Theravance's (TBPH) Q2 Earnings Beat Estimates, Revenues Miss

Theravance Biopharma TBPH reported second-quarter 2023 adjusted net loss of 13 cents per share, narrower than the Zacks Consensus Estimate of a loss of 16 cents.

The reported loss excludes share-based compensation expense and non-cash interest expense. In the year-ago quarter, the company reported a loss of 17 cents per share.

Revenues totaled $13.7 million, which missed the Zacks Consensus Estimate of $15 million. The figure was up 24.5% year over year.

Shares of Theravance have lost 12.4% year to date compared with the industry’s 3.6% decline.

Image Source: Zacks Investment Research

Quarter in Detail

The top line almost fully comprised of Viatris’ VTRS collaboration revenues in relation to Yupelri (revefenacin). Yupelri collaboration revenues beat our model estimate of $13 million.

Theravance and Viatris have collaborated for the development and commercialization of the drug. Viatris and Theravance are sharing U.S. profits and losses received in connection with the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance receives 35%. The Viatris collaboration revenues include Theravance’s 35% share of net sales of Yupelri, as well as its proportionate amount of the total shared costs incurred by the two companies. Viatris recognizes product sales from Yupelri and also owns a stake in Theravance.

Research & development expenses (including share-based compensation) totaled $9.4 million, down 37% from the year-ago quarter’s level. Selling, general & administrative expenses (including share-based compensation) rose 19.1% year over year to $19.3 million.

As of Jun 30, 2023, Theravance had cash, cash equivalents and marketable securities worth $167.5 million compared with $260.0 million as of Mar 31, 2023.

2023 Guidance

Theravance continues to expect adjusted research & development expenses (excluding one-time restructuring expenses and share-based compensation) in the $35-$45 million range. Adjusted selling, general and administrative expenses are projected between $45 million and $55 million.

TBPH expects to generate adjusted profit in the second half of 2023.

Pipeline and Other Updates

Theravance is developing an investigational candidate, ampreloxetine (TD-9855), a norepinephrine reuptake inhibitor for the treatment of symptomatic nOH in patients with multiple system atrophy (MSA).

In May, the FDA granted Orphan Drug Designation status to ampreloxetine for the treatment of symptomatic nOH in patients with MSA.

Theravance is enrolling MSA patients with symptomatic nOH patients in a phase III CYPRESS study. During the quarter, the company submitted clinical trial application in various European countries for the expansion of the study into different geographical locations. The study is expected to complete patient enrollment by the second half of 2024.

Through June 2023, the company repurchased $263.8 million of stock of the $325 million shares authorized to be repurchased. The remaining $61.2 million is expected to be completed by the end of 2023.

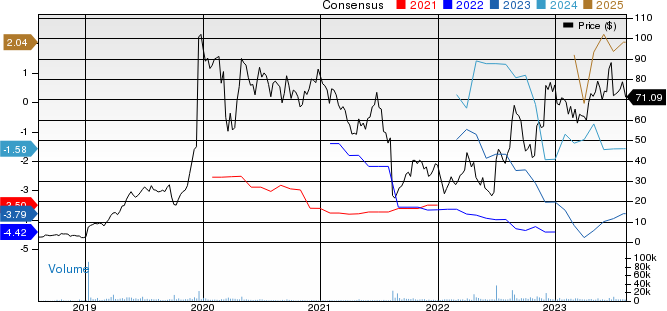

Theravance Biopharma, Inc. Price and Consensus

Theravance Biopharma, Inc. price-consensus-chart | Theravance Biopharma, Inc. Quote

Zacks Rank & Stocks to Consider

Theravance currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same industry are ADC Therapeutics ADCT and ImmunoGen IMGN, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics has widened from a loss of $2.60 per share to a loss of $2.61 for 2023. The consensus estimate has narrowed from a loss of $2.75 per share to a loss of $2.55 for 2024 during the same time frame. Shares of the company have lost 60.9% year to date.

ADCT’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for ImmunoGen has narrowed from a loss of 56 cents per share to a loss of 21 cents for 2023. The consensus estimate has improved from a loss of 30 cents per share to a profit of 3 cents for 2024 during the same time frame. Shares of the company have rallied 234.1% year to date.

IMGN’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 31.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report