Teva Pharmaceutical: Long-Term Cash Cow

Teva Pharmaceutical Industries (NYSE:TEVA) is one of the leading companies in the healthcare sector, specializing in developing and commercializing generic products and branded medicines aimed at combating neurological and neurodegenerative diseases.

Investment thesis

The last twelve months have been some of the most eventful in the company's history, from Richard Francis's accession to the CEO position to the settlement of thousands of opioid-related lawsuits.

On November 8, 2023, Teva released third-quarter financial results that exceeded our expectations and raised its full-year 2023 revenue guidance from $15-$15.4 billion to $15.1-$15.5 billion. We highlight several factors contributing to the company's improved financial position in recent quarters.

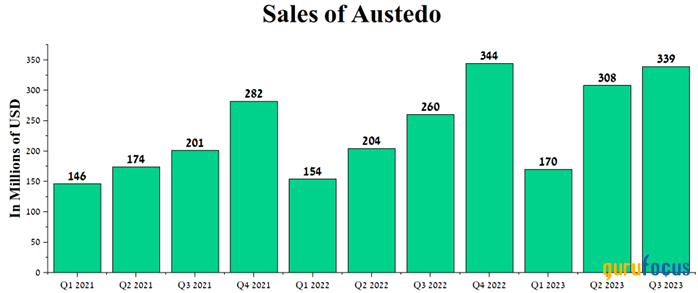

Demand for Austedo and Ajovy continues to grow

Sales of Austedo (deutetrabenazine) were $339 million in the third quarter of 2023, up 10% from the prior quarter and 30.4% from the third quarter of 2022, primarily due to the launch of its extended-release version called Austedo XR in mid-May 2023. Both of these medicines are used to treat patients with tardive dyskinesia and chorea caused by Huntington's disease.

Author's elaboration, based on quarterly securities reports

The continued high demand for Teva Pharmaceutical's product is ensured, among other things, by its more favorable safety profile relative to Lundbeck's Xenazine, with comparable efficacy between them in the treatment of chorea caused by Huntington's disease.

Author's elaboration, based on the FDA

Moreover, we expect that demand for Austedo will continue to grow in 2024, including due to the aging of the world's population and the use of antipsychotic medications by patients, some of whom subsequently develop tardive dyskinesia.

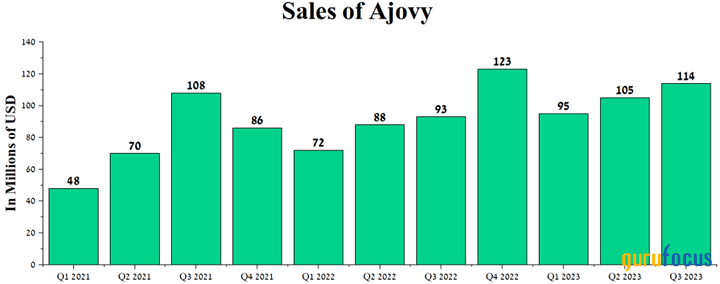

Additionally, along with the growth in sales of Austedo, the demand for Ajovy (fremanezumab-vfrm), which is a medicine approved by the FDA and EMA for the preventive treatment of migraine in adults, is growing. Its sales amounted to $114 million, an increase of 22.6% compared to the previous year.

Author's elaboration, based on quarterly financial reports

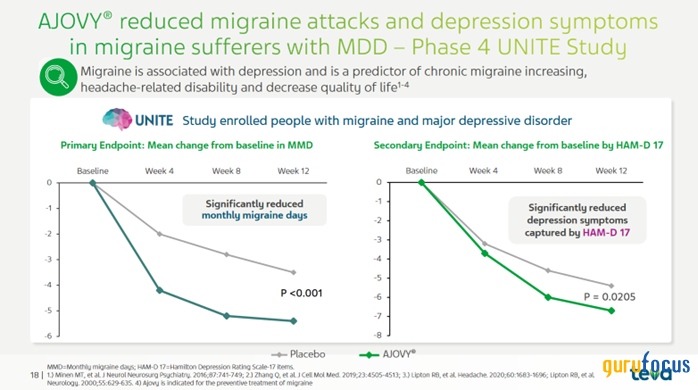

In addition, we expect that demand will continue to grow in the future due to data obtained from a phase 4 clinical trial that recruited 353 patients with migraine and major depressive disorder (MDD). The group of patients taking the company's product experienced an average of 5.1 reduced monthly migraine days compared to 2.9 in the placebo group, a statistically significant improvement.

Simultaneously, patients taking fremanezumab experienced a 6.7 decrease in the Hamilton Rating Scale for Depression (HAM-D 17) at week 12, compared with a 5.4 reduction in the placebo group. As a result, Teva's drug has shown further evidence of its effectiveness in combating the disease affecting millions of people worldwide.

Earnings Call Presentation

Teva Pharmaceutical has an extensive portfolio of biosimilars and experimental drugs

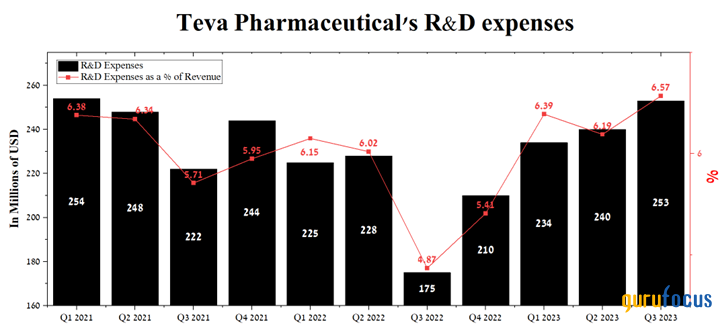

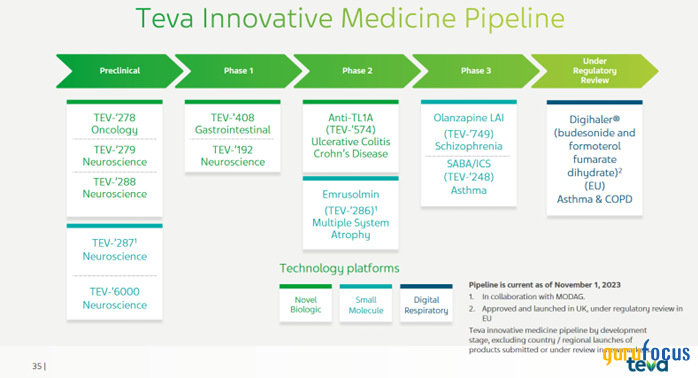

On May 18, 2023, the company's management launched a strategy called "Pivot to Growth," which aims to develop branded medicines and biosimilars more actively to increase Teva's margins and reduce the share of generics in its revenue. As a result, the company's R&D expenses continued to grow from quarter to quarter and amounted to $253 million for the three months ended September 30, 2023.

Author's elaboration, based on Seeking Alpha

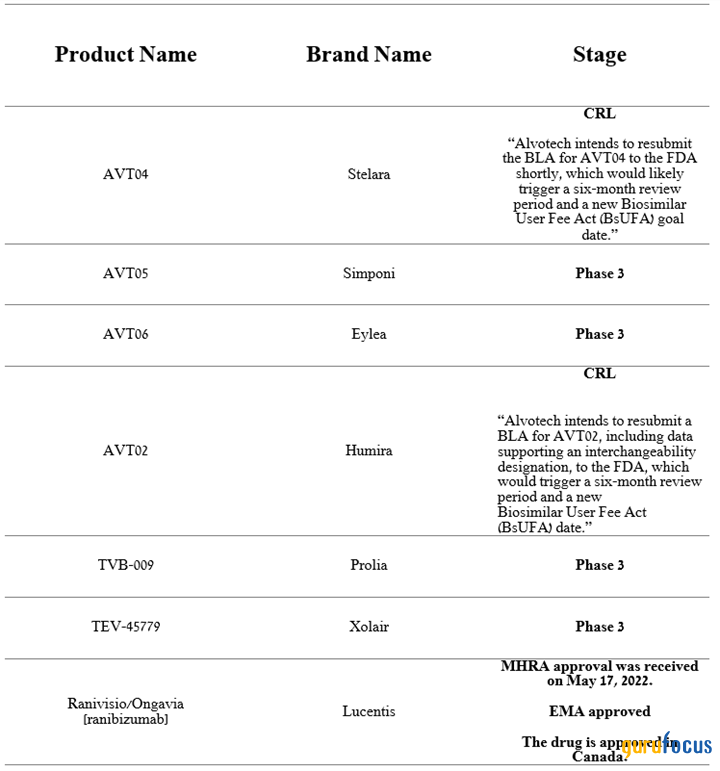

So, Teva's portfolio of biosimilar medicines continues to expand through partnerships with other pharmaceutical companies, including Alvotech (NASDAQ:ALVO) and Celltrion. We believe that the crown jewel of the experimental drugs listed below is AVT04.

Author's elaboration, based on quarterly securities reports

AVT04 is a biosimilar of Johnson & Johnson's Stelara (JNJ), whose sales were $2,864 million in Q3 2023, an increase of 16.9% year-over-year. However, on October 12, the FDA issued a CRL for Alvotech's BLA for AVT04. We expect Teva and Alvotech to resolve the deficiencies that the FDA found during the inspection of the plant in Reykjavik, where AVT04 is manufactured, and will resubmit the BLA at the end of the fourth quarter. If approved by the FDA, the start of commercialization of AVT04 will be possible in the second half of 2024, which will have a positive impact on the company's revenue growth rate.

In addition to biosimilars, Teva Pharmaceutical is developing innovative medicines that have the potential to improve the quality of life for millions of patients suffering from diseases such as schizophrenia, asthma, Crohn's disease, ulcerative colitis, and more.

Earnings Call Presentation

In order to speed up the development of product candidates and reduce the company's total debt, its management has entered into major partnership agreements with Royalty Pharma (NASDAQ:RPRX) and Sanofi (NASDAQ:SNY) in the last two months. So, on October 4, 2023, Teva entered into a collaboration agreement with Sanofi for the joint development and commercialization of TEV 574, a TL1A inhibitor for treating inflammatory bowel diseases. Under the terms of the agreement, the Israeli pharmaceutical company received an upfront payment of $500 million and is eligible to receive up to $1 billion upon achieving certain milestones.

Teva Pharmaceutical's Q3 2023 financial results and outlook for the 2H 2023

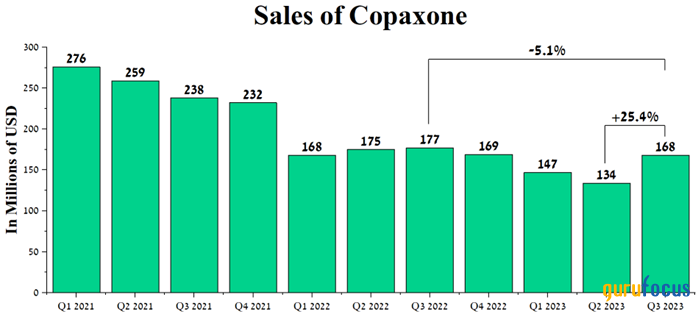

On November 8, 2023, the company released financial results for the third quarter of 2023 that were quite good. The company's revenue was $3.85 billion for the three months that ended September 30, 2023, an increase of 6.9% year-over-year due to increased demand for Austedo, Ajovy, and its generic products in North America. Moreover, sales of Copaxone (glatiramer acetate), Teva's blockbuster medicine for the treatment of relapsing forms of multiple sclerosis, grew quarterly despite the increased competition from its generic versions.

Author's elaboration, based on quarterly financial reports

The Israeli pharmaceutical company is anticipated to release its financial report for the fourth quarter of 2023 on February 9, 2024. According to Seeking Alpha, Teva Pharmaceutical's revenue for the quarter is expected to be $3.88 billion to $4.13 billion, up 6.7% from analysts' expectations for the previous quarter.

Author's elaboration, based on GuruFocus and Seeking Alpha

At the same time, according to our model, the company's total revenue will be slightly above the median of this range and will reach $4.02 billion. Its growth, both year-on-year and quarter-on-quarter, will be driven primarily by rising prices of its products, the launch of generic versions of branded products in North America, and increased demand for its medicines targeting central nervous system disorders.

Created by author

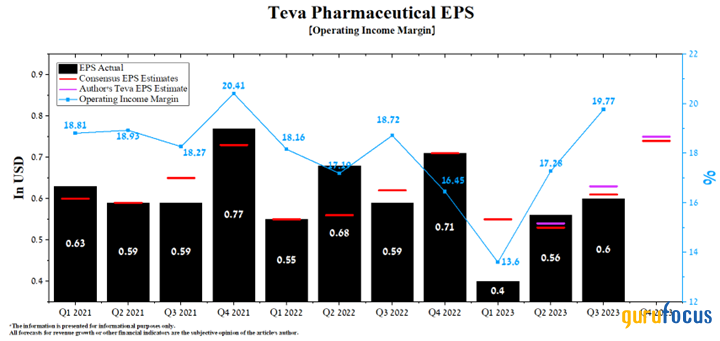

Thanks to the receipt of payments under partnership agreements in the fourth quarter, we expect the company's operating income margin to reach 18.1% for 2023. On the other hand, this financial indicator will increase to 19.6% by 2024, mainly due to lower inflation, expansion of the company's portfolio of generic products, optimization of labor costs, and increased demand for its key products such as Ajovy, Austedo, and Uzedy.

Teva Pharmaceutical's Non-GAAP EPS for the third quarter of 2023 was $0.6, up 6.7% from the previous quarter. According to Seeking Alpha, Teva's fourth-quarter EPS is expected to be $0.69-$0.85, up 4.2% from analysts' consensus estimates for the fourth quarter of 2022. In addition, we expect its EPS to be slightly above the median of this range and reach $0.75.

Author's elaboration, based on GuruFocus and Seeking Alpha

Meanwhile, Teva's Non-GAAP P/E [TTM] is 4.16x, which is 75.92% lower than the sector average and 4.84% higher than the average over the past five years. Furthermore, the Non-GAAP P/E [FWD] is 4.12x, which is one of the key factors indicating that the company is significantly undervalued by Mr. Market, especially when demand for Copaxone remains stable and its net debt decreases.

Conclusion

Teva Pharmaceutical Industries is one of the leading companies in the healthcare sector, specializing in developing and commercializing generic products and branded medicines aimed at combating neurological and neurodegenerative diseases.

Unlike many large pharmaceutical companies, Teva's financial position is less affected by President Biden's Inflation Reduction Act (IRA). However, due to the impact of risks such as Hamas' war against Israel, which could escalate into a larger conflict in the Middle East, and increased competition in the global migraine drugs market, downward pressure remains on its share price.

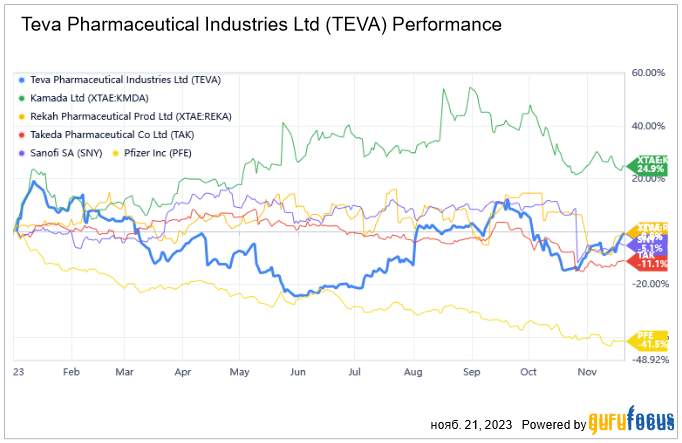

GuruFocus

On the other hand, Teva's debt, which has remained a headache for its management for a long time, continues to decline. So, net debt was about $18.05 billion at the end of September 2023, decreasing by 47.1% compared to 2016.

Moreover, the company's growing revenue year on year, the relatively high rate of expansion of its portfolio of experimental drugs and biosimilars, rising operating income margin, and numerous partnership agreements are some of the main investment theses that make Teva Pharmaceutical an attractive asset for long-term investors.

We continue our analytics coverage of Teva with an "outperform" rating for the next 12 months.

This article first appeared on GuruFocus.