inc (NASDAQ:TENB)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Tenable Holdings Inc for further details.

This article first appeared on GuruFocus.