Is Teradyne Inc (TER) Stock Fairly Valued? An In-Depth Analysis

Teradyne Inc (NASDAQ:TER) has experienced a daily loss of -4.16%, and a 3-month gain of 12.42% with an Earnings Per Share (EPS) of 3.37. This article aims to explore whether the stock is fairly valued. Read on for a comprehensive valuation analysis.

Company Overview

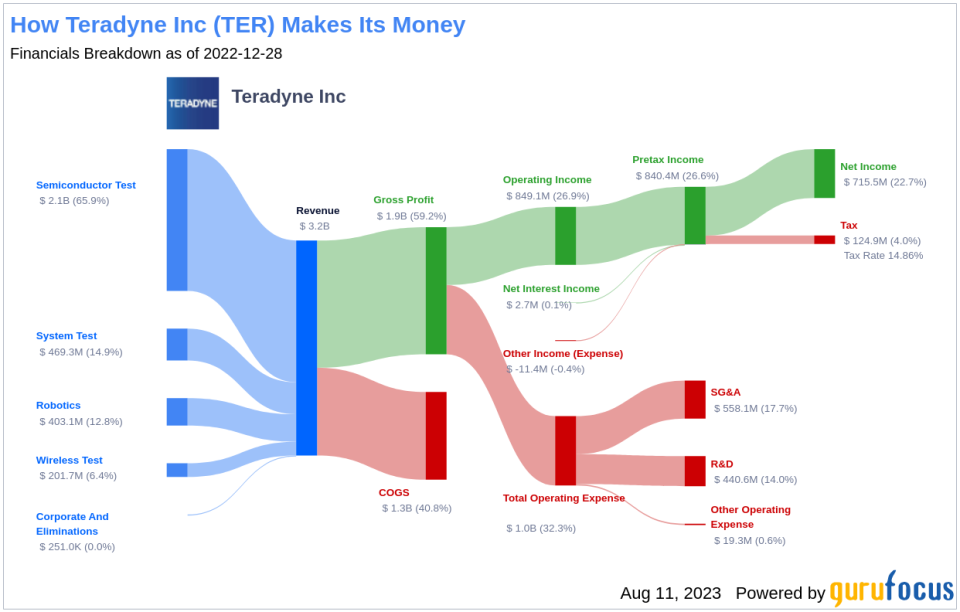

Teradyne Inc (NASDAQ:TER) is a leading provider of testing equipment, including automated test equipment for semiconductors, system testing for hard disk drives, circuit boards, and electronics systems, and wireless testing for devices. The company ventured into the industrial automation market in 2015, selling collaborative and autonomous robots for factory applications. With significant exposure to semiconductor testing, Teradyne serves vertically integrated, fabless, and foundry chipmakers directly and indirectly with its products.

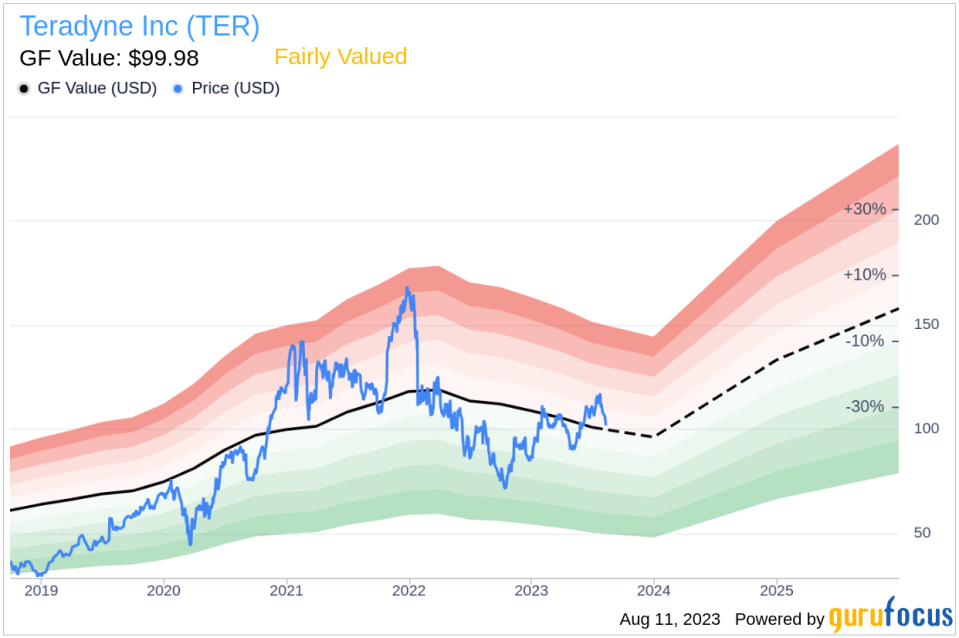

GF Value Analysis

The GF Value is a unique measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. Teradyne's stock is believed to be fairly valued according to the GF Value calculation. With a current price of $101.99 per share, Teradyne has a market cap of $15.70 billion. Because Teradyne is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.

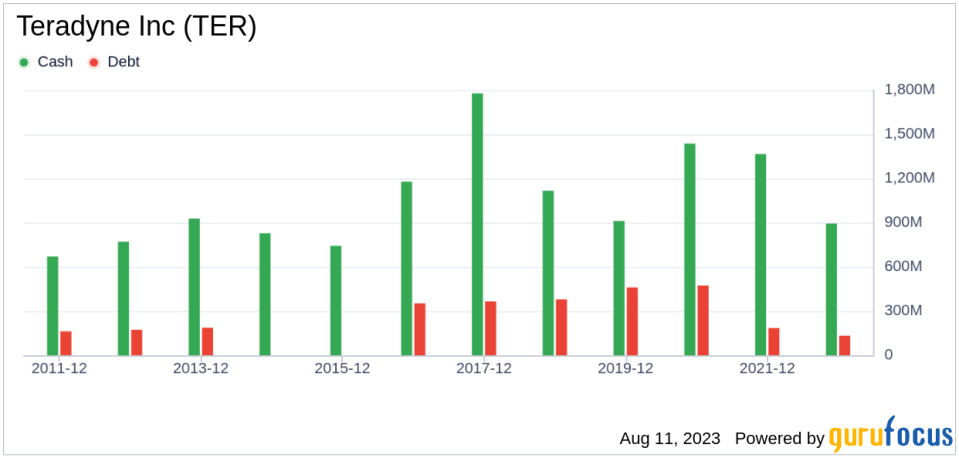

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Teradyne has a cash-to-debt ratio of 6, which ranks better than 66.07% of companies in the Semiconductors industry. Based on this, GuruFocus ranks Teradyne's financial strength as 9 out of 10, suggesting a strong balance sheet.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is typically less risky. Teradyne has been profitable 9 over the past 10 years, with a revenue of $2.90 billion and Earnings Per Share (EPS) of $3.37 over the past twelve months. Its operating margin is 22.32%, which ranks better than 83.53% of companies in the Semiconductors industry. Overall, the profitability of Teradyne is ranked 9 out of 10, indicating strong profitability.

Growth is probably the most important factor in the valuation of a company. The 3-year average annual revenue growth rate of Teradyne is 13.3%, which ranks better than 53.63% of companies in the Semiconductors industry. However, the 3-year average EBITDA growth rate is 14.7%, which ranks worse than 59.74% of companies in the Semiconductors industry.

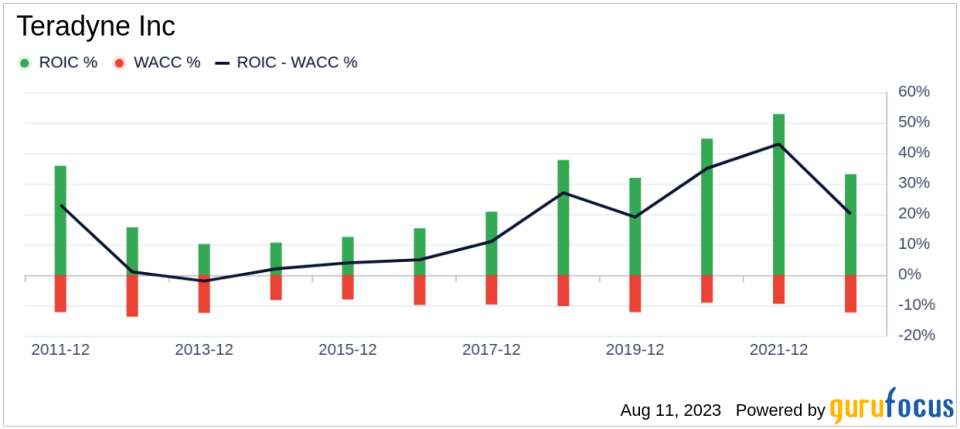

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to evaluate its profitability. Over the past 12 months, Teradyne's ROIC was 23.58, while its WACC came in at 13.73, indicating that the company is creating value for shareholders.

Conclusion

In conclusion, Teradyne Inc (NASDAQ:TER) stock is believed to be fairly valued. The company's financial condition is strong, and its profitability is robust. Its growth ranks worse than 59.74% of companies in the Semiconductors industry. To learn more about Teradyne stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.