Textron (TXT) Secures 1,500 Cessna Jet Order, Shares Soar 5%

Textron Inc. TXT shares soared a solid 4.9% in the last trading session to reach $79.37 on Sep 20, 2023, thereby reflecting investors’ optimism about this stock following its latest order win from the NetJets airline. Textron has clinched a record-breaking deal for delivering up to 1,500 additional Cessna Citation business jets to NetJets over 15 years.

Over the course of its history, NetJets has received and added more than 800 private jets from Textron to its fleet. The recent agreement further strengthens Textron’s 40-year long-standing customer relationship with NetJets.

The latest order not only extends NetJets’ current fleet agreement but also introduces options for acquiring a growing number of aircraft each year. This facilitates the expansion of its fleet to include the Cessna Citation Ascend, Citation Latitude and Citation Longitude models. This bolsters Textron’s revenue generation prospects.

Can Textron Sustain Such Order Demand?

TXT’s Textron Aviation unit manufactures, sells and services the Cessna family of business aircraft. The company witnesses a significant order flow for its jets manufactured at Textron Aviation due to their ability to combine reliability, efficiency and comfort with advanced technology and class-leading performance. Textron Aviation’s backlog of $6.8 billion at the end of the second quarter bears testimony to its robust order intake.

With that being said, its Cessna Citation family of jets has evolved to offer an unmatched range of capabilities, systems and options that allow customers to expand their business reach. This has resulted in the strong demand for these jets, which currently have six Citation models in production — Citation M2 Gen2, Citation CJ3+, Citation CJ4 Gen2, Citation XLS Gen2, Citation Latitude and Citation Longitude.

To further boost its Cessna Citation line of midsize-class jets, Textron is currently developing Citation Ascend. Deliveries are expected to begin in 2025, and NetJets will be the launch customer for the same.

Given the high demand, TXT recently announced its plans to add 16,000 square feet to its Interior Manufacturing Facility to effectively meet the accelerating demand for unique and custom Cessna and Beechcraft aircraft interiors. The expansion will allow Textron Aviation to enhance production efficiency across its entire range of Cessna Citation jets, ease the manufacturing process of new models and efficiently meet the latest order it won from NetJets.

Growth Prospects

As businesses are expanding globally, the need for efficient and flexible air travel increases, making private jets an attractive option. Per the report from GlobeNewswire, the global business and private jet market is poised to witness a CAGR of 16.2% over the 2023-2033 period.

Such abounding growth prospects tend to benefit Textron as the company boasts a strong portfolio of business jets that offers a seamless progression of aircraft with extraordinary capabilities. Other jet manufacturers that may reap the perks of the expanding private jet market are as follows:

Embraer ERJ: Embraer delivers the ultimate experience in business aviation through aircraft that feature disruptive performance, comfort and technology. Its portfolio consists of the Phenom 100EV, the Phenom 300E and the Praetor 500 and the Praetor 600.

Embraer boasts a long-term earnings growth rate of 17%. The Zacks Consensus Estimate for ERJ’s 2023 sales suggests a growth rate of 22.1% from the prior-year reported figure.

Boeing BA: It offers customers a wide range of Boeing products that can be uniquely customized for the private, business or governmental sectors. Its portfolio of private jets includes the BBJ Max family, BBJ787 and BBJ 777X.

Boeing boasts a long-term earnings growth rate of 4%. The Zacks Consensus Estimate for BA’s 2023 sales suggests a growth rate of 18.5% from the prior-year reported figure.

Airbus SE EADSY: Airbus Corporate Jets provide customers with the unique expertise, the finest service, the best technology and the highest standards of care in corporate aviation. Its product portfolio includes ACJ350, ACJ330neo, ACJneo, etc.

The long-term earnings growth rate of Airbus is 12.4%. The Zacks Consensus Estimate for EADSY’s 2023 sales implies a growth rate of 17.8% from the prior-year reported figure.

Price Movement

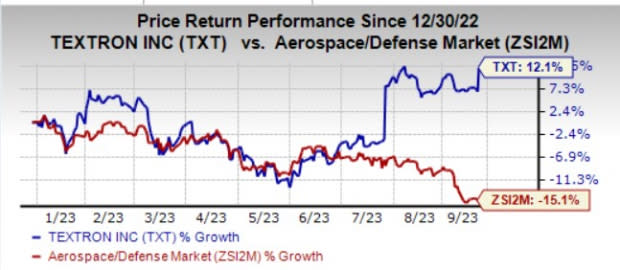

In the past year, shares of Textron have risen 12.1% against the industry’s decline of 15.1%.

Image Source: Zacks Investment Research

Zacks Rank

Textron currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report