Terex (TEX) Gains 40% in a Year: Will the Rally Last in 2024?

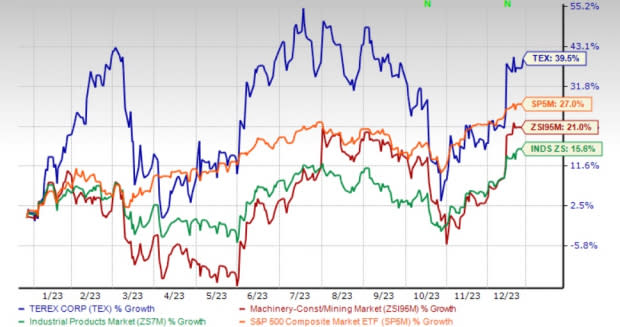

Terex TEX has gained 39.5% in a year, faring way better than the industry’s 21% growth. The Industrial Products sector has risen 15.6% while the Zacks S&P 500 composite has moved up 27% in the same time frame.

TEX has a market capitalization of around $4 billion. The average volume of shares traded in the last three months was 953.7k.

Terex currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Strong Demand Driving Earnings Growth

Terex has been gaining from strong demand and improved volumes, which is evident from the year-over-year growth in earnings over the past 11 quarters. Pricing actions and efforts to cut down costs have also helped to offset the impact of supply-chain challenges and higher costs.

Terex reported third-quarter 2023 adjusted earnings per share of $1.75, which marks a year-over-year improvement of 45.8%. The upside was driven by healthy demand across multiple businesses and improved price realization that helped offset higher costs.

Backed by a strong performance in the third quarter, Terex raised its 2023 outlook. It expects earnings per share to be around $7.05, up from the previously stated earnings of $7.00 per share. Compared with the adjusted earnings per share of $4.32 reported in 2022, the projected figure highlights solid growth of 63%. Terex expects sales to be $5.15 billion. The company had earlier projected sales to be $5.1 billion.

Robust Backlog Bodes Well

TEX’s backlog was $3.3 billion at the end of third-quarter 2023. The figure remains significantly more than historical levels and is the second highest in recent history. Robust backlog and strong end-market demand are expected to support its top-line performance in the forthcoming quarters. Increased spending from the Infrastructure Bill is expected to be a major catalyst for Terex.

Upbeat Growth Projections

The Zacks Consensus Estimate for the company’s 2023 earnings is pegged at $7.09 per share. It suggests growth of 64% from the year-ago reported figure. The consensus mark for 2024 earnings is currently at $7.20 per share, which suggests a year-over-year improvement of 1.6%.

Strategic Initiatives Continue to Bear Fruit

The company continues to progress well on its “Execute, Innovate, Grow” strategy. In sync with this, it has been investing in innovative products, digital innovation, the expansion of manufacturing facilities and acquisitions. This will drive its performance in the forthcoming quarters.

TEX’s efforts to overcome supply disruptions and increase production will also boost results in the upcoming quarters. Price hikes and cost reductions will help offset inflationary pressures and aid earnings.

Solid Balance Sheet

As of Sep 30, 2023, the company had $846 million of total available liquidity and net leverage of 0.5X. It expects to generate a free cash flow of $375 million in 2023 compared with cash flow of $152 million in 2022.

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Resideo Technologies, Inc. REZI, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

REZI currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Resideo Technologies’ 2023 earnings per share is pegged at $1.48. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 5.7%. REZI shares have rallied 15.6% year to date.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 40% year to date.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 45.6% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Resideo Technologies, Inc. (REZI) : Free Stock Analysis Report