Thermo Fisher (TMO) Completes the CorEvitas Acquisition

Thermo Fisher Scientific Inc. TMO completed the acquisition of its previously-acquired CorEvitas, LLC ("CorEvitas") for $912.5 million in cash. The buyout advances world-class clinical research capabilities with a leading regulatory-grade registry platform.

CorEvitas will join the Laboratory Products and Biopharma Services division of Thermo Fisher. The deal should deliver $0.03 in adjusted earnings per share in 2024 and be marginally accretive in 2023.

About CorEvitas

Headquartered in Waltham, MA, CorEvitas has served pharma and biotech customers for over 20 years. The company provides regulatory-grade, real-world evidence solutions to biopharmaceutical companies with objective data and clinical insights to improve patient care and clinical outcomes.

Strategic Implications.

Image Source: Zacks Investment Research

The collection and use of information on patient health care utilization and outcomes obtained via ordinary clinical care is called "real-world evidence." This market category is experiencing rapid expansion as regulatory agencies, pharmaceutical and biotechnology clients, and other stakeholders look more closely at the effectiveness and value of approved medications in post-approval settings.

With its highly complementary real-world evidence solutions, CorEvitas enhances Thermo Fisher’s clinical research business, a growing sector that will speed up decision-making and reduce the price and duration of medication development. The company is optimistic about the opportunity to continue accelerating innovation and advancing productivity for the pharma and biotech customers in their efforts to offer innovative therapies and medications for the benefit of patients.

Industry Prospects

According to a report by Grand View Research, real-world evidence is considered a high-growth market segment valued at $2.45 billion in 2022 and is expected to witness a CAGR of 8.2% by 2030.

Pharmaceutical and biotechnology customers and regulating bodies are increasingly looking to monitor and evaluate approved therapies' safety and their effectiveness and value in the post-approval setting.

Recent Developments

In June 2023, TMO launched the OncoPro Tumoroid Culture Medium Kit to accelerate the development of novel cancer therapies. This is the first commercially available culture medium specifically developed for expanding patient-derived tumoroids or cancer organoids from multiple cancer indications.

In the same month, Thermo Fisher acquired MarqMetrix, a privately held developer of Raman-based spectroscopy solutions for in-line measurement. The acquisition of MarqMetrix is an excellent strategic fit for Thermo Fisher and adds highly complementary Raman-based in-line PAT to Thermo Fisher’s portfolio.

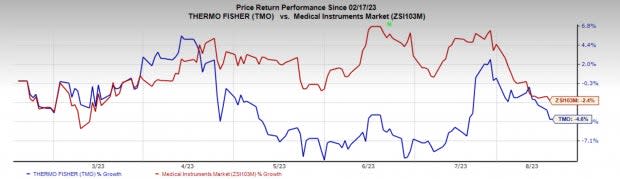

Price Performance

In the past six months, TMO’s shares have declined 4.6% compared with the industry’s fall of 2.4%.

Zacks Rank and Key Picks

Thermo Fisher currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Penumbra, Inc. PEN, Integer Holdings Corporation ITGR and Patterson Companies, Inc. PDCO.

Penumbra, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2023 adjusted EPS of 43 cents, beating the Zacks Consensus Estimate by 53.6%. Revenues of $261.5 million outpaced the consensus mark by 3.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra has an estimated 2024 growth rate of 57.9%. PEN’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 94.2%.

Patterson Companies has an Earnings ESP of +5.66% and a Zacks Rank of 1. PDCO has an estimated long-term growth rate of 9.2%.

Patterson Companies’ earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 4.5%.

Integer Holdings reported second-quarter 2023 adjusted EPS of $1.14, beating the Zacks Consensus Estimate by 15.2%. Revenues of $400 million surpassed the Zacks Consensus Estimate by 8.9%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report