Third Avenue Management Bolsters Stake in Trinity Place Holdings Inc

Third Avenue Management (Trades, Portfolio), a firm known for its value-oriented investment approach, has recently expanded its portfolio with an additional stake in Trinity Place Holdings Inc (TPHS). On March 18, 2024, the firm added 1,896,851 shares to its holdings, bringing the total share count to 6,806,323. This transaction has increased the firm's position in TPHS to 10.69% and had a 0.06% impact on its portfolio, with the shares purchased at a price of $0.1804 each.

Third Avenue Management (Trades, Portfolio)'s Investment Approach

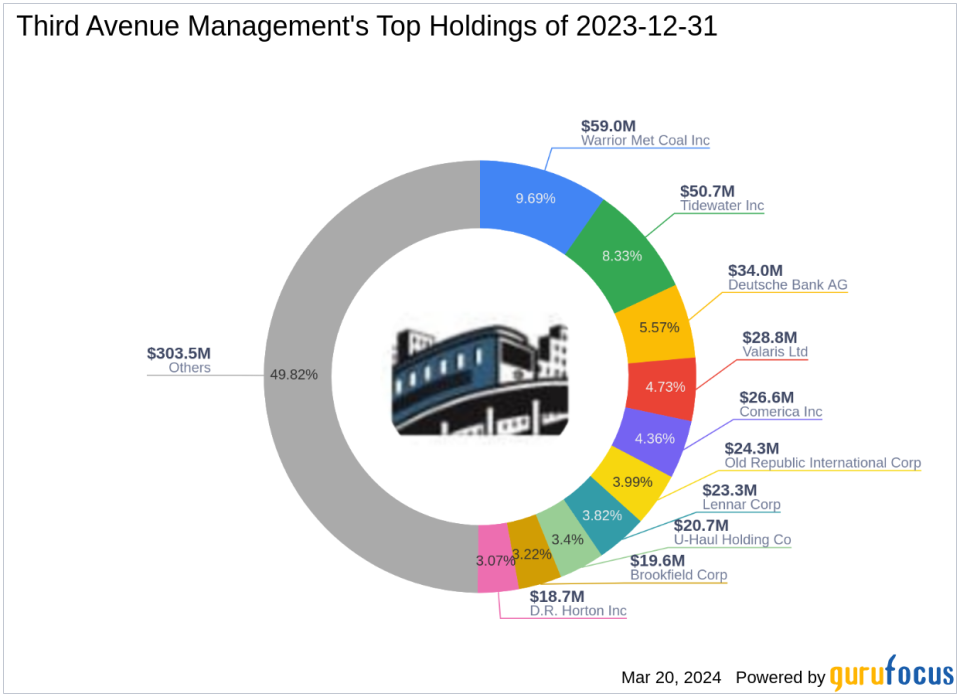

Founded by the legendary Martin Whitman, Third Avenue Management (Trades, Portfolio) has been a significant player in the investment world, managing a variety of funds and accounts. The firm's partnership with Affiliated Managers Group since 2002 has allowed it to offer ownership rights to its senior professionals, ensuring a transparent succession plan. Third Avenue Management (Trades, Portfolio) is known for its fundamental, bottom-up approach to deep value and distressed investing, focusing on high-conviction ideas across various market capitalizations and geographies. With 59 stocks in its portfolio and an equity of $609 million, the firm's top sectors include Financial Services and Real Estate, with top holdings such as Comerica Inc (NYSE:CMA) and Deutsche Bank AG (NYSE:DB).

Trinity Place Holdings Inc: A Real Estate Investment Focus

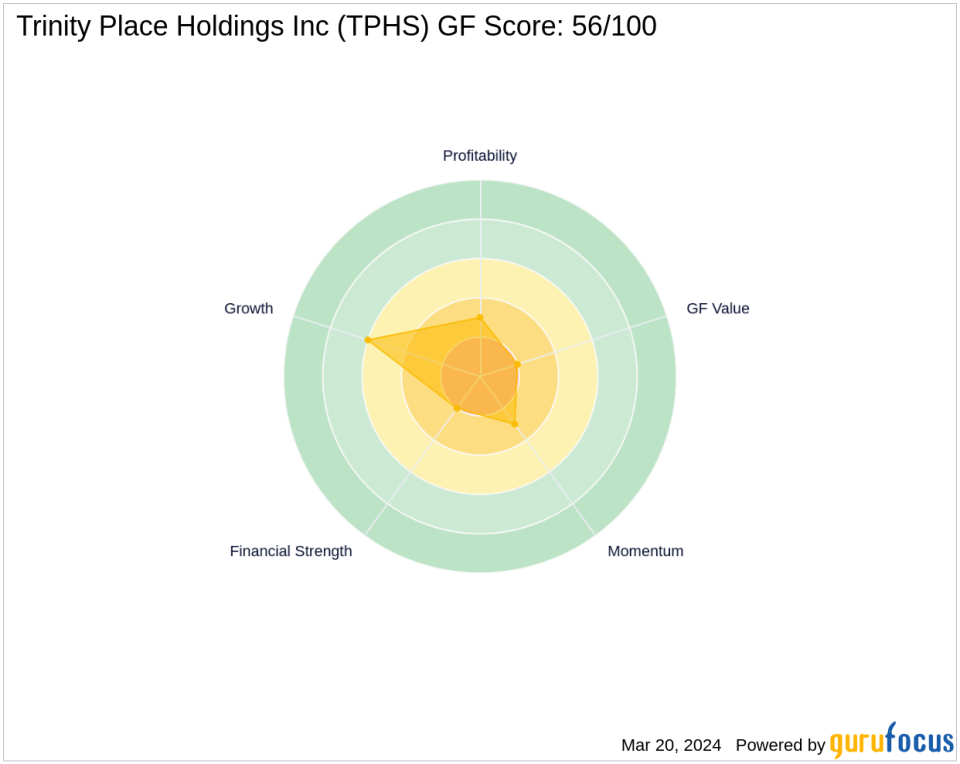

Trinity Place Holdings Inc, operating under the stock symbol TPHS, is a real estate holding, investment, and asset management company based in the USA. Since its IPO on September 18, 2012, the company has been involved in owning, investing, managing, developing, and redeveloping real estate assets and related securities. With a market capitalization of $10 million and segments including other income, rental revenues, and the sale of residential condominium units, TPHS also boasts a portfolio of intellectual property assets. However, the company's financial health is under scrutiny, with a GF Score of 56/100, indicating poor future performance potential.

Impact of the Trade on Third Avenue Management (Trades, Portfolio)'s Portfolio

The recent acquisition of TPHS shares by Third Avenue Management (Trades, Portfolio) has solidified the firm's stake in the real estate sector. The trade, which saw a share change of 38.64%, has not only increased the firm's position in TPHS but also reflects its confidence in the stock's potential despite its current market challenges. With a trade price of $0.1804 and a current stock price of $0.157, the firm appears to be taking a long-term view on its investment.

Comparing Trinity Place Holdings Inc with Third Avenue's Top Investments

When juxtaposed with Third Avenue Management (Trades, Portfolio)'s top holdings, Trinity Place Holdings Inc presents a unique case. Unlike the firm's other major investments in more stable financial and energy sectors, TPHS operates in the volatile real estate market. This addition to the portfolio suggests a strategic diversification by Third Avenue Management (Trades, Portfolio), aiming to capitalize on potential growth in the real estate sector.

Financial Health and Market Valuation of TPHS

Trinity Place Holdings Inc's financial health raises concerns, with a Financial Strength rank of 2/10 and a Profitability Rank of 3/10. The stock's GF Value is $1.78, but with a current price to GF Value ratio of 0.09 and a designation as a possible value trap, investors are advised to think twice. The stock's performance since IPO has declined by 96.38%, yet it has seen a year-to-date increase of 37.48%.

Performance and Risk Assessment of TPHS

Trinity Place Holdings Inc's stock performance since its IPO has been less than stellar, with a significant decline. However, the year-to-date performance shows a notable increase. The stock's risk is quantified by a Z-Score of -0.64 and a Piotroski F-Score of 1, indicating potential financial distress and poor business operation, respectively.

Market Sentiment and Other Investors in TPHS

Third Avenue Management (Trades, Portfolio) is currently the largest guru holding shares in Trinity Place Holdings Inc. Other notable investors include Kahn Brothers (Trades, Portfolio), suggesting that despite the stock's challenges, it has garnered interest from seasoned investors who may see long-term value in its real estate endeavors.

Conclusion: Analyzing the Transaction's Influence

Third Avenue Management (Trades, Portfolio)'s recent trade in Trinity Place Holdings Inc reflects a strategic move to strengthen its position in the real estate sector. While TPHS's financial metrics and market performance indicate a high-risk investment, the firm's commitment to a value-oriented approach and its willingness to invest in distressed assets suggest a calculated bet on the company's future. As the market continues to observe TPHS's performance, Third Avenue Management (Trades, Portfolio)'s latest transaction will be a focal point for investors interested in the real estate market's dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.