We Think MTQ (SGX:M05) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, MTQ Corporation Limited (SGX:M05) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for MTQ

What Is MTQ's Debt?

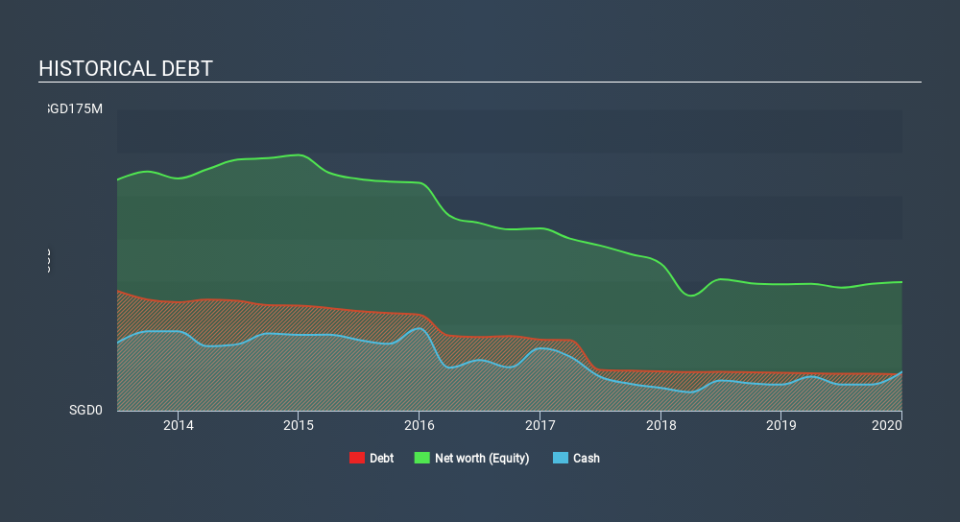

As you can see below, MTQ had S$20.9m of debt at December 2019, down from S$22.0m a year prior. However, its balance sheet shows it holds S$22.6m in cash, so it actually has S$1.64m net cash.

How Healthy Is MTQ's Balance Sheet?

According to the last reported balance sheet, MTQ had liabilities of S$39.2m due within 12 months, and liabilities of S$14.8m due beyond 12 months. On the other hand, it had cash of S$22.6m and S$29.3m worth of receivables due within a year. So it has liabilities totalling S$2.15m more than its cash and near-term receivables, combined.

Of course, MTQ has a market capitalization of S$43.3m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, MTQ also has more cash than debt, so we're pretty confident it can manage its debt safely.

We also note that MTQ improved its EBIT from a last year's loss to a positive S$3.6m. When analysing debt levels, the balance sheet is the obvious place to start. But it is MTQ's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While MTQ has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, MTQ recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that MTQ has S$1.64m in net cash. And it impressed us with free cash flow of S$3.4m, being 93% of its EBIT. So we don't have any problem with MTQ's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for MTQ you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.