TFI International Inc (TFII): A Deeper Look into its Dividend Performance and Sustainability

Uncovering TFII's dividend history, yield, growth rates, payout ratio, and growth metrics

TFI International Inc (NYSE:TFII) recently announced a dividend of $0.35 per share, payable on October 16, 2023, with the ex-dividend date set for September 28, 2023. As investors anticipate this upcoming payment, it's essential to examine the company's dividend history, yield, and growth rates. Using GuruFocus data, this article will delve into TFI International Inc's dividend performance and evaluate its sustainability.

Understanding TFI International Inc

Warning! GuruFocus has detected 3 Warning Sign with HST. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

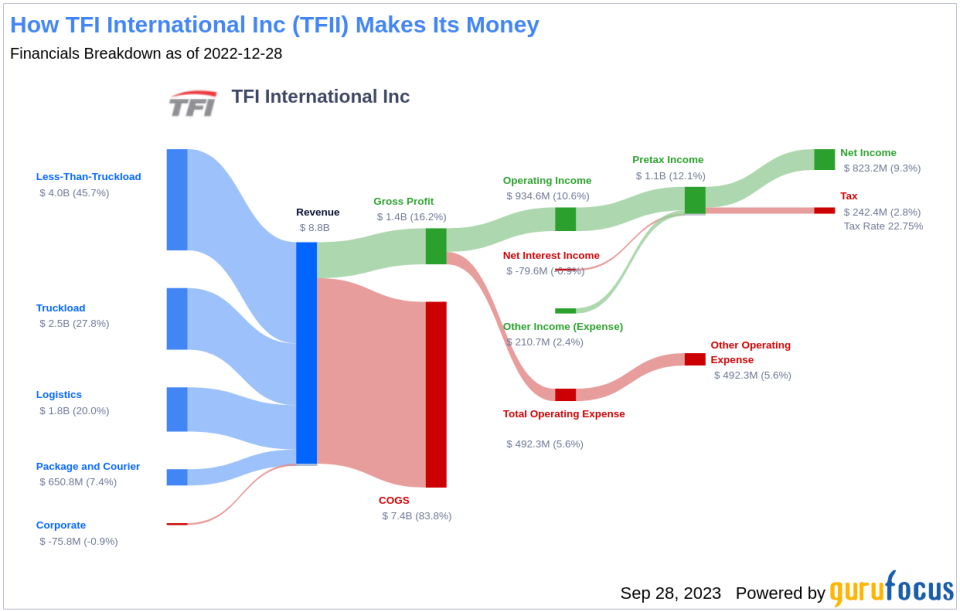

TFI International Inc is a transportation and logistics firm based in Canada. The company operates in four segments: package and courier, less-than-truckload, truckload, and logistics. The majority of its revenue is derived domestically, followed by the United States.

TFI International Inc's Dividend History

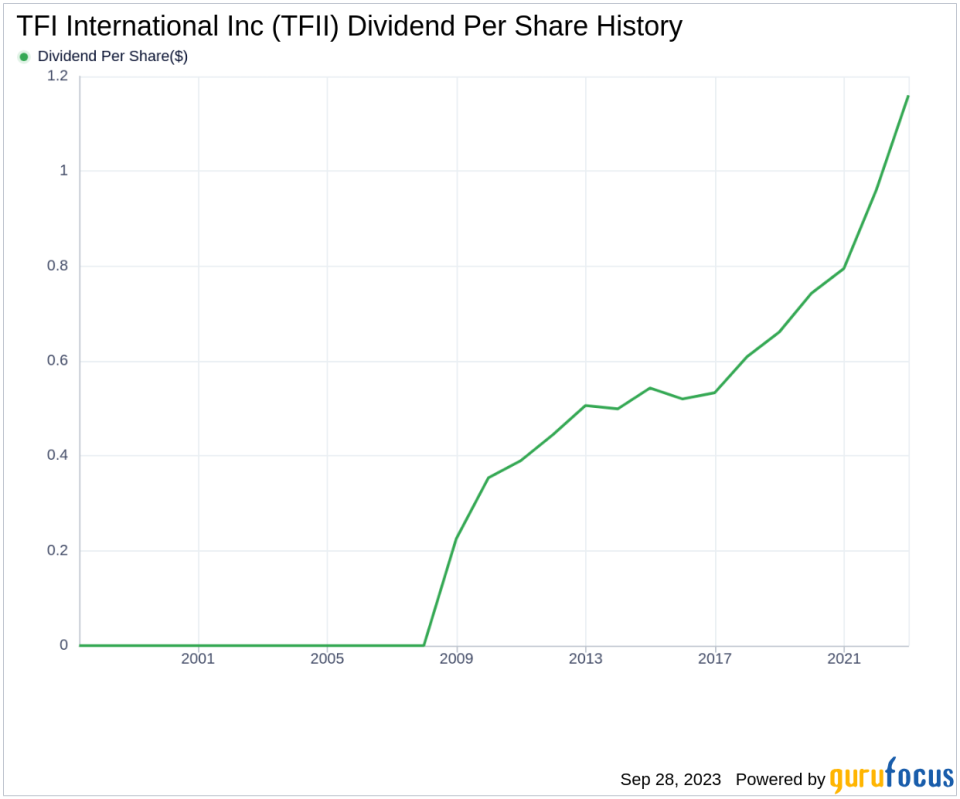

Since 2008, TFI International Inc has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The chart below shows the annual Dividends Per Share for historical trend analysis.

TFI International Inc's Dividend Yield and Growth

As of today, TFI International Inc has a 12-month trailing dividend yield of 1.02% and a 12-month forward dividend yield of 1.09%. This indicates an expected increase in dividend payments over the next 12 months.

Over the past three years, TFI International Inc's annual dividend growth rate was 17.20%. This rate decreased to 13.90% per year over a five-year horizon. However, over the past decade, TFI International Inc's annual dividends per share growth rate remains impressive at 10.80%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

To evaluate the sustainability of the dividend, the company's payout ratio is a key metric. TFI International Inc's dividend payout ratio as of June 30, 2023, is 0.18, suggesting that the company retains a significant portion of its earnings for future growth and unexpected downturns.

TFI International Inc's profitability rank as of June 30, 2023, is 9 out of 10, indicating good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Future Prospects: Growth Metrics

TFI International Inc's growth rank of 9 out of 10 suggests a good growth trajectory relative to its competitors. The company's 3-year EPS growth rate and 5-year EBITDA growth rate of 48.20% and 46.30% respectively, further underscore its strong growth potential.

Conclusion

TFI International Inc's impressive dividend history, growth rate, and payout ratio, combined with its strong profitability and growth metrics, suggest a promising outlook for its dividend performance. However, as with any investment, it's crucial to conduct thorough research and consider the company's overall financial health before making a decision.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.