There's No Escaping Mayne Pharma Group Limited's (ASX:MYX) Muted Revenues

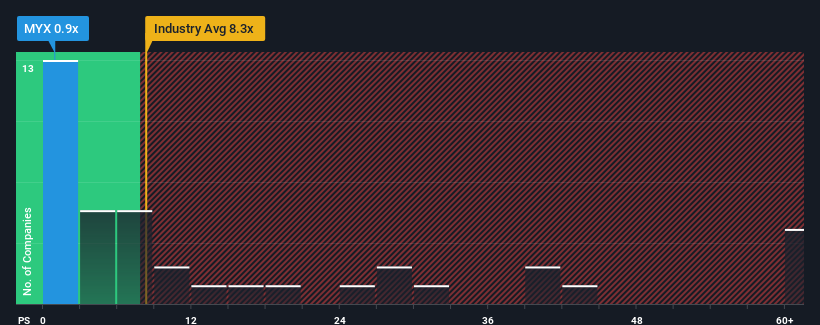

Mayne Pharma Group Limited's (ASX:MYX) price-to-sales (or "P/S") ratio of 0.9x might make it look like a strong buy right now compared to the Pharmaceuticals industry in Australia, where around half of the companies have P/S ratios above 8.3x and even P/S above 28x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mayne Pharma Group

What Does Mayne Pharma Group's P/S Mean For Shareholders?

Recent times haven't been great for Mayne Pharma Group as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Mayne Pharma Group's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Revenue Growth Forecasted For Mayne Pharma Group?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Mayne Pharma Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.7%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 15% over the next year. With the industry predicted to deliver 309% growth, that's a disappointing outcome.

In light of this, it's understandable that Mayne Pharma Group's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Mayne Pharma Group's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you take the next step, you should know about the 2 warning signs for Mayne Pharma Group that we have uncovered.

If you're unsure about the strength of Mayne Pharma Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here