Theseus (THRX) Up 57% in a Month on Strategic Restructuring Plan

Theseus Pharmaceuticals THRX, a pre-clinical stage oncology company, is focused on developing pan-variant targeted next-generation therapies that address all major drivers of cancer treatment resistance.

The company announced that it is set to conduct a process to explore strategic alternatives to maximize shareholder value, earlier this month.

Theseus slashed its workforce by approximately 72%. The headcount reduction included the company's president of Research and Development, William C. Shakespeare, who will continue to support THRX in a consulting capacity until Jun 30, 2024.

As part of its strategic reprioritization efforts, THRX will consider a wide range of options with a focus on maximizing shareholder value, including the potential sale of assets of the company, a sale of the company and merger or other strategic action.

As of the end of September 2023, Theseus had cash, cash equivalents and marketable securities of $225.4 million on its balance sheet.

In the past month, shares of Theseus have surged 56.7% compared with the industry’s 3% rise.

Image Source: Zacks Investment Research

In July 2023, THRX stock suffered immensely after it discontinued enrollment in its phase I/II study and terminated the development of THE-630 in patients with gastrointestinal stromal tumors (GIST). This decision reverted the company to the pre-clinical stage.

The decision to discontinue the early-mid-stage study of THE-630 in GIST was taken after dose-limiting toxicities related to hand-foot skin reaction were observed in two patients in the 27 mg cohort. Theseus also stated that it does not believe that THE-630 has a differentiated profile at doses below 27 mg.

After the discontinuation of THE-630 in GIST, the company adopted THE-349 in non-small cell lung cancer (NSCLC) as its new lead product candidate.

The company’s lead product candidate, THE-349, is a fourth-generation epidermal growth factor receptor (EGFR) tyrosine kinase inhibitor (TKI). It is currently undergoing pre-clinical evaluation in the treatment of EGFR-mutant NSCLC that has developed resistance to first- or later-line AstraZeneca’s AZN Tagrisso (osimertinib).

Per the data observed in pre-clinical studies, THE-349 has shown potential in the inhibition of all major classes of EGFR activating and resistance mutations that occur in a post-first- or later-line Tagrisso setting.

In the second-quarter 2023 earnings release, Theseus reported that all investigational new drug (IND) application-enabling toxicology studies have been completed. The company remains on track to submit an IND application for THE-349 with the FDA in the fourth quarter of 2023.

Subject to clearance, the company expects to initiate a clinical program for THE-349 as soon as possible.

AstraZeneca received FDA approval for Tagrisso, as a monotherapy, in March 2017 for the treatment of patients with metastatic EGFR T790M mutation-positive NSCLC, whose disease has progressed on or after EGFR TKI therapy.

Last month, AZN announced that the FDA has accepted its supplemental new drug application (sNDA) for review, seeking expanded use for its blockbuster drug Tagrisso as a combination treatment in advanced lung cancer.

AstraZeneca is looking to get approval for Tagrisso in combination with chemotherapy for the first-line treatment of adult patients with locally advanced or metastatic NSCLC whose tumors have EGFR mutations.

With the FDA granting a priority review to the sNDA, a decision from the regulatory body is expected in the first quarter of 2024. The FDA generally grants a priority review to drugs with the potential to treat a serious condition.

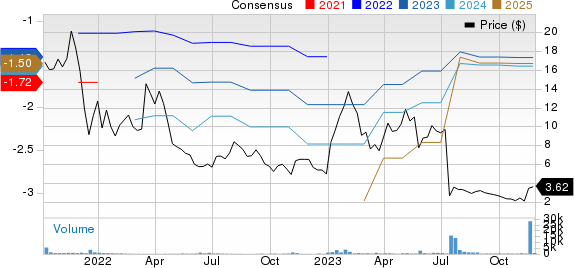

Theseus Pharmaceuticals, Inc. Price and Consensus

Theseus Pharmaceuticals, Inc. price-consensus-chart | Theseus Pharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

Theseus currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks worth mentioning are Ligand Pharmaceuticals LGND and Acadia Pharmaceuticals ACAD. While LGND sports a Zacks Rank #1 (Strong Buy), ACAD carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2023 earnings per share has increased from $5.10 to $5.33. During the same time frame, the estimate for Ligand’s 2024 earnings per share has increased from $4.59 to $4.64. In the past month, shares of LGND have gained 18.1%.

LGND’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 67.19%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has narrowed from 37 cents to 33 cents. The estimate for Acadia’s 2024 earnings per share is pegged at 94 cents. In the past month, shares of ACAD have risen 0.3%.

ACAD beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Theseus Pharmaceuticals, Inc. (THRX) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report