Things to Note Ahead of Service Corporation's (SCI) Q3 Earnings

Service Corporation International SCI will likely register top- and bottom-line growth when it reports third-quarter 2023 earnings on Nov 1. The Zacks Consensus Estimate for quarterly revenues is pegged at $978.6 million, suggesting growth of 0.1% from the prior-year quarter’s reported figure.

Although the consensus estimate for quarterly earnings has moved down by a couple of cents in the past 30 days to 70 cents per share, the projection indicates growth of 2.9% from the year-ago quarter’s reported figure.

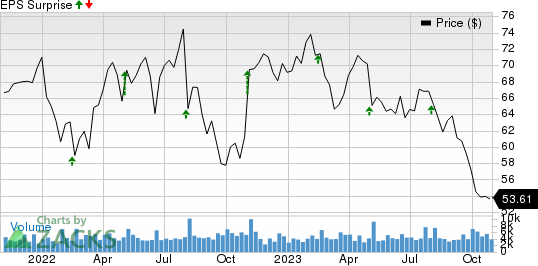

This deathcare products and services company has a trailing four-quarter earnings surprise of 14.4%, on average. SCI delivered an earnings surprise of 3.8% in the last reported quarter.

Service Corporation International Price and EPS Surprise

Service Corporation International price-eps-surprise | Service Corporation International Quote

Things To Note

Service Corporation has been benefiting from robust funeral service revenues. The company continues to see momentum in the Cemetery segment, which is likely to be reflected in the third-quarter 2023 results. We expect total Cemetery revenue of $437.1 million in the third quarter, up 3.2% year over year.

Management remains committed to pursuing strategic buyouts for both its segments and building new funeral homes to generate greater returns. The continuation of these trends bodes well for the to-be-reported quarter.

Service Corporation has been encountering inflationary pressure, which is exerting pressure on its margin. The rise in corporate general and administrative costs remains a threat to the company’s performance.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for Service Corporation this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Service Corporation carries a Zacks Rank #4 (Sell) and has an Earnings ESP of -1.52%.

Stocks With the Favorable Combination

Here are three companies worth considering, as our model shows that these have the correct combination to beat on earnings this time:

e.l.f. Beauty ELF currently has an Earnings ESP of +0.42% and a Zacks Rank #1. The company is likely to register top and bottom-line growth when it reports third-quarter 2023 numbers. The Zacks Consensus Estimate for e.l.f. Beauty’s quarterly earnings per share of 54 cents suggests an increase of 50% from the year-ago quarter’s levels. You can see the complete list of today’s Zacks #1 Rank stocks here.

ELF has a trailing four-quarter negative earnings surprise of 108.3% on average. The Zacks Consensus Estimate for e.l.f. Beauty’s quarterly revenues is pegged at $197.3 million, indicating a rise of 61.2% from the figure reported in the prior-year quarter.

Church & Dwight Co. CHD has an Earnings ESP of +2.21% and a Zacks Rank #3. The company is slated to witness top-line growth when it reports third-quarter 2023 results. The Zacks Consensus Estimate for CHD’s quarterly revenues is pegged at $1.43 billion, suggesting growth of 8.7% from the figure reported in the prior-year quarter.

Although the Zacks Consensus Estimate for Church & Dwight’s quarterly earnings has moved up by a penny in the past 30 days to 68 cents per share, it projects a decline of 10.5% from the year-ago quarter’s reported number. CHD has delivered an earnings surprise of 12.1%, on average, in the trailing four quarters.

Monster Beverage MNST currently has an Earnings ESP of +1.98% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2023 results. The Zacks Consensus Estimate for Monster Beverage’s quarterly revenues is pegged at $1.9 billion, suggesting growth of 14.7% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Monster Beverage’s quarterly earnings has remained unchanged in the past 30 days at 40 cents per share, which indicates 33.3% growth from the year-ago quarter's reported number. MNST delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Service Corporation International (SCI) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report