Terex Corp (TEX) Reports Robust Full-Year 2023 Results with Significant Margin Expansion

Full-Year Sales: $5.2 billion, a 17% increase year-over-year.

Full-Year EPS: $7.56, with a 63% increase to $7.06 when excluding non-recurring items.

Operating Margin: Improved to 12.4% for the full year, with a 320 bps increase to 12.7% excluding non-recurring items.

Return on Invested Capital: Increased significantly to 28.5%, up 720 bps.

Free Cash Flow: $366 million, demonstrating a $214 million increase over the prior year.

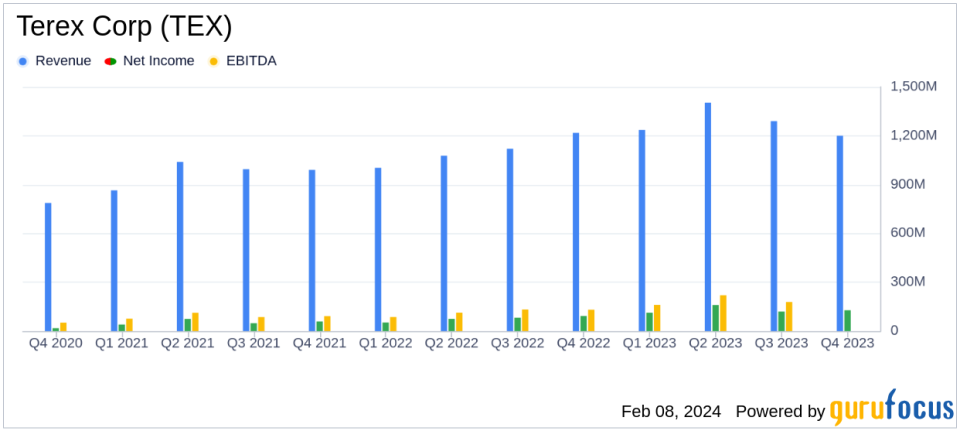

On February 8, 2024, Terex Corp (NYSE:TEX), a global manufacturer of aerial work platforms and materials processing equipment, announced its fourth quarter and full-year 2023 results through its 8-K filing. The company reported a full-year sales increase of 17% to $5.2 billion, with a full-year income from operations of $637 million. The fourth quarter and full-year operating margins stood at 9.5% and 12.4%, respectively, with a notable full-year EPS of $7.56. Adjusting for non-recurring items, the full-year EPS was $7.06, marking a 63% increase from the previous year.

Company Overview and Performance

Terex Corp (NYSE:TEX) has evolved through numerous acquisitions to focus on its core segments, which are in high demand in nonresidential construction, maintenance, manufacturing, energy, and materials management. The company's strong performance in 2023, as highlighted by the significant improvement in operating margins and EPS, reflects its ability to manage cost inflation and supply chain challenges effectively.

President and CEO Simon Meester expressed confidence in the company's position and its ability to deliver value, citing strong demand for products and favorable long-term megatrends. However, he also acknowledged potential headwinds from European markets and lingering supply chain disruptions. For 2024, Terex anticipates sales between $5.1 and $5.3 billion and EPS between $6.85 and $7.25.

Financial Achievements and Challenges

Terex Corp (NYSE:TEX) achieved a return on invested capital of 28.5%, a substantial increase from the previous year, demonstrating efficient capital utilization. The company's effective tax rate was 10.9%, influenced by a deferred tax asset recognition related to its Swiss operations. Excluding this impact, the effective tax rate would have been 18.2%.

The company's Materials Processing segment saw a slight increase in net sales for Q4 2023, with a full-year increase of 14.7%. However, income from operations decreased slightly in Q4 due to non-recurring charges. The Aerial Work Platforms segment experienced a slight decrease in Q4 net sales but saw a significant 17.6% increase for the full year, with income from operations up by 89.2%.

Terex's capital allocation strategy remained robust, with $151 million deployed in capital expenditures and investments, and over $100 million returned to shareholders through share repurchases and dividend payments. The company also increased its dividend twice in 2023, totaling a 31% rise.

Outlook and Commentary

Julie Beck, Senior Vice President and Chief Financial Officer, highlighted the company's profitable growth, margin expansion, and strong return on invested capital. She emphasized Terex's commitment to its capital allocation strategy, which positions the company for growth initiatives and shareholder value enhancement.

The Board of Directors declared a quarterly dividend of $0.17 per share, payable on March 19, 2024, to stockholders of record as of March 8, 2024. Looking ahead to 2024, Terex expects to continue its growth trajectory, with a projected operating margin between 12.8% and 13.1% and free cash flow between $325 and $375 million.

Terex Corp (NYSE:TEX) remains focused on delivering innovative solutions and maintaining its leadership in the Farm & Heavy Construction Machinery industry. Value investors may find the company's strong financial performance, efficient capital allocation, and positive outlook compelling reasons to consider Terex as a part of their investment portfolio.

Explore the complete 8-K earnings release (here) from Terex Corp for further details.

This article first appeared on GuruFocus.