Thermo Fisher (TMO) Launches New Chromosomal Microarray

Thermo Fisher Scientific, Inc. TMO recently launched the Applied Biosystems CytoScan HD Accel array — a new chromosomal microarray intended to enhance cytogenetic research lab productivity, efficiency and profitability with an industry-leading two-day turnaround time.

The Applied Biosystems CytoScan HD Accel array analyses the whole human genome. It offers increased coverage in more than 5,000 crucial genomic areas, offering insights on chromosomal variants for various prenatal, postnatal and cancer research applications.

More on New Chromosomal Microarray

Thermo Fisher has continued to upgrade its instrumentation and services as part of its commitment to helping customers progress cytogenetic research. Thermo Fisher recently added CytoScan Automated Interpretation and Reporting (AIR) Solution for automated data interpretation and reporting to its data analysis Applied Biosystems Chromosome Analysis Suite (ChAS) software. The autoloader is pre-assembled inside the scanner of Thermo Fisher's high-performance microarray instrument for array processing, the Applied Biosystems GeneChip System (GCS) 3000, allowing for easier installation and a more contemporary appearance.

The need for laboratory services is increasing, but the need for qualified laboratory personnel persists. Labs must become more efficient to handle the rising workload. With their current installed equipment base, labs can boost assay productivity by up to 100% with the use of the CytoScan HD Accel array. In addition to requiring up to 50% less input sample than existing commercially available chromosomal microarrays — as little as 100 ng input DNA — the novel array minimizes sample handling and preparation time.

Significance of New Chromosomal Microarray

The CytoScan HD Accel array can save labs weeks or months over a year by accelerating the time it takes to get findings from cytogenetic research. Microarray technology will only increase in utility as a cost-effective platform of choice for cytogenetic analysis due to its scalability and capacity to deliver trustworthy, reproducible results faster.

With an extended reference model covering a wide range of samples, including buccal swabs, saliva, amniotic fluid, chorionic villus, fetuses and blood, the CytoScan HD Accel array improves data quality.

Industry Prospects

Per a report by Grand View Research, the global microarray market size was valued at $3.90 billion in 2018 and is anticipated to grow at a CAGR of 8.7% by 2026. The worldwide rise in cancer incidence is one of the key factors propelling the market growth. According to a report published by WHO in 2018, global cancer was estimated to have risen by 18.1 million new cases during this year, leading to 9.6 million deaths. The rise in healthcare R&D is also anticipated to be one of the factors boosting market potential during the forecast period.

Recent Developments

In August 2023, Thermo Fisher completed the acquisition of its previously-acquired CorEvitas for $912.5 million in cash. The buyout advances world-class clinical research capabilities with a leading regulatory-grade registry platform. With its highly complementary real-world evidence solutions, CorEvitas enhances Thermo Fisher’s clinical research business, a growing sector that will speed up decision-making and reduce the price and duration of medication development.

Image Source: Zacks Investment Research

In June 2023, TMO launched the OncoPro Tumoroid Culture Medium Kit to accelerate the development of novel cancer therapies. This is the first commercially available culture medium specifically developed for expanding patient-derived tumoroids or cancer organoids from multiple cancer indications.

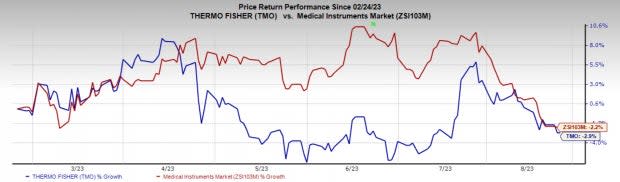

Price Performance

In the past six months, TMO’s shares have declined 2.9% compared with the industry’s fall of 2.2%.

Zacks Rank and Key Picks

Thermo Fisher currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space are Elevance Health, Inc. ELV, Integer Holdings Corporation ITGR and Patterson Companies, Inc. PDCO.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Integer Holdings reported second-quarter 2023 adjusted EPS of $1.14, beating the Zacks Consensus Estimate by 15.2%. Revenues of $400 million surpassed the Zacks Consensus Estimate by 8.9%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Patterson Companies has an Earnings ESP of +5.66% and a Zacks Rank of 1. PDCO has an estimated long-term growth rate of 9.2%.

Patterson Companies’ earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 4.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report