Texas Roadhouse Inc (TXRH) Reports Robust Earnings Growth and Increased Dividend

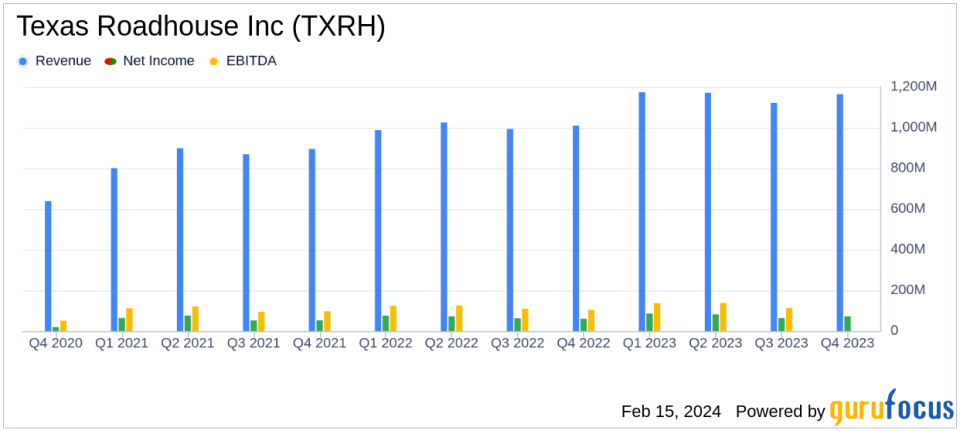

Total Revenue: Increased by 15.3% for Q4 and 15.4% for the full year.

Net Income: Grew by 21.0% in Q4 and 13.0% for the full year.

Diluted Earnings Per Share: Rose by 21.3% to $1.08 for Q4 and by 14.3% to $4.54 for the full year.

Dividend: Quarterly cash dividend increased by 11% to $0.61 per share.

Restaurant Margin: Improved to 15.3% of restaurant and other sales for Q4 and 15.4% for the full year.

Comparable Restaurant Sales: Increased by 6.8% for the first 50 days of Q1 2024.

New Openings: 19 new company restaurants under construction, with a more evenly distributed opening schedule expected.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 15, 2024, Texas Roadhouse Inc (NASDAQ:TXRH) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 26, 2023. The company, known for its casual dining restaurants, including the flagship Texas Roadhouse brand, Bubba's 33, and other segments, reported significant growth in revenue and net income, alongside an increase in its quarterly dividend.

Financial Performance Highlights

For the 13 weeks ended December 26, 2023, Texas Roadhouse Inc saw a 15.3% increase in total revenue compared to the same period in the previous year, reaching $1.16 billion. The full-year results were similarly impressive, with a 15.4% increase in total revenue, amounting to $4.63 billion. Income from operations and net income also experienced double-digit growth, with the latter increasing by 21.0% in the fourth quarter and 13.0% for the full year.

Diluted earnings per share for the fourth quarter were $1.08, a 21.3% increase from the prior year's $0.89. For the full year, diluted earnings per share rose by 14.3% to $4.54. These results reflect the company's ability to drive profitability through effective management and operational efficiency.

Strategic Growth and Dividend Increase

CEO Jerry Morgan highlighted the company's "outstanding year," marked by double-digit same-store sales growth and a record number of new system-wide openings. Looking ahead to 2024, Texas Roadhouse Inc plans to continue its expansion with 19 new company restaurants currently under construction. The company's strong balance sheet and disciplined capital allocation strategy are expected to support ongoing growth and shareholder returns.

In line with this strategy, the Board of Directors authorized an 11% increase in the quarterly cash dividend to $0.61 per share, demonstrating confidence in the company's financial health and commitment to delivering shareholder value.

Operational Efficiency and Future Outlook

The company's restaurant margin, a key metric for evaluating operational efficiency, improved to 15.3% for the fourth quarter and 15.4% for the full year. This non-GAAP measure reflects the company's ability to manage restaurant-level operating costs effectively.

For the first 50 days of the first quarter of fiscal 2024, comparable restaurant sales at company restaurants increased by 6.8% compared to the same period in 2023. Additionally, management plans to implement a menu price increase of approximately 2.2% in late March, which may contribute to revenue growth in the coming year.

Texas Roadhouse Inc's performance in 2023 sets a positive tone for the year ahead, with a strong development pipeline and a focus on operational efficiencies poised to drive continued success. Value investors may find the company's robust financial achievements, disciplined growth strategy, and commitment to shareholder returns particularly appealing.

For more detailed information, investors are encouraged to review the full 8-K filing and listen to the conference call hosted by Texas Roadhouse Inc.

Explore the complete 8-K earnings release (here) from Texas Roadhouse Inc for further details.

This article first appeared on GuruFocus.