Things to Consider Ahead of B&G Foods' (BGS) Q4 Earnings

B&G Foods, Inc. BGS is likely to register top- and bottom-line decline when it reports fourth-quarter fiscal 2023 earnings on Feb 27. The Zacks Consensus Estimate for quarterly revenues is pegged at $573.4 million, indicating a decline of 8% from the prior-year quarter’s reported figure. The consensus mark for fiscal 2023 revenues is pinned at $2.1 billion, suggesting a fall of 4.9% from the year-ago period’s reported actuals.

The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the past 30 days at 28 cents per share, indicating a decline of 30% year over year. The consensus mark for fiscal 2023 earnings is pegged at 97 cents per share, indicating a decline of 10.2% from the prior-year period’s level.

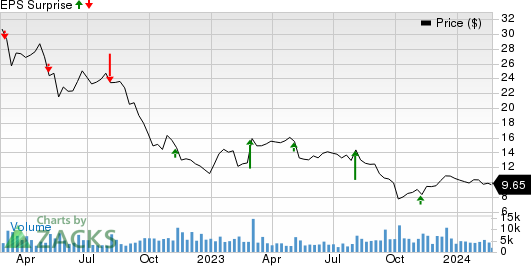

The company, which manufactures, sells and distributes a portfolio of shelf-stable and frozen foods and household products, has a trailing four-quarter earnings surprise of 40.5%, on average. BGS posted an earnings surprise of 17.4% in the last reported quarter.

B&G Foods, Inc. Price and EPS Surprise

B&G Foods, Inc. price-eps-surprise | B&G Foods, Inc. Quote

Things To Consider

B&G Foods is grappling with higher selling, general and administrative (SG&A) expenses, which have been putting pressure on its profits. The company has been struggling with lower volume, hurting its sales performance. Our model suggests a volume decline of 4.5% in the to-be-reported quarter. The company’s international presence keeps it exposed to unfavorable currency rates.

For the fiscal 2023, management anticipates net sales in the band of $2.05-$2.07 billion compared with $2.16 billion reported in the fiscal 2022. Adjusted earnings per share (EPS) in fiscal 2023 are envisioned between 93 cents and $1.13. In the fiscal 2022, the company posted an adjusted EPS of $1.08.

The company has been on track to counter the inflationary pressure through pricing and productivity efforts. Management anticipates fiscal 2023 adjusted EBITDA in the range of $310-$330 million, whereas it reported $301 million in fiscal 2022. This and brand strength are likely to be reflected in the company’s performance in the quarter under review.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for B&G Foods this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

B&G Foods has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00% at present.

Some Stocks With Favorable Combination

Here are some companies worth considering, as our model shows that these, too, have the right combination of elements to beat on earnings this reporting cycle.

The Gap, Inc. GPS currently has an Earnings ESP of +24.44% and sports a Zacks Rank of 1. GPS is likely to register a bottom-line increase when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 19 cents suggests a rise of 125.3% from the year-ago fiscal quarter’s reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Gap’s top line is expected to decrease from the prior-year fiscal quarter’s reported number. The consensus estimate for quarterly revenues is pegged at $4.21 billion, suggesting a decline of 0.7% from the prior-year fiscal quarter’s reported figure. GPS has a trailing four-quarter earnings surprise of 137.9%, on average.

American Eagle Outfitters AEO currently has an Earnings ESP of +0.87% and sports a Zacks Rank #1. AEO is likely to register top- and bottom-line growth when it reports fourth-quarter fiscal 2023. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.65 billion, suggesting 10.5% growth from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for American Eagle’s fiscal fourth-quarter earnings is pegged at 50 cents, suggesting 35.1% growth from the year-ago quarter. The consensus mark has moved up 4.2% in the past 30 days.

Costco Wholesale COST has an Earnings ESP of +1.58% and a Zacks Rank of 2. COST is likely to register top- and bottom-line growth when it reports the second-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for Costco’s quarterly revenues is pegged at $59.2 billion, suggesting growth of 7.1% from that reported in the prior-year quarter.

The Zacks Consensus Estimate for Costco’s earnings for the fiscal second quarter is pegged at $3.60 per share, indicating an increase of 9.1% from the year-ago period reported figure. COST delivered an earnings beat of 2.6%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report