Terex (TEX) Q2 Earnings & Sales Top Estimates, '23 View Raised

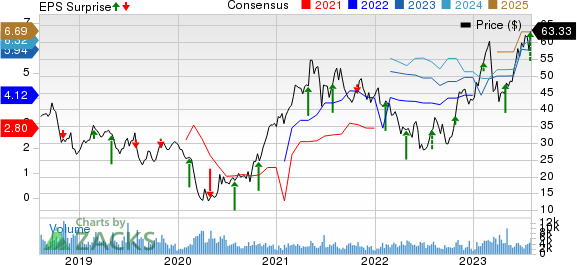

Terex Corporation TEX reported second-quarter 2023 adjusted earnings per share of $2.35, which beat the Zacks Consensus Estimate of $1.61. The bottom line surged 120% from the prior-year quarter, courtesy of strong demand, higher pricing and gains from the company’s efforts to improve manufacturing efficiencies.

Operational Update

Revenues in the reported quarter increased 30% year over year to $1,403 million, surpassing the Zacks Consensus Estimate of $1,256 million. The upside was driven by increased demand across all regions and product lines, improved price realization, partially offset by unfavorable currency translation.

The company reported a backlog of $3.7 billion in the second quarter of 2023. The backlog, however, came in lower than our projection of $3.9 billion.

The cost of goods sold increased 22.7% year over year to $1,060 million. Gross profit surged 61% to $343 million. Selling, general and administrative expenses were $133 million in the quarter under review, up 22% from the prior-year quarter.

Terex Corporation Price, Consensus and EPS Surprise

Terex Corporation price-consensus-eps-surprise-chart | Terex Corporation Quote

Terex reported an operating profit of $210 million, which marked a 102% increase from the prior-year quarter. Operating margin in the quarter under review was 15%, a 540 basis point expansion due to higher sales volume, price realization, favorable mix and improved manufacturing efficiencies. However, higher costs had a dampening effect.

Segment Performances

The Aerial Work Platforms segment generated revenues of $825 million in the reported quarter, up 38% from the year-ago quarter. Solid demand, higher pricing and easing of supply-chain disruptions led to the improvement in revenues.

The segment reported an operating profit of $134 million, a 189% jump from the prior-year quarter’s $46 million. Higher sales volume, price realization, favorable mix, gains from cost reduction initiatives and manufacturing efficiencies, partially offset by cost increases, led to the solid improvement in profit. We had expected revenues of $691 million and operating income of $86 million.

The Material Processing segment’s revenues totaled $577 million, reflecting year-over-year growth of 20%. Strong demand for the company’s products across multiple businesses and price realization drove the improvement. The segment’s revenues were higher than our estimate of $537 million.

The segment reported an operating income of $98 million, up 23 .5% year over year. The figure was higher than our estimate of $94 million. Gains from increased sales volume, favorable mix and improved manufacturing efficiencies were partially negated by cost increases.

Financial Position

Terex had cash and cash equivalents of $268 million as of Jun 30, 2023, compared with $304 million as of Dec 31, 2022. The company generated $130 million in cash from operating activities in the first six month period of 2023, marking a substantial improvement from $19 million reported in the prior-year comparable period. The company has returned $54 million to shareholders through share repurchases and dividends in the first half of fiscal 2023.

2023 Outlook

Backed by strong performance so far, this fiscal, Terex raised its outlook for 2023. The company expects earnings per share at around $7, higher than its earlier projection of $5.60-$6.00. The company expects sales at around $5.1 billion. Terex had earlier projected sales between $4.8 billion and $5 billion.

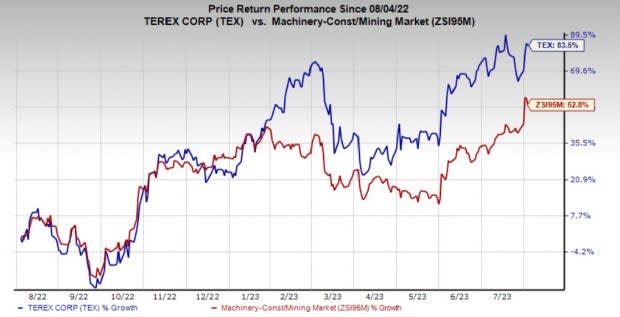

Price Performance

Terex's shares have gained 83.5% over the past year compared with the industry’s 52.8% growth.

Image Source: Zacks Investment Research

Zacks Rank and Other Stocks to Consider

Terex currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and Caterpillar CAT. WOR and MTW sport a Zacks Rank #1 (Strong Buy) at present, and CAT has a Zacks Rank of 2.

Worthington Industries has an average trailing four-quarter earnings surprise of 14.9%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $5.65 per share. The consensus estimate for 2023 earnings has moved 22.6% north in the past 60 days. Its shares have gained 43.4% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 256.3%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at $1.12 per share. The consensus estimate for 2023 earnings has moved 7.8% north in the past 60 days. MTW’s shares have gained 54.8% in the last year.

The Zacks Consensus Estimate for CAT’s 2023 earnings per share is pegged at $18.75. The estimates have been revised upward 6% over the last 60 days. It has a trailing four-quarter average earnings surprise of 18.5%. CAT’s shares have gained 53% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Terex Corporation (TEX) : Free Stock Analysis Report