Tetra Tech (TTEK) Gains More Than 10% Since Q4 Earnings Release

Tetra Tech, Inc. TTEK shares have gained 10.7% since its fourth-quarter fiscal 2022 (ended Oct 2, 2022) earnings release on Nov 9. Better-than-expected results and an impressive fiscal 2023 outlook seem to have pleased investors.

The company’s earnings beat the Zacks Consensus Estimate by 7.7%, marking the 21st consecutive quarter of delivering a surprise. Sales also surpassed estimates by 3.1%.

Tetra Tech’s adjusted earnings per share in the reported quarter were $1.26, ahead of the Zacks Consensus Estimate of $1.17. Quarterly earnings expanded 20% from the year-ago reported figure of 95 cents.

The bottom line also surpassed management’s projection of $1.13-$1.18 per share.

In fiscal 2022, the company’s adjusted earnings per share came in at $4.50, up 21% year over year.

Revenue & Segmental Performance

In the fiscal fourth quarter, Tetra Tech generated adjusted revenues of $902.6 million, reflecting a year-over-year increase of 1%. Adjusted net revenues (adjusted revenues minus subcontractor costs) were $736.1 million, up 4% year over year. The quarterly top line came above management’s guidance of $676-$726 million.

Tetra Tech’s revenues exceeded the Zacks Consensus Estimate of $714 million.

The backlog at the end of the quarter was $3,744.1 million, up 7.6% year over year.

In fiscal 2022, its adjusted net revenues were $2,835.6 million, up 11% year over year.

Revenues from U.S. Federal customers (accounting for 29% of the quarter’s revenues) were up 15% year over year. U.S. Commercial sales (25% of the quarter’s revenues) increased 25% year over year on higher renewable energy and environmental programs.

U.S. State and Local sales (14% of the quarter’s revenues) increased 2% due to strength in municipal infrastructure. International sales (32% of the quarter’s revenues) increased 5% year over year, backed by strength in sustainable infrastructure.

Tetra Tech reports revenues under the segments discussed below:

Net sales of Government Services Group were $336 million, up 8% year over year. Revenues from the Commercial/International Services Group totaled $400 million, representing a year-over-year increase of 15%.

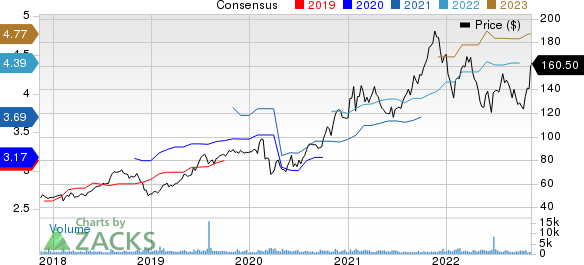

Tetra Tech, Inc. Price and Consensus

Tetra Tech, Inc. price-consensus-chart | Tetra Tech, Inc. Quote

Margin Profile

In the fiscal fourth quarter, Tetra Tech’s subcontractor costs totaled $166.4 million, reflecting a decrease of 9% from the year-ago quarter. Other costs of revenues were $580.1 million, up 2.6%. Selling, general and administrative expenses were $61.2 million, up 1.4% from the year-ago quarter.

Operating income (adjusted) in the reported quarter increased 29% year over year to $93.8 million, while the adjusted margin expanded 170 basis points to 13.8%.

Balance Sheet and Cash Flow

While exiting fourth-quarter fiscal 2022, Tetra Tech had cash and cash equivalents of $185.1 million, up 11.1% from $166.6 million recorded at the end of the fourth quarter of fiscal 2021. Long-term debt increased 23.2% from $200 million recorded at the end of fourth-quarter fiscal 2021 to $246.3 million.

In fiscal 2022, Tetra Tech generated net cash of $336.2 million from operating activities compared with $304.4 million in the prior fiscal year’s comparable period. Capital expenditure was $10.6 million, up 23.3% year over year. In the said period, TTEK’s proceeds from borrowings amounted to $161.5 million, while repayments on long-term debt totaled $117.1 million.

Shareholder-Friendly Policies

Tetra Tech bought back shares worth $200 million and distributed dividends totaling $46.1 million in fiscal 2022. These compare favorably with the share buybacks of $60 million and dividends of $40 million distributed in fiscal 2021.

Outlook

For fiscal 2023 (ending September 2023), Tetra Tech anticipates net revenues of $2.90-$3.10 billion. Adjusted earnings are predicted to be $4.70-$4.90 per share.

For the first quarter of fiscal 2023 (ending December 2022), management estimates net revenues of $675-$725 million and adjusted earnings of $1.15-$1.20 per share.

Zacks Rank & Stocks to Consider

Tetra Tech currently has a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

EPAC’s earnings estimates have increased 9.1% for fiscal 2023 (ending August 2023) in the past 60 days. The company’s shares have gained 33% in the past six months.

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank #1 and a trailing four-quarter earnings surprise of 24.8%, on average.

AIT’s earnings estimates have increased 3% for fiscal 2023 (ending June 2023) in the past 60 days. The company’s shares have risen 23.4% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2 (Buy). IEX’s earnings surprise in the last four quarters was 5.7%, on average.

In the past 60 days, IDEX’s earnings estimates have increased 1.8% for 2022. The stock has rallied 26.3% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research