Third Avenue Management's Strategic Moves: Spotlight on Tidewater Inc's Portfolio Impact

Insights from Third Avenue Management (Trades, Portfolio)'s Latest 13F Filing

Third Avenue Management (Trades, Portfolio), under the stewardship of the legendary Martin Whitman, has long been synonymous with deep value and distressed investing. The firm's recent 13F filing for Q3 2023 offers a window into its strategic investment decisions, showcasing a commitment to a fundamental, bottom-up approach. With a diverse portfolio spanning various sectors, Third Avenue Management (Trades, Portfolio) continues to leverage its expertise in value, small-cap, and real estate investments, aiming to deliver high-conviction opportunities to its investors.

New Additions to the Portfolio

Third Avenue Management (Trades, Portfolio) has expanded its portfolio with two new stock additions:

Atlanta Braves Holdings Inc (NASDAQ:BATRK) leads the new entries with 25,700 shares, making up 0.15% of the portfolio and valued at $913,640.

LSB Industries Inc (NYSE:LXU) follows, with 30,618 shares representing 0.05% of the portfolio, amounting to a total value of $314,140.

Significant Increases in Existing Holdings

The firm has also bolstered its positions in seven stocks, with notable increases in:

Investors Title Co (NASDAQ:ITIC), where an additional 22,926 shares were acquired, bringing the total to 29,599 shares. This represents a substantial 343.56% increase in share count and a 0.57% portfolio impact, valued at $4,373,550.

Sun Communities Inc (NYSE:SUI) saw an addition of 25,010 shares, increasing the total to 36,527 shares. This adjustment marks a 217.16% increase in share count, with a total value of $4,324,430.

Complete Exits

In a strategic move, Third Avenue Management (Trades, Portfolio) has fully divested from:

Chase Corp (CCF), selling all 40,192 shares, which had a -0.8% impact on the portfolio.

Noteworthy Reductions

The firm has reduced its stakes in 24 stocks, with significant reductions in:

Tidewater Inc (NYSE:TDW), cutting 289,414 shares, leading to a -26.34% decrease in shares and a -2.65% portfolio impact. The stock's average trading price was $63.14 during the quarter, with a -3.08% return over the past three months and a 63.77% year-to-date return.

Deutsche Bank AG (NYSE:DB) saw a reduction of 563,229 shares, resulting in an -18.48% decrease in shares and a -0.98% portfolio impact. The stock traded at an average price of $10.81 during the quarter, with a 10.06% return over the past three months and a 6.29% year-to-date return.

Portfolio Overview

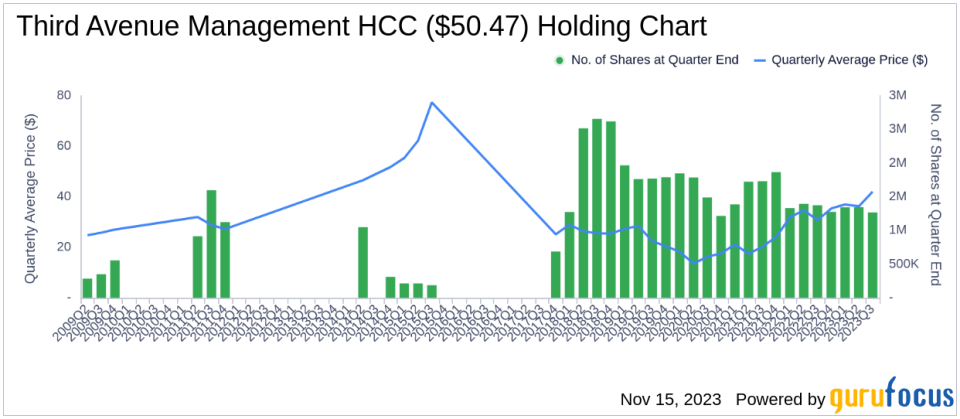

As of the third quarter of 2023, Third Avenue Management (Trades, Portfolio)'s portfolio comprises 59 stocks. The top holdings include 10.85% in Warrior Met Coal Inc (NYSE:HCC), 9.81% in Tidewater Inc (NYSE:TDW), 5.37% in Valaris Ltd (NYSE:VAL), 4.57% in Deutsche Bank AG (NYSE:DB), and 3.78% in Old Republic International Corp (NYSE:ORI). The investments are primarily concentrated in eight industries: Financial Services, Real Estate, Energy, Basic Materials, Industrials, Consumer Cyclical, Communication Services, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.