Tensile Capital Management LP Reduces Stake in Vertex Inc

On October 10, 2023, Tensile Capital Management LP (Trades, Portfolio) made a significant move in the stock market by reducing its stake in Vertex Inc (NASDAQ:VERX). The firm sold 150,000 shares, resulting in a 2.58% change in its holdings. This transaction had a -0.47% impact on the firm's portfolio, leaving it with a total of 5,656,717 shares in Vertex Inc, which now represents 17.87% of its portfolio.

Vertex Inc, a US-based company, made its Initial Public Offering (IPO) on July 29, 2020. The company, symbolized as VERX, provides tax technology and services, automating and integrating tax processes while leveraging advanced and predictive analytics of tax data. Vertex offers both cloud-based and on-premise solutions to various industries for every line of tax, including income, sales, consumer use, value-added, and payroll. Its primary segments include services and software subscriptions.

About Tensile Capital Management LP (Trades, Portfolio)

Tensile Capital Management LP (Trades, Portfolio), a firm based in Larkspur, California, holds a portfolio of 18 stocks, with a total equity of $773 million. The firm's top holdings include Crown Holdings Inc (NYSE:CCK), Dick's Sporting Goods Inc (NYSE:DKS), Lithia Motors Inc (NYSE:LAD), Valvoline Inc (NYSE:VVV), and Vertex Inc (NASDAQ:VERX). The firm's top sectors are Consumer Cyclical and Technology.

Analysis of the Transaction

The shares were traded at a price of $24.3 each. After the transaction, Tensile Capital Management LP (Trades, Portfolio)'s holdings in Vertex Inc represent 3.72% of the total shares. The transaction indicates a strategic move by the firm, possibly based on the current market conditions and the performance of Vertex Inc.

Performance and Financial Health of Vertex Inc

Vertex Inc, with a market cap of $3.71 billion, is currently trading at $24.37 per share. The company's PE percentage is 0.00, indicating that it is currently at a loss. According to GuruFocus, the stock is fairly valued with a GF Value of $22.74. The stock's price to GF Value is 1.07, suggesting that it is slightly overvalued.

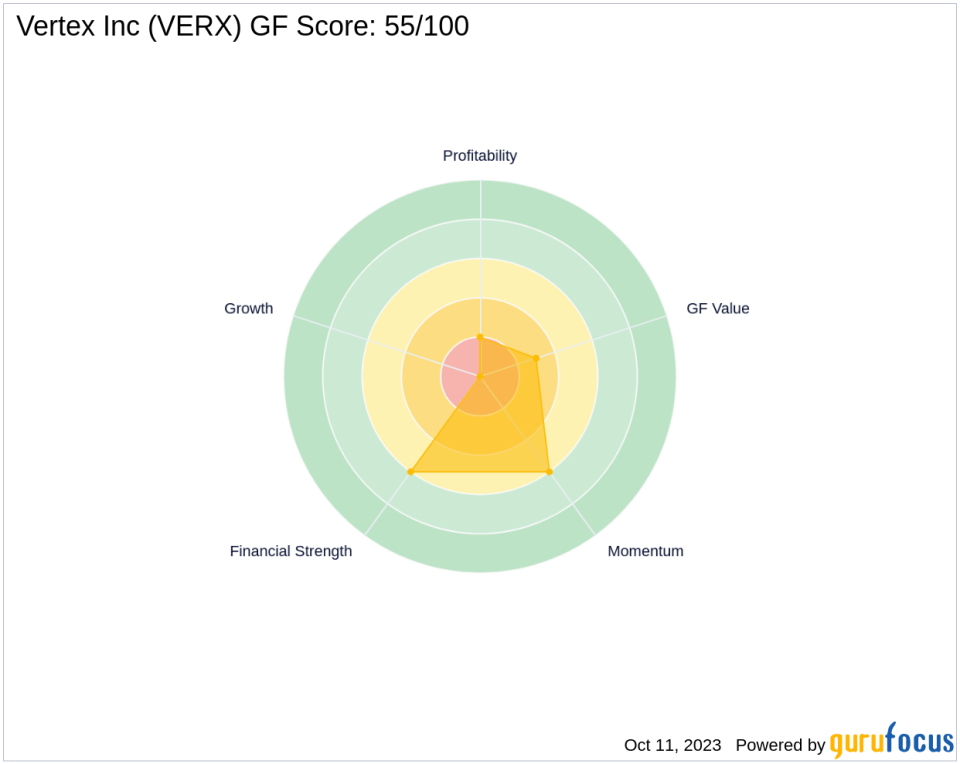

Vertex Inc's GF Score is 55/100, indicating poor future performance potential. The company's Financial Strength is ranked 6/10, while its Profitability Rank is 2/10. The Growth Rank is 0/10, indicating no growth. The GF Value Rank is 3/10, and the Momentum Rank is 6/10.

The company's Piotroski F-Score is 5, and its Altman Z score is 4.73. The cash to debt ratio is 0.75, ranking it 1906 in the software industry.

Performance Metrics and Momentum of Vertex Inc

Vertex Inc's ROE is -14.13, and its ROA is -4.45. The company's gross margin growth and operating margin growth are both 0.00. The 3-year revenue growth is 9.80, while the EBITDA growth over the same period is -6.90.

The stock's RSI 5 Day is 43.34, RSI 9 Day is 50.01, and RSI 14 Day is 52.23. The Momentum Index 6 - 1 Month is -1.75, and the Momentum Index 12 - 1 Month is 48.14.

In conclusion, this transaction by Tensile Capital Management LP (Trades, Portfolio) reflects the firm's strategic investment decisions based on the current market conditions and the performance of Vertex Inc. It will be interesting to observe the future performance of Vertex Inc and its impact on the firm's portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.