Texas Instruments Inc (TXN) Faces Revenue Decline Amidst Strong Cash Flow Performance

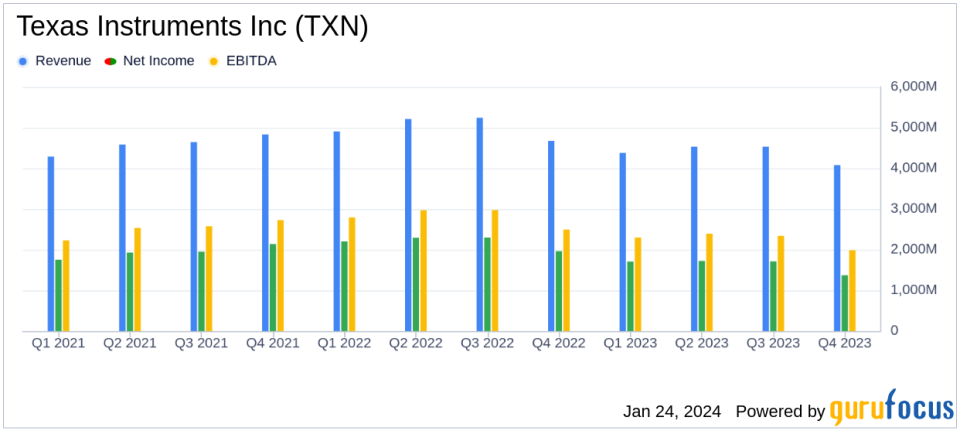

Revenue: Reported a 13% year-over-year decrease to $4.08 billion.

Net Income: Dropped by 30% compared to Q4 2022, totaling $1.37 billion.

Earnings Per Share (EPS): Decreased by 30% year-over-year to $1.49, including a 3-cent benefit.

Free Cash Flow: Marked a significant 77% decline from the previous year, standing at $1.3 billion.

Capital Expenditures: Increased by 81% year-over-year, reflecting a $5.1 billion investment.

Shareholder Returns: Dividends and stock repurchases totaled $4.9 billion over the past 12 months.

Outlook: Q1 2024 revenue is expected to be between $3.45 billion and $3.75 billion, with EPS forecasted at $0.96 to $1.16.

On January 23, 2024, Texas Instruments Inc (NASDAQ:TXN) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The Dallas-based semiconductor giant, known for its analog chips and processors, reported a decrease in revenue and net income, reflecting broader challenges in the industry.

Financial Performance and Industry Challenges

TI's revenue saw a 13% decline from the same quarter a year ago, with a notable sequential decrease in the industrial sector and a decline in automotive. Net income and earnings per share both fell by 30% year-over-year. Despite these challenges, the company's business model and 300mm production have continued to generate strong cash flow, with $6.4 billion from operations over the trailing 12 months.

President and CEO Haviv Ilan highlighted the company's resilience amidst market challenges, stating,

Our cash flow from operations of $6.4 billion for the trailing 12 months again underscored the strength of our business model, the quality of our product portfolio and the benefit of 300mm production."

However, the company's free cash flow experienced a significant decline, which may raise concerns about its ability to sustain high levels of shareholder returns in the future.

Investments and Shareholder Returns

Over the past year, Texas Instruments has invested heavily in research and development (R&D) and selling, general, and administrative (SG&A) expenses, totaling $3.7 billion. Capital expenditures were also substantial at $5.1 billion, an 81% increase from the previous year. Despite these investments, the company returned $4.9 billion to shareholders through dividends and stock repurchases, demonstrating a commitment to shareholder value.

Financial Statements Overview

The income statement reflects the downturn in revenue and net income, with operating profit also decreasing by 30%. The balance sheet shows a healthy cash and short-term investments position, although there is an increase in long-term debt. The cash flow statement reveals the robust operational cash flow, offset by significant capital expenditures and cash returned to shareholders.

Analysis and Outlook

While Texas Instruments faces industry-wide headwinds, its strong cash flow and strategic investments position the company to navigate the uncertain market. The outlook for Q1 2024 suggests a cautious approach, with expected revenue and earnings per share lower than the previous year's figures. Investors will be watching closely to see if the company can leverage its strengths to overcome the challenges ahead.

For a detailed analysis of Texas Instruments Inc (NASDAQ:TXN)'s financial results and strategic outlook, value investors and potential GuruFocus.com members are encouraged to visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Texas Instruments Inc for further details.

This article first appeared on GuruFocus.