Tensile Capital Management LP Reduces Stake in Vertex Inc

Overview of Tensile Capital Management's Recent Transaction

On November 10, 2023, Tensile Capital Management LP (Trades, Portfolio), a notable investment firm, made a significant adjustment to its portfolio by reducing its stake in Vertex Inc (NASDAQ:VERX). The firm sold 260,418 shares of Vertex Inc, which resulted in a 4.60% decrease in their holdings, impacting the portfolio by -0.89%. The shares were traded at a price of $26.51 each. Following the transaction, Tensile Capital Management LP (Trades, Portfolio) still holds a substantial 5,396,299 shares in Vertex Inc, representing an 18.67% position in their portfolio and a 3.53% stake in the company.

Profile of Tensile Capital Management LP (Trades, Portfolio)

Tensile Capital Management LP (Trades, Portfolio), based in Larkspur, California, is a firm that prides itself on a concentrated investment approach, focusing on long-term value creation. With an equity portfolio of $773 million, the firm has a preference for the Consumer Cyclical and Technology sectors. Among its top holdings are Crown Holdings Inc (NYSE:CCK), Dick's Sporting Goods Inc (NYSE:DKS), Lithia Motors Inc (NYSE:LAD), Valvoline Inc (NYSE:VVV), and Vertex Inc (NASDAQ:VERX), showcasing a diverse range of interests within its favored sectors.

Introduction to Vertex Inc

Vertex Inc, headquartered in the USA, is a provider of tax technology and services. Since its IPO on July 29, 2020, the company has been offering a suite of solutions that automate and integrate tax processes, including tax determination, data management, and compliance reporting. Vertex Inc caters to various industries with its cloud-based and on-premise solutions, deriving revenue primarily from software subscriptions. The company operates in the competitive Software industry, focusing on services and software subscriptions.

Financial Snapshot of Vertex Inc

As of the latest data, Vertex Inc boasts a market capitalization of $4.18 billion, with a current stock price of $27.32. However, the company's PE Percentage stands at 0.00, indicating that it is not generating a profit at the moment. According to GuruFocus's proprietary GF Valuation, Vertex Inc is considered modestly overvalued with a GF Value of $22.64 and a price to GF Value ratio of 1.21.

Vertex Inc's Stock Performance Indicators

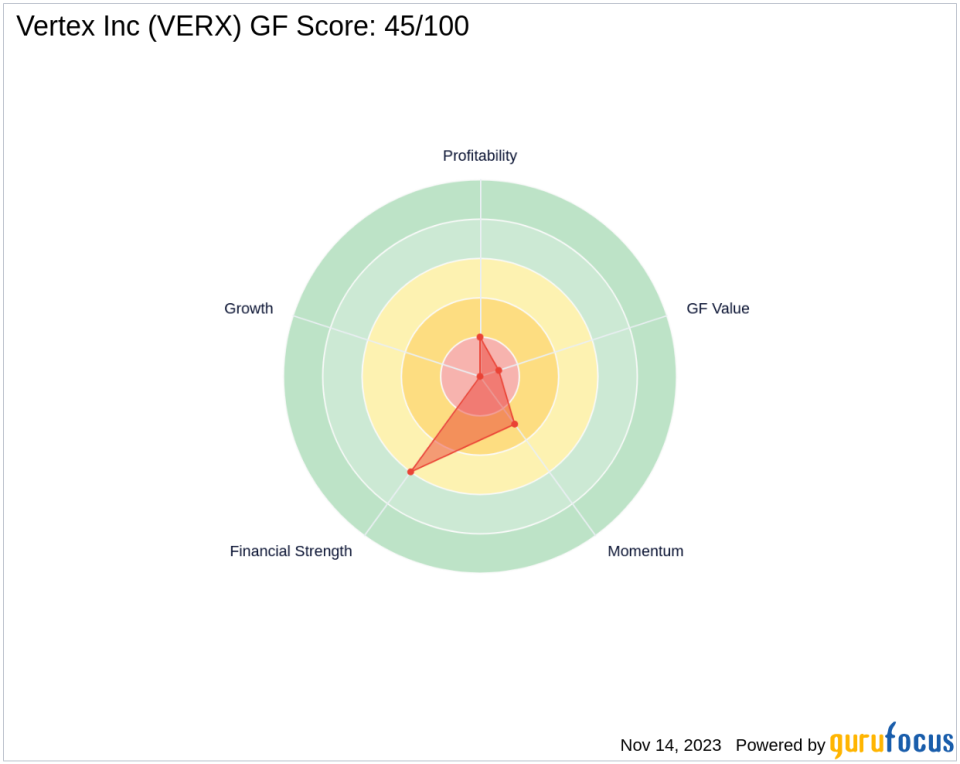

Since the trade by Tensile Capital Management LP (Trades, Portfolio), Vertex Inc's stock has seen a gain of 3.06%. From its IPO, the stock has increased by 6.89%. The year-to-date price change ratio is an impressive 87%, reflecting a strong performance in the current fiscal year. The GF Score for Vertex Inc stands at 45/100, indicating potential challenges in future performance.

Analysis of Vertex Inc's Fundamentals

Vertex Inc's financial health is a mixed bag, with a Financial Strength rank of 6/10 and a Profitability Rank of 2/10. The company's Growth Rank is not applicable, and its GF Value Rank is at the bottom with 1/10. The Cash to Debt ratio is 0.84, and the Piotroski F-Score is a moderate 5, indicating a stable financial situation but with room for improvement.

Market Momentum and Predictability of Vertex Inc

Vertex Inc's stock momentum is reflected in its RSI indicators, with a 14-day RSI of 67.53. However, the company does not have a Predictability Rank, and its revenue growth trend is modest at 9.80% over the past three years. The EBITDA growth over the same period is negative at -6.90%, suggesting some operational challenges.

Implications of Tensile Capital Management's Trade

The decision by Tensile Capital Management LP (Trades, Portfolio) to reduce its position in Vertex Inc could be attributed to various strategic considerations, including portfolio rebalancing or a response to the company's current valuation and growth prospects. The trade has slightly decreased the firm's exposure to Vertex Inc but still leaves it with a significant stake in the company. This move could signal Tensile Capital Management's cautious optimism about Vertex Inc's future or a shift in investment strategy towards other opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.