We Think Some Shareholders May Hesitate To Increase Analog Devices, Inc.'s (NASDAQ:ADI) CEO Compensation

Key Insights

Analog Devices to hold its Annual General Meeting on 13th of March

CEO Vince Roche's total compensation includes salary of US$1.13m

The overall pay is 54% above the industry average

Over the past three years, Analog Devices' EPS grew by 14% and over the past three years, the total shareholder return was 38%

Performance at Analog Devices, Inc. (NASDAQ:ADI) has been reasonably good and CEO Vince Roche has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 13th of March. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Analog Devices

Comparing Analog Devices, Inc.'s CEO Compensation With The Industry

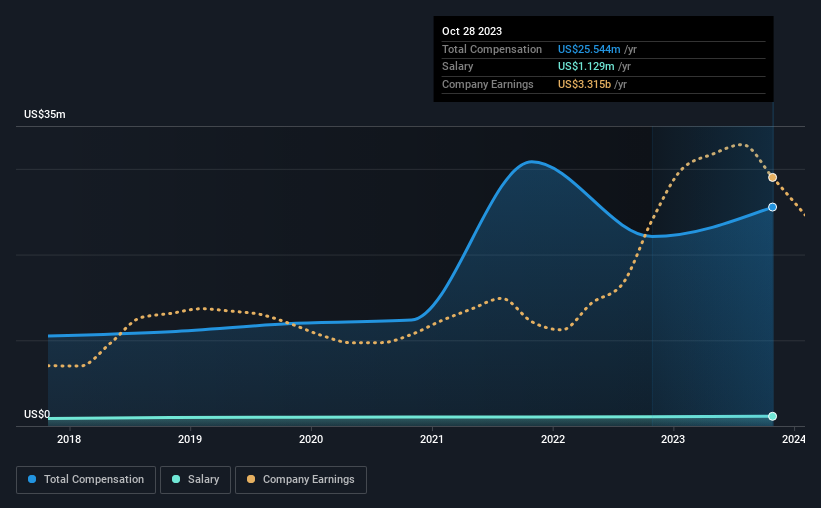

According to our data, Analog Devices, Inc. has a market capitalization of US$94b, and paid its CEO total annual compensation worth US$26m over the year to October 2023. Notably, that's an increase of 16% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.1m.

For comparison, other companies in the American Semiconductor industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$17m. This suggests that Vince Roche is paid more than the median for the industry. Moreover, Vince Roche also holds US$12m worth of Analog Devices stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$1.1m | US$1.1m | 4% |

Other | US$24m | US$21m | 96% |

Total Compensation | US$26m | US$22m | 100% |

On an industry level, roughly 11% of total compensation represents salary and 89% is other remuneration. Interestingly, the company has chosen to go down an unconventional route in that it pays a smaller salary to Vince Roche as compared to non-salary compensation over the one-year period examined. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Analog Devices, Inc.'s Growth Numbers

Analog Devices, Inc.'s earnings per share (EPS) grew 14% per year over the last three years. It saw its revenue drop 8.2% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Analog Devices, Inc. Been A Good Investment?

We think that the total shareholder return of 38%, over three years, would leave most Analog Devices, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Analog Devices primarily uses non-salary benefits to reward its CEO. Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Analog Devices (free visualization of insider trades).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.