There's Reason For Concern Over Kingsoft Cloud Holdings Limited's (NASDAQ:KC) Massive 52% Price Jump

Kingsoft Cloud Holdings Limited (NASDAQ:KC) shares have continued their recent momentum with a 52% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

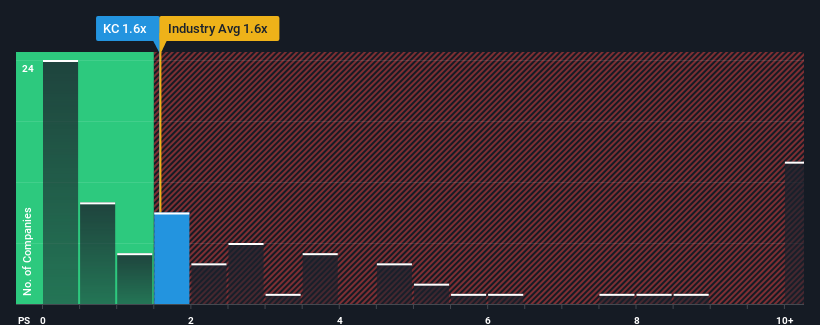

Although its price has surged higher, it's still not a stretch to say that Kingsoft Cloud Holdings' price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the IT industry in the United States, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Kingsoft Cloud Holdings

What Does Kingsoft Cloud Holdings' P/S Mean For Shareholders?

Kingsoft Cloud Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Kingsoft Cloud Holdings' future stacks up against the industry? In that case, our free report is a great place to start.

How Is Kingsoft Cloud Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Kingsoft Cloud Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. Even so, admirably revenue has lifted 107% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 9.2% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 14% each year growth forecast for the broader industry.

In light of this, it's curious that Kingsoft Cloud Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Kingsoft Cloud Holdings' P/S?

Kingsoft Cloud Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of Kingsoft Cloud Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 2 warning signs for Kingsoft Cloud Holdings that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here