There's No Escaping Aytu BioPharma, Inc.'s (NASDAQ:AYTU) Muted Revenues

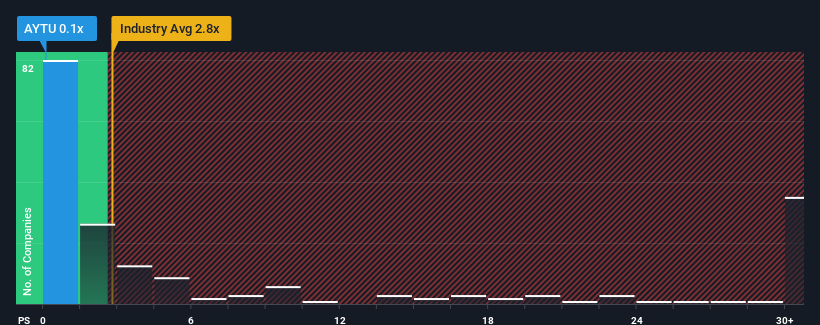

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Aytu BioPharma, Inc. (NASDAQ:AYTU) is definitely a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.8x and even P/S above 17x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Aytu BioPharma

How Has Aytu BioPharma Performed Recently?

Recent times haven't been great for Aytu BioPharma as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aytu BioPharma.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aytu BioPharma's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.2% per year during the coming three years according to the one analyst following the company. That's not great when the rest of the industry is expected to grow by 36% each year.

With this information, we are not surprised that Aytu BioPharma is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Aytu BioPharma maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Aytu BioPharma (of which 1 is a bit unpleasant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.