Terex (TEX) to Report Q3 Earnings: What's in the Cards?

Terex TEX is likely to register an improvement in both the top and bottom lines when it reports third-quarter 2023 results later this month.

Q3 Estimates

The Zacks Consensus Estimate for TEX’s third-quarter revenues is pegged at $1.25 billion, indicating growth of 11.5% from the year-ago quarter’s reported figure. The consensus mark for earnings per share is pegged at $1.66, suggesting an improvement of 38.3% from the prior-year quarter’s reported figure.

Q2 Results

In the last reported quarter, Terex’s earnings and revenues increased year over year. The bottom and top-line figures beat the Zacks Consensus Estimate. The company delivered a trailing four-quarter average earnings surprise of 32.8%.

Terex Corporation Price and EPS Surprise

Terex Corporation price-eps-surprise | Terex Corporation Quote

Key Factors

Terex has been delivering year-over-year growth in earnings over the past 10 quarters, driven by robust bookings and revenue growth, and margin expansion in both business segments. Its backlog has also shown year-over-year improvements over the past 10 quarters and reached a solid $3.7 billion at the end of second-quarter 2023. Both segments witnessed improvements in backlog over the said time frame. Robust backlog and strong end-market demand are expected to support its top-line performance in the third quarter of 2023 as well. Price hikes and ongoing cost reductions are also expected to have negated the inflationary pressures and aided its margin performance.

The company’s Aerial Work Platforms segment is anticipated to gain from its efforts to right-size the cost structure to align with customer demand and efforts to improve operational execution. The segment has been witnessing strong global demand driven by fleet replacement and growth. In the Genie business globally, rental rates have been improving, used equipment pricing remains strong and fleet utilization continues to improve, thus reflecting a recovering aerials rental industry. The Utilities market has been improving with demand strong across its end-markets of tree care, rental, and investor-owned utilities. Increased electrical grid investment is a tailwind for Utilities.

We expect quarterly revenues to be $717 million for the Aerial Work Platforms segment, indicating year-over-year growth of 8.2%.

In the Material Processing segment, robust end-market demand across minerals processing, material handling and lifting, environmental, and concrete is likely to drive third-quarter 2023 revenues. We expect the Material Processing segment’s revenues to be $518 million, indicating year-over-year growth of 13%.

Terex’s manufacturing operations had been adversely affected by material shortages and production delays as the continuity of supply was impacted by capacity constraints, global logistics disruptions and raw material shortages. The company has been trying to mitigate the impact of these risks by utilizing alternate suppliers, expanding the supply base globally and leveraging overall purchasing volumes to obtain favorable pricing and quantities, among others. Supply-chain issues and cost pressures have reportedly eased through the quarter under review. This is likely to aid Terex’s third-quarter results.

What the Zacks Model Indicates

Our proven model predicts an earnings beat for Terex for the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is exactly the case here.

Earnings ESP: Terex has an Earnings ESP of 3.93%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

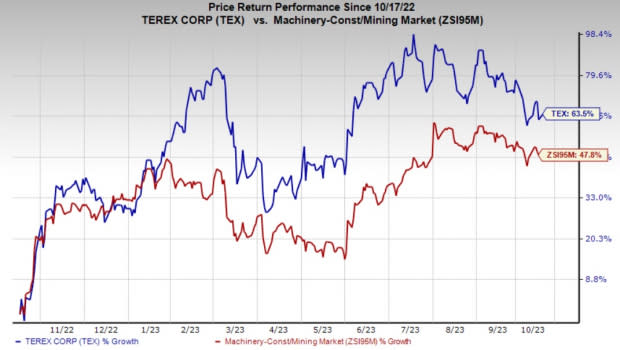

Price Performance

Shares of the company have gained 63.5% in the past year compared with the industry’s 47.8% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks, which have the right combination of elements, to post an earnings beat in their upcoming releases.

ESAB Corporation ESAB, scheduled to release earnings on Nov 1, has an Earnings ESP of +0.81% and a Zacks Rank of 1.

The Zacks Consensus Estimate for ESAB’s third-quarter earnings is currently pegged at 92 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 13.6%.

H&E Equipment Services, Inc. HEES, expected to release earnings on Oct 10, has an Earnings ESP of +14.79%.

The Zacks Consensus Estimate for HEES’ earnings for the second quarter is pegged at $1.31 per share. It currently carries a Zacks Rank of 2. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 24.1%.

Ingersoll Rand Inc. IR, expected to release earnings on Nov 1, has an Earnings ESP of +1.00%. IR currently carries a Zacks Rank of 3.

The consensus estimate for Ingersoll Rand’s earnings for the third quarter is currently pegged at 70 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

ESAB Corporation (ESAB) : Free Stock Analysis Report