Tesla Stock-Price Rout Overshadows Rivian, Lucid Collapses

(Bloomberg) -- While Tesla Inc.’s epic stock-price collapse dominated headlines over the past year, for some smaller electric-vehicle companies the rout has been even worse, a sign that investors see few attractive alternatives in the sector.

Most Read from Bloomberg

Hindenburg’s Short Sell Call Shaves $12 Billion Off Adani Stocks

US Confronts China Over Companies’ Ties to Russia War Effort

Josh Kushner Is Richer Than Trump After Billionaires Back His Firm

US and Germany Set to Send Tanks to Ukraine, Breaking Deadlock

Doomsday Clock Moves to 90 Seconds to Midnight — the Closest in History

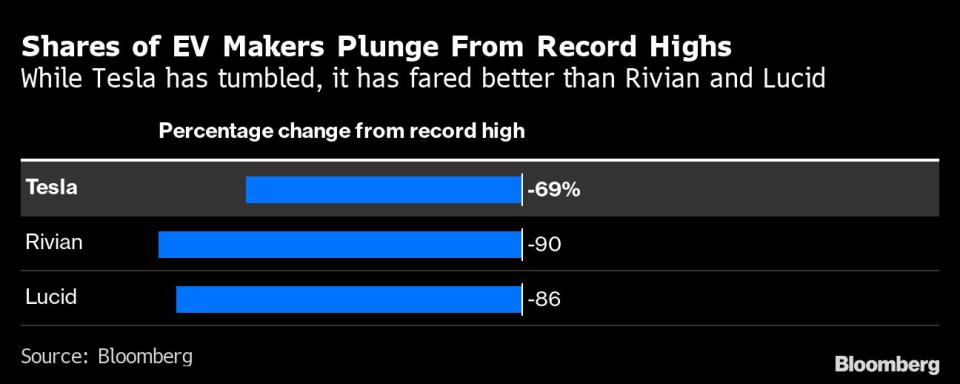

Two of the most prominent new EV makers — Rivian Automotive Inc. and Lucid Group Inc. — have lost roughly 90% of their equity values from their bull-market peaks, compared with a 69% drop for Tesla. The companies have struggled to ramp up output of vehicles amid supply-chain woes just as investors grew leery of highly valued companies with no earnings.

“Tesla’s stock performance has certainly had an impact on the group, and this group’s own production issues have also weighed,” said Canaccord Genuity analyst George Gianarikas.

A Rivian representative declined to comment on the stock-price decline, while Lucid didn’t reply to a request for comment. Both stocks were trading lower in New York on Thursday, Rivian slid as much as 3% and Lucid fell 3.4%.

The staggering 740% climb for Tesla shares in 2020 helped spur investor euphoria around the sector. EV stocks of all kinds — whether the companies were making passenger cars, commercial vehicles, buses or niche autos — exploded as well, with even the tiniest names commanding valuations of several billion dollars. Rivian and Lucid were touted as potential “next Teslas,” with valuations bigger than century-old legacy car companies.

Lucid began trading in July 2021 and its equity value topped out at $91 billion in November that year. Rivian shares peaked just days after its November 2021 initial public offering, valuing the company at $153 billion — more than Volkswagen AG, despite Rivian having zero revenue at the time.

Rising interest rates over the past year and fears of a recession have curbed investors’ risk appetite, causing them to flee unprofitable companies with high expected growth. Rivian is now worth $14.8 billion, while Lucid is valued at $13.7 billion. Even Tesla, which is profitable, plunged, casting a shadow over the rest of the industry.

Lucid built 7,180 Air Sedans in 2022, a far cry from its projection of 20,000 vehicles at the beginning of that year, as it struggled with supply-chain snags and logistics problems. Rivian also narrowly missed its annual production target of making 25,000 cars.

Their sinking share prices will raise the cost of equity financing for the carmakers, which are still investing heavily in their businesses.

Lucid, which had $3.3 billion of cash, said in November it could raise up to $1.5 billion in equity in subsequent months. For now, Rivian has no immediate need to tap capital markets —- the company had about $13.2 billion in cash as of Sept. 30, which it said is enough until 2025, though it’s been spending a lot to bring models to market and expand production.

“People are worried that given the pace of production, they will not be able to make cars fast enough to reach that point where they will not need to raise cash anymore,” Canaccord’s Gianarikas said of Rivian.

The EV startups appear increasingly risky at a time when investors are looking for safe assets. Car manufacturing was already a capital-intensive, supply-chain-focused business. On top of that, the industry is highly sensitive to economic swings and climbing borrowing costs that drive up the cost of financing a car purchase. And as consumers tighten their purse strings, EVs that are typically more expensive than gasoline-powered vehicles are bound to take a harder hit.

“Most unprofitable technology stocks got hard hit last year due to tightening Fed policies and commensurate impact on interest rates,” said Ivana Delevska, chief investment officer at SPEAR Invest. “But in addition to that, fundamentals for EVs deteriorated in the fourth quarter as it became clear that too much supply was coming on the market.”

For Rivian, the selloff has been especially ugly. It has performed worse than Tesla and Lucid, as well as other EV makers such as Nikola Corp., Fisker Inc., Polestar Automotive Holding UK Plc, Workhorse Group Inc. and Lordstown Motors Corp.

The disadvantages of being a smaller EV maker in these times became clearer last week when Tesla announced a price cut across its product lineup, a move that analysts said could come as a bigger blow to its competitors who will be forced to follow. On Friday’s trading session after the cut was announced, Rivian and Lucid shares dropped more than Tesla’s.

Shrunken equity values and price cuts aren’t the only risks the startups face. The pace of EV sales also is expected be slower than previously expected. According to BloombergNEF, while the adoption of electric cars will continue to rise in 2023, it will be at a more tepid pace than the last two years.

“Even without a recession, the risk for the ‘next Teslas’ is elevated,” SPEAR’s Delevska said. “Tesla now has scale and profitability, and while we expect significant downside to that profitability, we don’t think Tesla will go out of business. Many of the newcomers will.”

Tech Chart of the Day

Netflix Inc. stock has almost doubled from its 2022 low as the streaming giant inches closer to Walt Disney Co.’s market value. The Los Gatos, California-based streaming company has not been more valuable than the Mouse House for more than a year now as the streaming company’s stock was hit by back-to-back earnings disappointments in the first half of 2022. Netflix has since embarked on some major changes, including the introduction of a cheaper ad-supported tier to attract new subscribers and retain old ones. The company is slated to report fourth-quarter results after the market closes on Thursday.

Top Tech Stories

Apple Inc. is working on a slate of devices aimed at challenging Amazon.com Inc. and Google in the smart-home market, including new displays and a faster TV set-top box, after relaunching its larger HomePod speaker.

Revenues in global contract chipmaking, or foundries, are projected to fall this year as demand cools rapidly for the advanced chips that have bolstered Asian technology-driven economies Taiwan and South Korea.

China plans to launch a government-backed app to integrate a variety of services including ride-hailing, a sign of more state involvement in a sector wracked by controversy.

Twitter Inc. has more than enough money to make its first interest payments, expected to total about $300 million. But with the payment date fast approaching, there’s nevertheless some anxiety over what the impulsive billionaire, Elon Musk, might do to ease the social-media company’s $12.5 billion debt burden.

Tesla CEO Elon Musk was on his way to the airport in August 2018 when he made a “split-second decision” to tweet that he was “considering” taking the company private with “funding secured” because he’d just read a news article revealing that Saudi Arabia was investing heavily in the electric-carmaker, his lawyer said.

Donald Trump’s campaign is asking Facebook’s parent company to reinstate his access on grounds he’s a declared 2024 presidential candidate and that keeping him off the platform is interfering with the political process.

--With assistance from Subrat Patnaik.

(Adds stock moves in fourth paragraph, updates valuations in seventh.)

Most Read from Bloomberg Businessweek

Wind Turbines Taller Than the Statue of Liberty Are Falling Over

Is a US Recession Near? Making the Call Is Trickier Than Ever

©2023 Bloomberg L.P.