TEVA Q2 Earnings & Sales Top as Austedo Outperforms, Stock Up

Teva Pharmaceutical Industries Limited TEVA reported second-quarter 2023 adjusted earnings of 56 cents per share, which beat the Zacks Consensus Estimate of 54 cents. Earnings however declined 17.6% year over year due to lower gross margin and higher financial expenses.

Revenues for the second quarter came in at $3.88 billion, which beat the Zacks Consensus Estimate of $3.69 billion. Total revenues rose a mere 2% on a reported basis. A strengthening dollar hurt the company’s revenues.

On a constant-currency basis, sales increased 4% as lower revenues of some branded drugs as well as generic products in the North America segment were partially offset by higher sales of newer products Austedo and Ajovy in North America and higher generic revenues in International markets. Overall, revenues were soft in the Europe market.

Segment Discussion

The company reports through the following segments based on three regions — North America (comprising the United States and Canada), Europe and International markets.

North America segment sales were $1.99 billion, up 5% year over year as lower sales of branded drugs, Copaxone, Bendeka/Treanda as well as generic products were offset by the increase in sales of Austedo, Ajovy and Anda. In the United States, sales increased 7% from the prior-year quarter to $1.89 billion.

Copaxone posted sales of $64 million in North America, down 33% year over year due to generic erosion in the United States and lower market share owing to increased competition. Copaxone sales missed our model estimates of $70.4 million as well as the Zacks Consensus Estimate of $74.0 million.

Combined sales of Bendeka and Treanda declined 17% from the year-ago quarter to $69 million. Sales of Bendeka and Treanda were hurt by generic erosion. Teva lost orphan drug exclusivity for bendamustine products in December 2022.

Huntington's disease drug, Austedo recorded sales of $308 million in North America, up 51% year over year, driven by volume growth as prescription trends continued to grow and the launch of Austedo extended release tablets, its once-a-day formulation, in May. Austedo sales beat our model estimate of $270.6 million as well as the Zacks Consensus Estimate of $253.0 million.

Ajovy recorded sales of $57 million for the quarter, up 16% year over year driven by higher volumes. Ajovy sales beat our model estimate of $49.4 million as well as the Zacks Consensus Estimate of $55.0 million.

In April, the FDA approved Teva’s Uzedy (risperidone) extended-release injectable suspension, a long-acting subcutaneous atypical antipsychotic injection, for the treatment of schizophrenia in adults. Uzedy has shown up to 80% reduction in the risk of schizophrenia relapse versus placebo in a phase III study. Teva did not report any Uzedy sales in the second quarter but just said mentioned that the initial launch uptake was encouraging.

Generic/biosimilar product revenues declined 6% from the year-ago period to $969 million in the North American segment due to increased competition faced by some medicines. Generic revenues, however, beat our model estimate of $887.1 million as well as the Zacks Consensus Estimate of $924.0 million.

Distribution revenues, generated by Anda, rose 27% year over year in the quarter to $392 million on account of higher demand in secondary wholesale markets.

The Europe segment recorded revenues of $1.16 billion, down 1% year over year on a reported basis. Sales were flat on a constant currency basis. Europe revenues missed our model estimates of $1.23 billion as well as the Zacks Consensus Estimate of $1.19 billion.

Generic products revenues in Europe rose 2% in constant currency terms to $909 million. However, generic revenues were softer than the first quarter due to a difficult comparison to the year-ago quarter and the impact of seasonality. Copaxone sales declined 21% to $60 million. Ajovy revenues increased 32% on a reported as well as constant currency basis to $39 million.

In the International Markets segment, sales rose 5% year over year to $479 million. In constant currency terms, sales increased 13% from a year ago, driven mainly by higher generic revenues.

Generic products revenues rose 13% in constant-currency terms to $394 million mainly driven by price increases. Copaxone sales were $10 million compared with $9 million in the year-ago quarter.

The Other segment (comprising the sale of active pharmaceutical ingredients to third parties and certain contract manufacturing services) recorded revenues of $245 million, down 5% year over year on reported as well as constant currency terms.

Cost Discussion

Adjusted gross margin was 52.2% for the quarter, down 220 basis points year over year due to an unfavorable portfolio mix and higher cost of goods sold due to inflationary pressure. However, gross margins rose 310 basis sequentially as Teva’s portfolio mix shifts toward newer drugs, Ajovy and Austedo and cost of goods sold decline due to supply improvements and easing of some elements of inflationary pressure.

Adjusted research & development expenses rose 5% year over year to $240 million due to higher costs related to generic/biosimilar and neuroscience (mainly neuropsychiatry) and immunology pipeline projects.

Selling and marketing expenditure rose 2% from the year-ago level to $603 million. General and administrative expenses declined 2% from the prior-year level to $307 million.

The adjusted operating margin declined 80 bps to 26.1% in the quarter due to lower gross profit margin.

Outlook for 2023 Reaffirmed

Teva slightly raised the lower end of its revenue guidance for 2023 while keeping the EPS range intact.

Teva expects to record revenues in the range of $15.0-$15.4 billion compared with $14.8-$15.4 billion expected previously.

Sales of Copaxone in all regions are expected to be approximately $500 million. Teva expects Ajovy and Austedo revenues of approximately $400 million and $1.2 billion, respectively.

Adjusted operating income is expected in the range of $4-$4.4 billion. Teva expects adjusted EBITDA in the range of $4.5-$4.9 billion.

Teva expects adjusted EPS in the range of $2.25-$2.55 in 2023. Free cash flow is expected to be in the range of $1.7-$2.1 billion.

Our Take

Teva’s second-quarter results were strong as it beat estimates for earnings as well sales. The increase in revenue guidance was also encouraging. However, the 51% increase in Austedo revenues in North America caught investor attention.

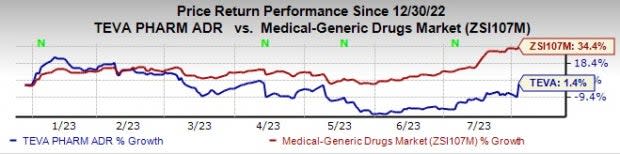

Teva’s shares were up almost 12% on Wednesday in response to the better-than-expected results. So far this year, shares of Teva Pharmaceuticals have risen 1.4% compared with the industry’s increase of 34.4%.

Image Source: Zacks Investment Research

Teva expects its newer drugs, Austedo, Uzedy, and Ajovy as well as a stable generics business to help revive top-line growth in the future quarters. Teva’s revenues have suffered significantly after it lost exclusivity of key multiple sclerosis medicine, Copaxone in 2015. It is also saving costs and improving margins through the optimization of operations for efficiency while also lowering the debt on its balance sheet. Teva expects a gradual improvement in its gross margin in the second half of the year.

Zacks Rank & Stocks to Consider

Teva currently carries a Zacks Rank #4 (Sell).

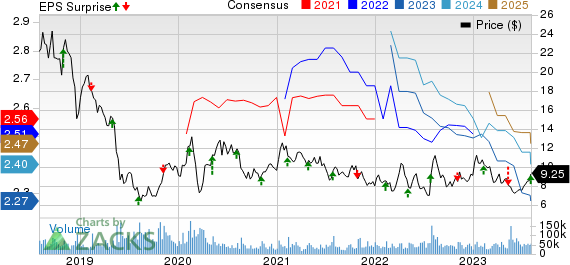

Teva Pharmaceutical Industries Ltd. Price, Consensus and EPS Surprise

Teva Pharmaceutical Industries Ltd. price-consensus-eps-surprise-chart | Teva Pharmaceutical Industries Ltd. Quote

Some better-ranked stocks generic drugmakers/biotech companies are Amphastar Pharmaceuticals AMPH, Dr. Reddys Laboratories RDY and Acasti Pharma ACST. While Amphastar Pharmaceuticals and Dr. Reddy’s sport a Zacks Rank #1 (Strong Buy), Acasti Pharma has a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings per share estimates for Amphastar Pharmaceuticals have increased from $2.56 to $2.69 for 2023 and from $2.89 to $3.25 for 2024 in the past 30 days. Shares of AMPH have surged 120.1% year to date. Earnings of Amphastar Pharmaceuticals beat estimates in three of the last four quarters and were in line in one, the average surprise being 33.83%.

Earnings per share estimates for Dr. Reddy’s Laboratories have increased from $3.40 to $3.64 for 2023 and from $3.79 to $4.06 for 2024 in the past 30 days. Shares of RDY have risen 34% so far this year. Earnings of Dr. Reddy’s Laboratories beat estimates in all the last four quarters, the average surprise being 39.63%

Loss per share estimates for Acasti Pharma have narrowed from $2.49 to $1.97 for 2023 and from $2.91 to $1.70 for 2024 in the past 30 days. Shares of ACST have declined 16.2% year to date. Earnings of Acasti Pharma beat estimates in the past two quarter, the average surprise being 46.16%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report

Acasti Pharma, Inc. (ACST) : Free Stock Analysis Report