Textron's (TXT) Unit Achieves 100th Delivery of King Air 360

Textron Inc.’s TXT business, Textron Aviation, recently achieved a significant milestone by delivering the 100th of its Beechcraft King Air 360 turboprop aircraft to the Comprehensive Blood and Cancer Center. This should strengthen TXT’s footprint in the turboprop jet market.

Importance of King Air 360

The Beechcraft King Air 360 reduces pilot workload with standard features like the Innovative Solutions & Support ThrustSense Autothrottle, which delivers precision control for optimized power output. It is known for its modern airframe, advanced avionics and comfortable interior, offering passengers a reliable and comfortable flying experience.

Over the years, there have been various updates in the aircraft. The cockpit is equipped with a new digital pressurization controller, which automatically schedules cabin pressure on both climb and descent. The cabin altitude has been lowered at the aircraft’s certified ceiling to 35,000 feet.

With nearly 7,800 turboprops delivered to customers worldwide since 1964, it is the best-selling business turboprop family globally, as claimed by Textron.

TXT’s Prospects in Turboprop Aircraft Market

Thanks to growing commercial air traffic over the past year, demand for turboprop aircraft in commercial aviation is increasing manifold. The military side of the turboprop market is also witnessing growth as nations across the globe are investing heavily in new jets to replace their aging transport and training aircraft amid increasing socio-political conflict arising among varied countries.

To this end, the Mordor Intelligence firm predicts the Turboprop Aircraft market to witness a compound annual growth rate (CAGR) of 1.88% during the 2023-2028 period, to reach a value of $1.82 billion at 2028-end.

Such abounding market prospects should boost TXT’s growth opportunities following the latest delivery milestone, with its Beechcraft King Air family having contributed more than 62 million flight hours, with both military and commercial applications.

Peer Moves

Apart from TXT, other companies expected to benefit from the growing turboprop aircraft market are Lockheed Martin Corp. LMT, Embraer SA ERJ and Airbus SE EADSY.

Lockheed Martin’s C-130J Super Hercules, an updated version of the C-130J Hercules, is a four-engine turboprop military transport aircraft. The C-130J, with its diverse mission capabilities and more than 2 million flight hours, is the choice of 21 nations around the world. In September 2023, The Air Force selected four more Air National Guard wings to transition to the new C-130J Super Hercules.

LMT’s long-term earnings growth is pegged at 8.4%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 1% from that reported in 2022.

Embraer’s A-29 Super Tucano is a Brazilian turboprop light attack aircraft carrying a wide range of weapons. It is the only 3-in-1 aircraft that delivers high performance in light attack, armed reconnaissance and tactical training. The company has received orders for more than 260 aircraft and has around 60,000 combat flight hours.

ERJ’s long-term earnings growth is pegged at 17%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 22.2% from that reported in 2022.

Airbus’ A400M Atlas, a turboprop military transport aircraft, is the most advanced airlifter with 21st century state-of-the-art technologies. These aircraft have three mission capabilities- tactical airlifting, strategic airlifting and air-to-air refueling. In October 2023, Airbus officially launched the construction of the new A400M maintenance center in Wunstorf.

EADSY’s long-term earnings growth is pegged at 12.4%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 17.8% from that reported in 2022.

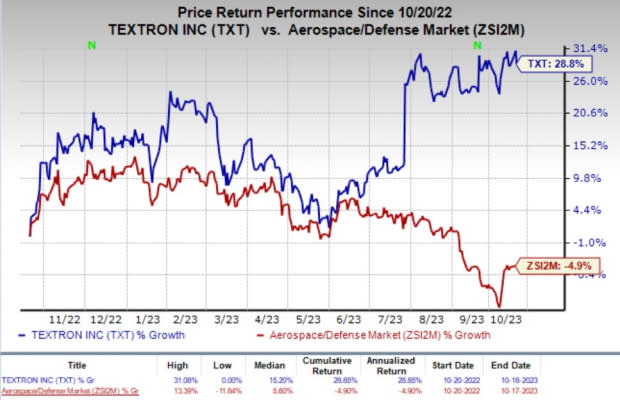

Price Performance

In the past year, shares of TXT have rallied 28.8% against the industry’s 4.9% decline.

Image Source: Zacks Investment Research

Zacks Rank

Textron currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report