Teradyne Inc (TER) Reports Decline in Q4 and FY 2023 Revenue; Robotics Segment Shows Growth

Q4 Revenue: $671 million, a decrease of 8% from Q4'22.

FY 2023 Revenue: $2,676 million, down 15% from FY 2022.

Q4 Robotics Revenue: Up 50% from Q3'23 and 17% from Q4'22, marking a record high.

GAAP EPS: Q4 at $0.72, down from $1.04 in Q4'22; FY 2023 at $2.73, down from $4.22 in FY 2022.

Non-GAAP EPS: Q4 at $0.79, compared to $0.92 in Q4'22; FY 2023 at $2.93, down from $4.25 in FY 2022.

On January 30, 2024, Teradyne Inc (NASDAQ:TER), a leading provider of automated testing equipment, released its 8-K filing, disclosing its financial results for the fourth quarter and fiscal year 2023. The company, known for its semiconductor testing equipment and industrial automation solutions, including collaborative and autonomous robots, reported a decline in revenue and earnings per share (EPS) for both the quarter and the fiscal year.

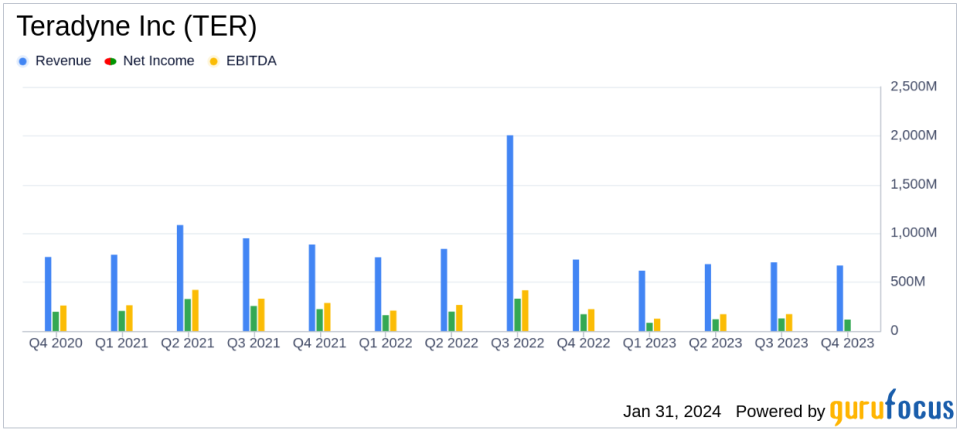

Teradyne's revenue for Q4'23 was $671 million, an 8% decrease from the same quarter in the previous year. The full-year revenue for 2023 stood at $2,676 million, representing a 15% decline from FY 2022. Despite the overall downturn, the company's Robotics segment achieved a record revenue in Q4'23, showing a 50% increase from the previous quarter and a 17% rise from Q4'22.

GAAP net income for Q4 was $117 million, or $0.72 per diluted share, compared to $172 million, or $1.04 per diluted share in Q4'22. On a non-GAAP basis, net income for Q4 was $127 million, or $0.79 per diluted share. For the full year, GAAP EPS was $2.73, and non-GAAP EPS was $2.93, both showing a decrease from the previous year's figures of $4.22 and $4.25, respectively.

Teradyne CEO Greg Smith commented on the results, stating, "We closed out 2023 with Q4 revenue and profit in line with our guidance as strong demand for memory test systems and 50% quarterly growth of Robotics revenue offset weakening demand for System-on-a-Chip (SOC) test systems." He also provided an outlook for 2024, anticipating low tester utilization impacting demand in the first half but expecting incremental improvement in Semiconductor test demand for the full year.

"Looking into the new year, we expect low tester utilization will impact demand in the first half of the year but anticipate the full year Semiconductor test demand to incrementally improve from 2023. In Robotics, after expected seasonal weakness in Q1, we project consistent quarterly growth powered by new products, new applications and improvements in our global distribution channels," said Smith.

For Q1 2024, Teradyne forecasts revenue between $540 million and $590 million, with GAAP net income per diluted share ranging from $0.19 to $0.35 and non-GAAP net income per diluted share from $0.22 to $0.38.

Teradyne's financial achievements in the Robotics segment are particularly noteworthy as they reflect the company's successful diversification beyond semiconductor testing. The growth in Robotics is significant for Teradyne as it represents the company's expansion into the industrial automation market, which is expected to be a key driver of future growth.

The company's balance sheet remains robust with $757 million in cash and cash equivalents as of December 31, 2023, although this represents a decrease from $854 million at the end of 2022. Teradyne's ability to maintain a strong cash position despite the revenue decline is a testament to its financial resilience and operational efficiency.

Overall, Teradyne's financial performance in Q4 and FY 2023 reflects the challenges faced by the semiconductor industry, including fluctuating demand and global economic uncertainties. However, the record revenue in the Robotics segment and the company's strategic focus on new products and market expansion provide a positive outlook for recovery and growth in the coming year.

For a detailed analysis of Teradyne Inc (NASDAQ:TER)'s financials and future prospects, investors are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Teradyne Inc for further details.

This article first appeared on GuruFocus.