Third Avenue Management Reduces Stake in Trinity Place Holdings Inc

Overview of Third Avenue Management (Trades, Portfolio)'s Recent Trade

Third Avenue Management (Trades, Portfolio), a firm with a reputation for deep value and distressed investing, has recently adjusted its investment in Trinity Place Holdings Inc (TPHS). On January 3, 2024, the firm reduced its stake in TPHS, signaling a strategic shift in its portfolio composition. This move by Third Avenue Management (Trades, Portfolio) has caught the attention of value investors, as it may reflect a change in the firm's assessment of TPHS's future prospects.

Third Avenue Management (Trades, Portfolio)'s Investment Approach

Founded by the legendary Martin Whitman, Third Avenue Management (Trades, Portfolio) is known for its fundamental, bottom-up approach to investing. The firm manages assets across various strategies, including Value, Small-Cap, Real Estate, and International Real Estate. With a focus on high-conviction ideas, Third Avenue Management (Trades, Portfolio) seeks to allocate maximum resources to the best risk-adjusted return opportunities. The firm's top holdings include Deutsche Bank AG (NYSE:DB), Old Republic International Corp (NYSE:ORI), and Warrior Met Coal Inc (NYSE:HCC), among others, with a significant presence in the Financial Services and Real Estate sectors.

Trinity Place Holdings Inc at a Glance

Trinity Place Holdings Inc, operating within the USA since its IPO on September 18, 2012, is a real estate holding, investment, and asset management company. TPHS's business activities encompass owning, investing in, managing, developing, or redeveloping real estate assets and securities. The company also holds intellectual property assets in the consumer sector, including the online marketplace at FilenesBasement.com.

Details of the Transaction

The transaction, which took place on January 3, 2024, saw Third Avenue Management (Trades, Portfolio) reduce its holdings in TPHS by 218,314 shares. This reduction had a minor impact of -0.01% on the firm's portfolio, with the trade executed at a price of $0.1761 per share. Following the transaction, Third Avenue Management (Trades, Portfolio)'s total shareholding in TPHS stands at 4,909,472 shares, representing a 12.85% position in the company and accounting for 0.14% of the firm's portfolio.

Financial and Market Analysis of TPHS

Currently, Trinity Place Holdings Inc's stock is priced at $0.1711, with a market capitalization of $6.538 million. The stock's performance indicators are not particularly encouraging, with a PE Percentage of 0.00, indicating the company is at a loss. The GF Valuation labels TPHS as a "Possible Value Trap," suggesting investors should think twice before investing. The stock's price to GF Value ratio stands at 0.10, and it has experienced a -2.84% decline since the transaction date.

Third Avenue Management (Trades, Portfolio)'s Position in TPHS

After the recent trade, Third Avenue Management (Trades, Portfolio)'s stake in Trinity Place Holdings Inc remains significant. The firm's 4,909,472 shares in TPHS make it one of the largest shareholders in the company. This position is substantial when compared to Third Avenue Management (Trades, Portfolio)'s other top holdings and reflects the firm's continued confidence in the real estate sector.

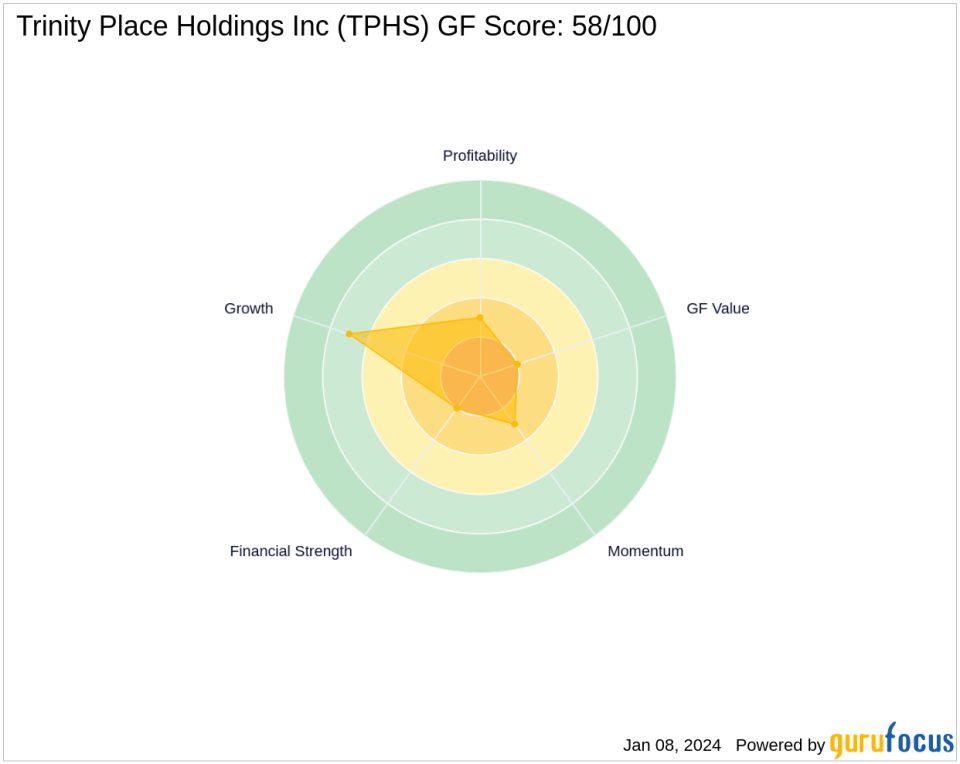

Performance Metrics of TPHS

Trinity Place Holdings Inc's GF Score is 58 out of 100, indicating poor future performance potential. The company's Financial Strength and Profitability Rank are low, at 2/10 and 3/10 respectively. However, its Growth Rank is relatively higher at 7/10, suggesting some potential in its growth metrics.

Broader Market Context

Other value investors, including Kahn Brothers (Trades, Portfolio), have also taken an interest in Trinity Place Holdings Inc. Third Avenue Management (Trades, Portfolio)'s recent reduction in TPHS shares may influence the broader market's perception of the stock. As the largest shareholder, Third Avenue Management (Trades, Portfolio)'s trading activities are closely monitored by the investment community for insights into the stock's potential.

Transaction Analysis

The reduction in TPHS shares by Third Avenue Management (Trades, Portfolio) is a strategic move that may reflect the firm's evolving investment strategy or a response to the company's current financial and market performance. While the trade has had a minimal impact on Third Avenue Management (Trades, Portfolio)'s portfolio, it is a significant change in the firm's position in Trinity Place Holdings Inc. Investors will be watching closely to see how this transaction influences TPHS's stock performance and Third Avenue Management (Trades, Portfolio)'s future investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.