Tesla Has More Chapters to Its Growth Story

Tesla Inc. (NASDAQ:TSLA) is arguably one of the most popular story stocks of all time. Consequently, it's been a tremendous wealth compounder for its investors, providing capital gains of more than 700% over the past five years. Moreover, the company continues to add new layers to its growth story, which could bolster Tesla stock in the future.

The EV pioneer wrapped up 2022 with aplomb, a year challenging for automotive players across the board. However, Tesla has still managed to grow, with revenue up 51% over a trailing 12-month period. Additionally, the company's Ebitda and net income margins have soared over 21.4% and 15.4%, respectively, blowing past its five-year averages.

Perhaps what's more appealing to investors is its valuation, which is more attractive than it has been in a long time. In fact, Tesla seems to have finally grown into its valuation. Therefore, with record deliveries, it's essentially a two-fold triumph for investors.

Adapting to a maturing EV industry

As the first company to make EVs that can both truly compare to internal combustion vehicles and be profitably manufactured and sold at scale, Tesla has dominated the EV market for years, and 2022 was no different. Tesla was able to generate record growth across both the top and bottom lines.

Tesla produced 65% of the world's new EVs in 2022. This was down more than 10% year over year as more competitors have entered into the fray. However, it's not necessarily bad news for the company as it's essentially due to standard industry evolution. Tesla doesn't have a monopoly in the EV sphere, which means it will eventually lose market share, bringing down its return on equity.

Though it won't be generating the lofty returns it once was, investors might appreciate it shedding the risk. We have seen the volatility of Tesla stock over the past year, and that volatility was born from investors falsely conflating Tesla stock with the entire total addressable market for EVs.

We can see how the stock's beta is at an alarming 2.47. Hence, its stock is likely to move more viciously than the market. As the industry evolves, its risk/return characteristics will adjust over time, resulting in more predictable returns.

Resilient performance despite headwinds

Industry dynamics aside, given Tesla's recent results, it is safe to say that it may take some some time before its growth rates normalize.

Its fourth-quarter results showed a record profit of $12.6 billion, more than 50% higher than its earnings in 2021. Production and deliveries improved by 47% and 40%, respectively. As the company advances, CEO Elon Musk believes that the 1.8 million vehicle production target is relatively conservative and it could do two million vehicles. It would represent a 46% increase from last year if it could deliver two million vehicles in 2023.

Tesla's profitability is mighty impressive and continues to outperform the competition. Its A-graded profitability profile has improved substantially compared to its historical averages and is significantly ahead of its competition. Its competitive Ebitda margin chart shows how Tesla is positioned at the top of the heap.

The company ended its most recent quarter with a whopping cash balance of $22.4 billion and $1.4 billion in free cash flows. Tesla's results have been partially offset by its debt payments of half a million dollars.

From the chart below, we can see how Tesla has grown its free cash flow balance at a breathtaking pace over the past year. In the past year, free cash flows have increased by a remarkable 117%. These results are perhaps more impressive given the macroeconomic backdrop.

Attractive valuation

Over the years, Tesla's stock price has been a bone of contention among investors. It was previously trading at a hefty premium due to its robust positioning in the EV space. Hence, its valuation reflected that; the stock was trading as if it was going to be the only EV stock ever.

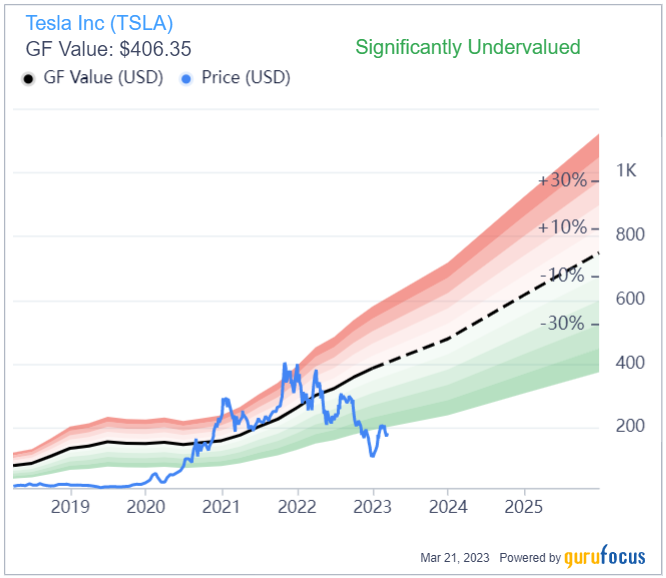

However, following its stock split and the stock market rout last year, combined with stellar earnigns growth, Tesla's stock is now trading at a significant discount to its GF Value. It also trades over 50% lower than its 52-week high and could be in for more volatility. The price-earnings ratio is now just 53 compared to its 10-year median of 252.5.

Takeaway

Tesla continues to be a trailblazer in the EV market, rewarding its investors with double-digit returns over the past several years. It may have seemed unimaginable to some when Tesla's stock price skyrocketed in 2020 and 2021, but the EV company has actually managed to grow earnings to meet its now-fallen stock price, and for once in its history, it shows undervaluation on several metrics. This makes the innovative EV leader more attractive than ever, in my opinion. It's only natural to lose market share and profitability as the industry grows and matures, but continued double-digit earnings growth in the coming years should help even that out.

This article first appeared on GuruFocus.