Texas Roadhouse (NASDAQ:TXRH) Reports Sales Below Analyst Estimates In Q3 Earnings

Restaurant company Texas Roadhouse (NASDAQ:TXRH) fell short of analysts' expectations in Q3 FY2023, with revenue up 12.9% year on year to $1.12 billion. Turning to EPS, Texas Roadhouse made a GAAP profit of $0.95 per share, improving from its profit of $0.93 per share in the same quarter last year.

Is now the time to buy Texas Roadhouse? Find out by accessing our full research report, it's free.

Texas Roadhouse (TXRH) Q3 FY2023 Highlights:

Revenue: $1.12 billion vs analyst estimates of $1.12 billion (small miss)

EPS: $0.95 vs analyst expectations of $1.07 (11.2% miss)

Gross Margin (GAAP): 15.1%, down from 15.9% in the same quarter last year

Same-Store Sales were up 8.2% year on year (beat vs. expectations of up 7.4% year on year)

Store Locations: 722 at quarter end, increasing by 37 over the last 12 months

Jerry Morgan, Chief Executive Officer of Texas Roadhouse, Inc. commented, “We are pleased to report another quarter of double-digit sales growth, highlighted by increased guest counts, which has continued through the October period. Our operators are clearly providing a legendary experience that is resonating with our guests.”

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ:TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

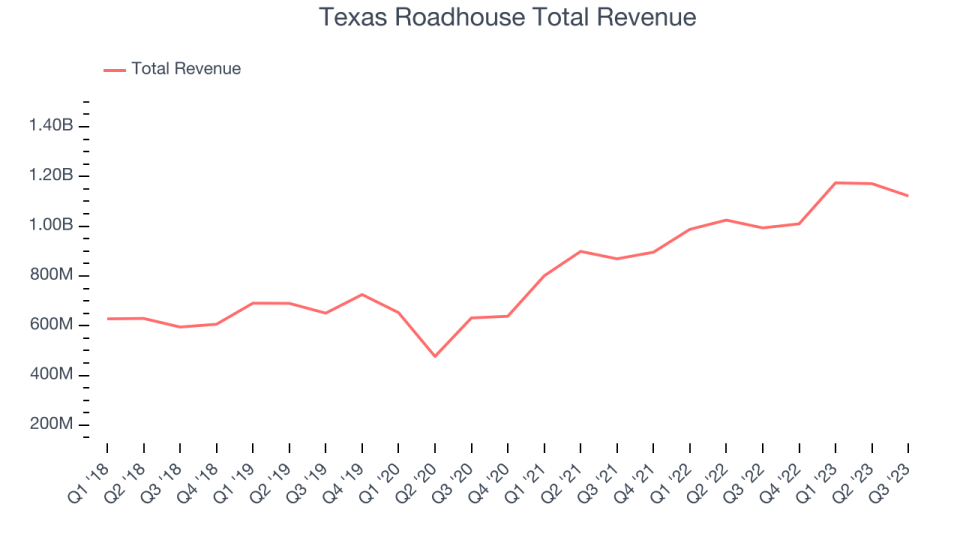

Sales Growth

Texas Roadhouse is one of the larger restaurant chains in the industry and benefits from a strong brand, giving it customer mindshare and influence over purchasing decisions.

As you can see below, the company's annualized revenue growth rate of 14.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Texas Roadhouse's revenue grew 12.9% year on year to $1.12 billion, falling short of Wall Street's estimates. Looking ahead, the analysts covering the company expect sales to grow 9.78% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

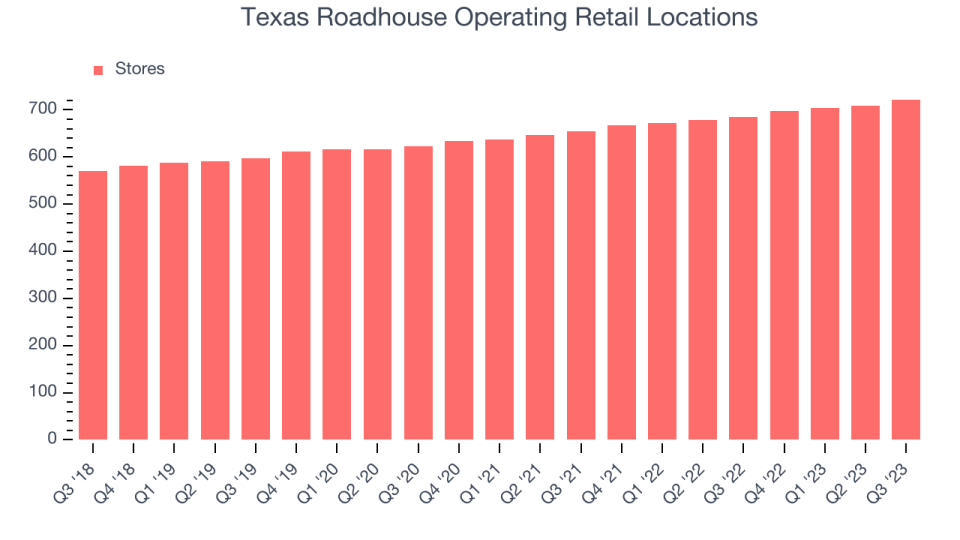

Number of Stores

When a chain like Texas Roadhouse is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Texas Roadhouse's restaurant count increased by 37, or 5.4%, to 722 locations in the most recently reported quarter.

Over the last two years, Texas Roadhouse has rapidly opened new restaurants, averaging 4.93% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Texas Roadhouse has more opportunities to feed customers and generate sales.

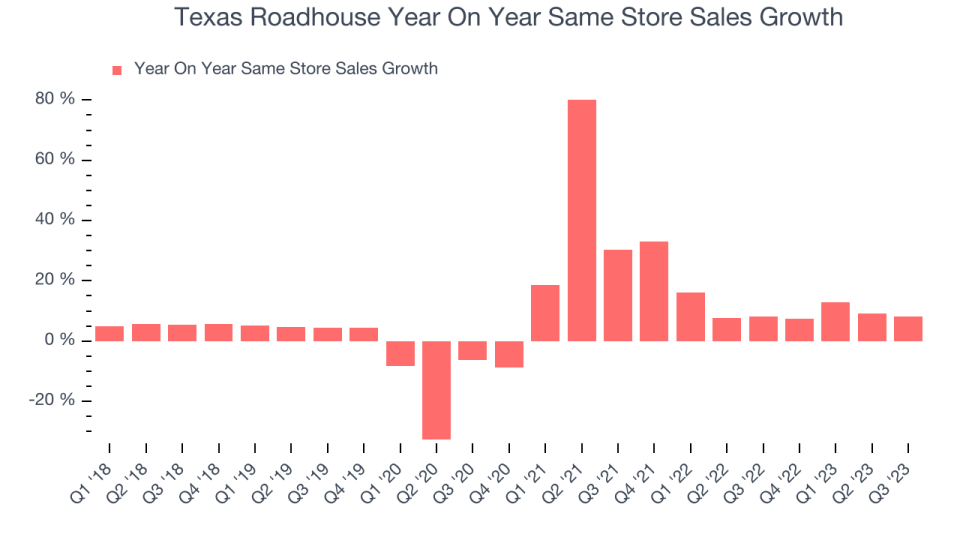

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

Texas Roadhouse's demand has been spectacular for a restaurant business over the last eight quarters. On average, the company has grown its same-store sales by an impressive 12.8% year on year. This performance suggests its steady rollout of new restaurants could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its meals.

In the latest quarter, Texas Roadhouse's same-store sales rose 8.2% year on year. This growth was in line with the 8.2% year-on-year increase it posted 12 months ago.

Key Takeaways from Texas Roadhouse's Q3 Results

With a market capitalization of $6.44 billion, Texas Roadhouse is among smaller companies, but its $69.3 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

Same store sales beat expectations although revenue was roughly in line. Both gross and operating margin missed analysts' expectations and its EPS also missed Wall Street's estimates. The company largely reiterated its previous outlook although new store openings for 2023 is higher than previously estimated. Overall, this was a mixed quarter for Texas Roadhouse. The company is down 1.72% on the results and currently trades at $93 per share.

Texas Roadhouse may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.