TEVA Beats Q4 Earnings Estimates, Sales Miss & Stock Down

Teva Pharmaceutical Industries Limited TEVA reported fourth-quarter 2022 adjusted earnings of 71 cents per share, which beat the Zacks Consensus Estimate of 68 cents. In the year-ago quarter, adjusted earnings stood at 77 cents per share.

Revenues for the fourth quarter came in at $3.88 billion, which slightly missed the Zacks Consensus Estimate of $3.91 billion. Total revenues declined 5% on a reported basis due to currency headwinds. Revenues were hurt by currency changes due to the appreciation of the U.S. dollar as around 47% of Teva’s revenues come from sales denominated in currencies other than the U.S. dollar.

On a constant-currency basis, sales increased by 1% compared with the fourth quarter of 2021. This tangible increase in sales was mostly driven by higher revenues from Anda, generic products in the Europe segment, Austedo and Ajovy, partially offset by lower revenues from Copaxone, generic products and certain respiratory products in the North America segment.

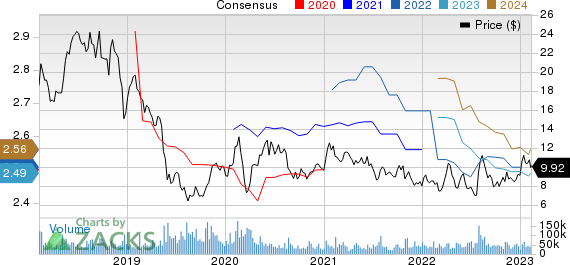

Teva Pharmaceutical Industries Ltd. Price and Consensus

Teva Pharmaceutical Industries Ltd. price-consensus-chart | Teva Pharmaceutical Industries Ltd. Quote

Full-Year 2022 Results

Revenues in the full-year 2022 were clocked at $14.93 billion, portraying a 6% decrease compared with 2021 results. Sales slightly missed the Zacks Consensus Estimate of $14.96 billion as well as the guided range of $15.0-$15.6 billion. On a constant currency basis, a reduction of 1% was observed compared with 2021.

Adjusted diluted EPS for the full year was $2.52 which is in line with the guidance range of $2.40-$2.60 per share.

Segment Discussion

The company reports through the following segments based on three regions — North America (comprising the United States and Canada), Europe and International markets.

North America segment sales were $2 billion, flat, compared with the year-over-year value due to lower sales of branded drugs, Copaxone, Bendeka/Treanda as well as generic products, offset by the increase in sales of Austedo, Ajovy and Anda. In the United States, sales increased 2% from the prior-year quarter to $1.9 billion.

Copaxone posted sales of $101 million in North America, down 22% year over year due to generic erosion in the United States and lower market share owing to increased competition.

Combined sales of Bendeka and Treanda declined 20% from the year-ago quarter to $75 million. Sales of Bendeka and Treanda were hurt because of the availability of alternative therapies and continued competitive pressure.

Austedo recorded sales of $344 million in North America, up 22% year over year, driven by volume growth as prescription trends continue to grow.

Ajovy, Teva’s migraine treatment, recorded sales of $75 million for the quarter, up 41% year over year, driven by higher volumes and effective pricing.

Generic/biosimilar product revenues declined 10% from the year-ago period to $818 million in the North American segment due to increased competition and supply disruptions, including the closure of Teva’s Irvine manufacturing site.

Distribution revenues, generated by Anda, rose 27% year over year for the quarter to $450 million on account of higher demand.

The Europe segment recorded revenues of $1.1 billion, down 11% year over year on a reported basis due to currency headwinds. Sales rose 4% in constant currency, driven by higher demand for generic and OTC products and higher sales of new generic products as well as higher revenues from Ajovy, partially offset by lower revenues from Copaxone and certain other respiratory products.

In the International Markets segment, sales declined 9% year over year to $482 million. In constant currency terms, sales increased by 3% from a year ago because of higher revenues in most markets.

The Other segment (comprising the API manufacturing business and certain contract manufacturing services) recorded revenues of $272 million, down 10% year over year on a reported basis and 7% in constant currency terms.

Costs Discussion

The adjusted gross margin was 54.2% for the quarter down 190 basis points year over year.

Adjusted research & development expenses declined 14% year over year to $210 million due to a decline in various generics projects as well as in the immunology pipeline, partially offset by higher R&D expenses related to the biosimilar products pipeline. Selling and marketing expenditure declined 13% from the year-ago level to $549 million. General and administrative expenses increased 4% from the prior-year level to $289 million.

Adjusted operating income declined 9.5% year over year in the reported quarter to $1.1 billion due to lower gross profit.

Outlook for 2023

Rolling into 2023, Teva issued 2023 revenue guidance of $14.8-$15.4 billion. The Zacks Consensus Estimate stood at $15.08 billion.

Adjusted operating income guidance is $4-$4.4 billion.

Teva expects an adjusted diluted EPS of $2.25-$2.55 in 2023. The Zacks Consensus Estimate stood at $2.49 per share.

Teva’s shares were down 9% on Wednesday in response to the earnings results due to the mixed results and probably as the financial guidance fell short of investor expectations.

In the past year, the shares of Teva Pharmaceuticals rose 12.6% against the industry’s decline of 14.8%.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Teva currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked generic/biotech stocks are Agile Therapeutics, Inc. AGRX, 89BIO, Inc. ETNB and ADMA Biologics, Inc. ADMA, all carrying a Zacks Rank #2 (Buy) at present.

In the past 90 days, the estimate for Agile Therapeutics’ 2023 loss per share estimate narrowed from 42 cents to 25 cents. In the past year, the shares of Agile Therapeutics’ have plunged by 98.1%.

AGRX’s earnings witnessed an average earnings surprise of 2.84% with a positive surprise of 23.33% in the last reported quarter.

In the past 90 days, the estimate for 89BIO’s 2022 loss per share has narrowed from $3.81 to $2.99. During the same period, the loss estimate per share for 2023 has narrowed from $3.59 to $2.59. In the past year, the shares of 89BIO have risen by 185.9%.

ETNB’s earnings witnessed an average earnings surprise of 10.08%, beating three out of four estimates in the trailing four reported quarters.

In the past 90 days, the consensus estimate for ADMA Biologics’ 2022 loss per share has narrowed from 34 cents to 33 cents. During the same period, the loss estimate per share for 2023 has narrowed from 20 cents to 19 cents. In the past year, the shares of ADMA Biologics have increased by 124.8%.

ADMA’s earnings beat estimates in three of the trailing four quarters, delivering an average earnings surprise of 1.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Agile Therapeutics, Inc. (AGRX) : Free Stock Analysis Report

89BIO (ETNB) : Free Stock Analysis Report