Tennant Co (TNC) Reports Record Earnings, Surges in Net Sales and Net Income

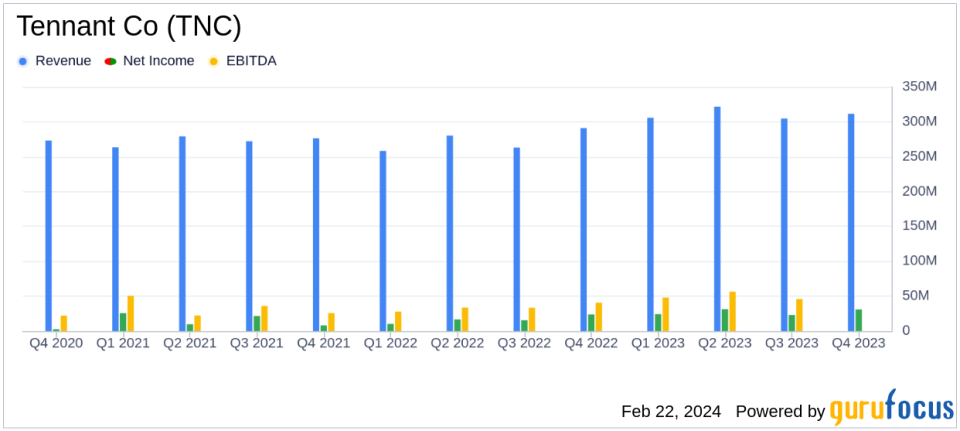

Net Sales: Achieved record full-year net sales of $1,243.6 million, a 13.9% increase from 2022.

Net Income: Full-year net income soared by 65.2% to $109.5 million compared to the previous year.

Diluted EPS: Reported a significant rise in diluted EPS to $5.83, a 64.2% increase year-over-year.

Adjusted EBITDA: Full-year adjusted EBITDA grew by 44.3% to $192.9 million, with margin expansion of 330 basis points.

Free Cash Flow: Demonstrated strong net income to free cash flow conversion, with $188.4 million in operating cash flow.

Debt Repayment: Strengthened financial position by repaying $100.0 million of debt, reducing net leverage ratio to 0.43x adjusted EBITDA.

2024 Guidance: Introduced full-year guidance with organic net sales growth targeted between 2% and 4%.

On February 22, 2024, Tennant Co (NYSE:TNC) released its 8-K filing, announcing record financial results for the fourth quarter and full year of 2023. The company, a leading manufacturer of floor cleaning equipment and solutions, reported a robust growth in net sales and net income, underpinned by strong performance across all geographic segments and product categories.

Company Overview

Tennant Co operates globally, providing innovative cleaning solutions and products, including mechanized cleaning equipment, sustainable technologies, and aftermarket parts. With a focus on financing, rental, leasing programs, and asset management solutions, the company caters to a diverse range of customers across North America, Latin America, Europe, Middle East, Africa, and Asia Pacific.

Financial Performance and Challenges

The company's impressive growth trajectory is highlighted by a 13.9% increase in net sales for the full year, reaching $1,243.6 million. This growth was largely organic, driven by strategic price realization across all regions, which effectively offset inflationary pressures. The fourth quarter alone saw a 7.0% increase in net sales to $311.4 million. However, the company faced challenges such as volume declines in certain regions and increased selling and administrative expenses as a percentage of sales, which rose due to higher variable costs and strategic investments aimed at future growth.

Financial Achievements

Tennant Co's financial achievements are particularly noteworthy in the industrial products sector, where efficient capital allocation and innovation are key drivers of success. The company's ability to repay $100 million in debt while returning over $40 million to shareholders through dividends and share repurchases speaks to its strong financial management and commitment to shareholder value. Additionally, the introduction of new products like the T1581 Ride-on Scrubber and the signing of an exclusive technology agreement with Brain Corp underscore Tennant's dedication to innovation and market leadership.

Income Statement and Balance Sheet Highlights

The company's income statement reflects a significant increase in net income, which rose by 65.2% to $109.5 million for the full year, bolstered by a lower effective tax rate and favorable operating results. Diluted EPS for the year stood at $5.83, up 64.2% from the previous year. The balance sheet remains robust, with a strong liquidity position of $117.1 million in cash and cash equivalents and $336.8 million of unused borrowing capacity on the revolving credit facility.

Looking Forward

As Tennant Co enters 2024, the company's strategic focus will be on executing its new enterprise strategy, which aims to deliver long-term revenue growth, expand margins, and continue generating strong cash flow. With specific growth initiatives in new product innovation, expanded go-to-market strategies, and disciplined pricing, Tennant is well-positioned for sustained long-term growth.

For the full year 2024, Tennant Co has set an organic net sales growth target between 2% and 4%, with a continued emphasis on strong price realization and cost-out activities to positively impact gross margins. The company remains disciplined in its spending, focusing on areas that will drive growth and enhance operating efficiencies.

Value investors and potential GuruFocus.com members interested in Tennant Co's financial journey can find more detailed information and analysis on our website, where we provide comprehensive coverage of the company's earnings and strategic initiatives.

Explore the complete 8-K earnings release (here) from Tennant Co for further details.

This article first appeared on GuruFocus.