Texas Pacific Land Corp: A High-Performing Giant in the Oil & Gas Industry

Texas Pacific Land Corp (NYSE:TPL) is a prominent player in the Oil & Gas industry. As of August 3, 2023, the company's stock price stands at $1559.77, with a market cap of $12 billion. The stock has seen a gain of 6.45% today and an impressive 15.86% over the past four weeks. This article will delve into the company's financial performance and potential, as indicated by its GF Score and other key metrics.

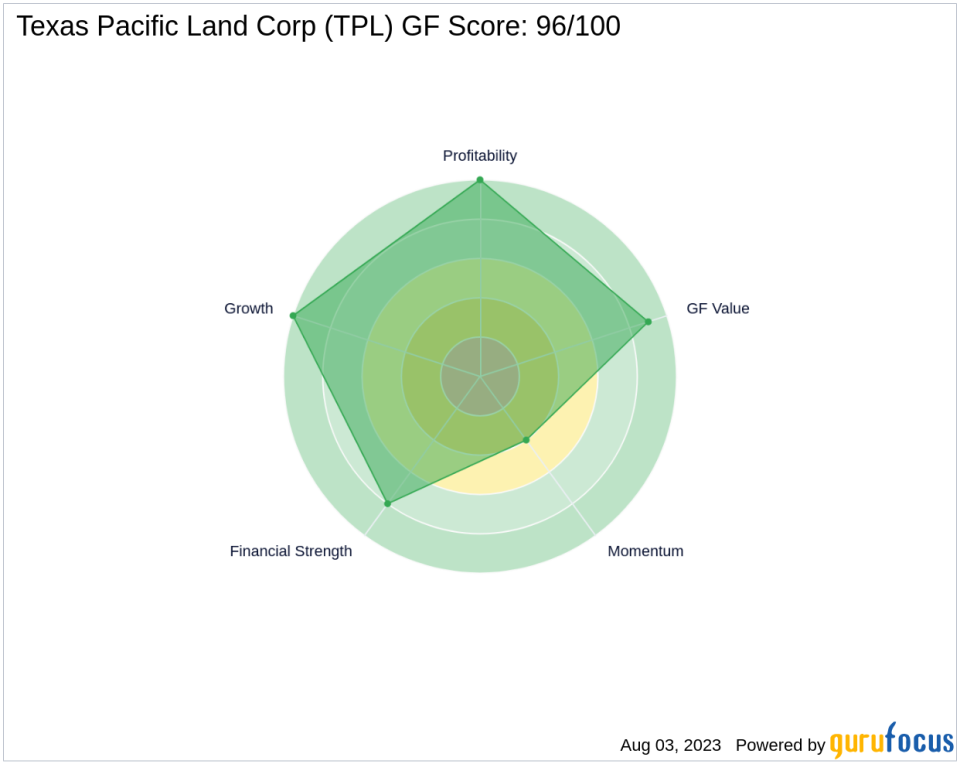

GF Score Analysis

The GF Score is a comprehensive ranking system developed by GuruFocus. It evaluates a stock's performance potential based on five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. TPL boasts a GF Score of 96/100, placing it in the highest outperformance potential category. This suggests that the company is likely to generate higher returns than those with lower GF Scores.

Financial Strength Analysis

The Financial Strength Rank measures a company's financial stability. TPL's rank of 8/10 indicates a strong financial situation. The company has no debt burden, as indicated by its debt to revenue ratio of 0.00, and its Altman Z-Score of 58.50 further underscores its financial health.

Profitability Rank Analysis

The Profitability Rank assesses a company's profitability and its likelihood of remaining profitable. TPL's rank of 10/10, the highest possible score, suggests exceptional profitability. The company's Operating Margin of 81.47% and Piotroski F-Score of 7 further support this.

Growth Rank Analysis

The Growth Rank measures a company's revenue and profitability growth. TPL's rank of 10/10 indicates strong growth prospects, with a 5-year revenue growth rate of 26.20% and a 3-year revenue growth rate of 11.00%.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. TPL's rank of 9/10 suggests that the company is attractively valued.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. TPL's rank of 4/10 indicates moderate momentum.

Competitor Analysis

When compared to its main competitors in the Oil & Gas industry, TPL stands out with its high GF Score. Chesapeake Energy Corp (NASDAQ:CHK) has a GF Score of 26, Ovintiv Inc (NYSE:OVV) has a score of 78, and APA Corp (NASDAQ:APA) has a score of 76. This suggests that TPL has a higher performance potential than these competitors. For more details, please visit our competitors' analysis page.

In conclusion, Texas Pacific Land Corp's strong GF Score, Financial Strength, Profitability Rank, Growth Rank, and GF Value Rank, coupled with its moderate Momentum Rank, make it a compelling investment in the Oil & Gas industry.

This article first appeared on GuruFocus.