Tensile Capital Management LP Reduces Stake in Vertex Inc

On September 29, 2023, Tensile Capital Management LP (Trades, Portfolio) made a significant move in the stock market by reducing its stake in Vertex Inc (NASDAQ:VERX). The firm sold 60,000 shares at a trade price of $23.36, resulting in a -1.02% change in its holdings. This transaction had a -0.18% impact on the firm's portfolio, leaving it with a total of 5,806,717 shares in Vertex Inc, which now represents 17.58% of its portfolio.

Vertex Inc, a US-based tax technology and services provider, has a market cap of $3.35 billion. The company offers cloud-based and on-premise solutions to various industries for every line of tax, including income, sales, consumer use, value-added, and payroll. Its primary revenue streams come from services and software subscriptions. The company's stock symbol is VERX.

About Tensile Capital Management LP (Trades, Portfolio)

Tensile Capital Management LP (Trades, Portfolio) is a firm based in Larkspur, California. It currently holds 18 stocks in its portfolio, with a total equity of $773 million. The firm's top holdings include Crown Holdings Inc (NYSE:CCK), Dick's Sporting Goods Inc (NYSE:DKS), Lithia Motors Inc (NYSE:LAD), Valvoline Inc (NYSE:VVV), and Vertex Inc (NASDAQ:VERX). The firm's top sectors are Consumer Cyclical and Technology.

Analysis of the Transaction

The transaction saw Tensile Capital Management LP (Trades, Portfolio) reduce its position in Vertex Inc by 3.82%. The trade price of $23.36 per share resulted in a total transaction value of approximately $1.4 million. Despite the reduction, Vertex Inc still holds a significant position in the firm's portfolio, representing 17.58% of its total holdings.

Vertex Inc's Stock Performance and Valuation

As of October 4, 2023, Vertex Inc's stock price stands at $22.06, down 5.57% since the transaction. The company's PE percentage is currently at 0.00, indicating that it is operating at a loss. According to GuruFocus's GF Valuation, the stock is fairly valued with a GF Value of $22.69, resulting in a Price to GF Value ratio of 0.97. Since its IPO on July 29, 2020, the stock has seen a decrease of 13.69%, but it has gained 50.99% year-to-date.

Financial Health and Growth of Vertex Inc

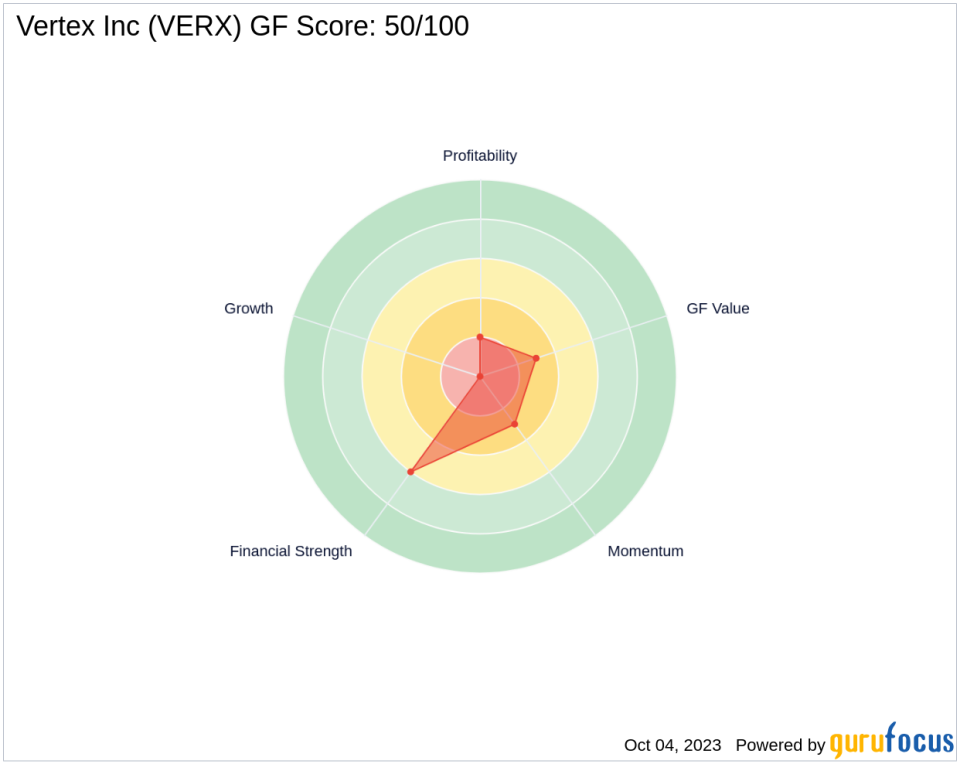

Vertex Inc's financial health and growth have been a mixed bag. The company has a balance sheet rank of 6/10 and a profitability rank of 2/10. Its growth rank is currently at 0/10, indicating no significant growth. The company's Piotroski F-Score is 5, and its Altman Z score is 4.53, suggesting financial stability. The company's cash to debt ratio is 0.75, ranking it 1903 in the software industry.

Performance Indicators and Momentum of Vertex Inc

Vertex Inc's performance indicators show a negative return on equity (ROE) of -14.13% and a negative return on assets (ROA) of -4.45%. The company has seen a 3-year revenue growth of 9.80%, but its EBITDA growth over the same period is -6.90%. The company's RSI 5 day, RSI 9 day, and RSI 14 day are 43.34, 50.01, and 52.23 respectively. Its momentum index for 6 - 1 month is 6.13, and for 12 - 1 month is 60.40.

Conclusion

In conclusion, Tensile Capital Management LP (Trades, Portfolio)'s recent transaction has slightly reduced its exposure to Vertex Inc. Despite the reduction, Vertex Inc remains a significant part of the firm's portfolio. The stock's current performance and valuation suggest that it is fairly valued, but its financial health and growth indicators show mixed results. This transaction provides valuable insights for value investors, especially those interested in the technology sector and tax services industry.

This article first appeared on GuruFocus.