Third Avenue Value Fund Adjusts Portfolio, Warrior Met Coal Sees Significant Reduction

Insights from the First Quarter of 2024 N-PORT Filing

Third Avenue Value Fund (Trades, Portfolio), established by the renowned Martin J. Whitman in 1990, has recently disclosed its investment activities for the first quarter of 2024. The fund is known for its global, all-cap equities approach and its penchant for investing in credit securities. With a keen eye for financial strength and the potential for NAV compounding, Third Avenue Value Fund (Trades, Portfolio) seeks out investments that are significantly undervalued relative to their intrinsic business value. The fund's latest N-PORT filing reveals strategic moves that reflect its commitment to long-term capital appreciation through a portfolio of contrarian and special-situation opportunities.

New Additions to the Portfolio

Third Avenue Value Fund (Trades, Portfolio) has expanded its portfolio with a new acquisition:

The fund's most significant new holding is Bolsa Mexicana de Valores SAB de CV (MEX:BOLSAA), purchasing 4,227,162 shares. This position represents 1.39% of the portfolio, with a total value of MXN 85.91 million.

Key Position Increases

The fund has also bolstered its stakes in several companies:

CK Hutchison Holdings Ltd (HKSE:00001) saw an additional 2,497,000 shares added, bringing the total to 3,560,480 shares. This represents a substantial 234.8% increase in share count and a 2.08% impact on the current portfolio, valued at HK$183.89 million.

S4 Capital PLC (LSE:SFOR) also experienced a significant boost with 7,558,242 additional shares, resulting in a total holding of 31,680,582 shares. This adjustment marks a 31.33% increase in share count, with a total value of 17.66 million.

Complete Exits from Holdings

Third Avenue Value Fund (Trades, Portfolio) has fully divested from two positions in the first quarter of 2024:

The fund sold all 989,199 shares of Ashmore Group PLC (LSE:ASHM), impacting the portfolio by -0.38%.

All 1,484,127 shares of Hutchison Port Holdings Trust (HCTPF) were liquidated, causing a -0.04% impact on the portfolio.

Significant Reductions in Holdings

Reductions were made in four stocks, with notable changes including:

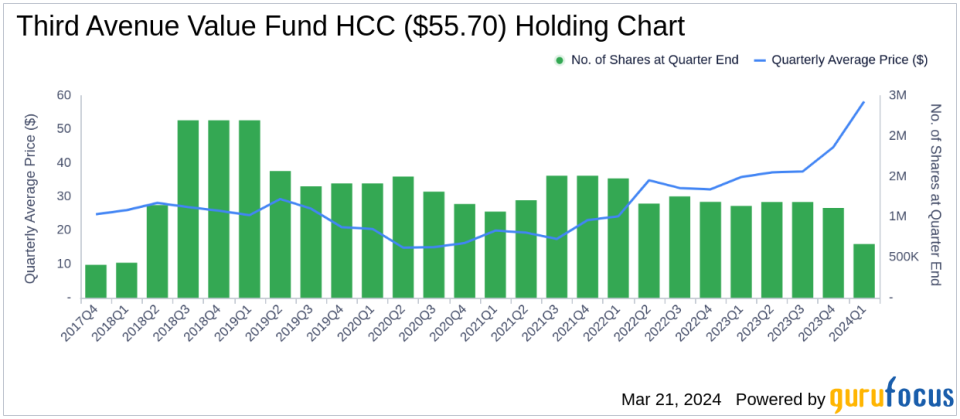

Warrior Met Coal Inc (NYSE:HCC) saw a reduction of 446,495 shares, a -40.16% decrease, affecting the portfolio by -4.08%. The stock's average trading price was $58.27 during the quarter, with a -7.09% return over the past three months and -6.42% year-to-date.

Tidewater Inc (NYSE:TDW) was reduced by 106,287 shares, a -19.21% decrease, impacting the portfolio by -1.36%. The stock traded at an average price of $64.87 during the quarter, returning 26.02% over the past three months and 24.60% year-to-date.

Portfolio Overview and Sector Allocation

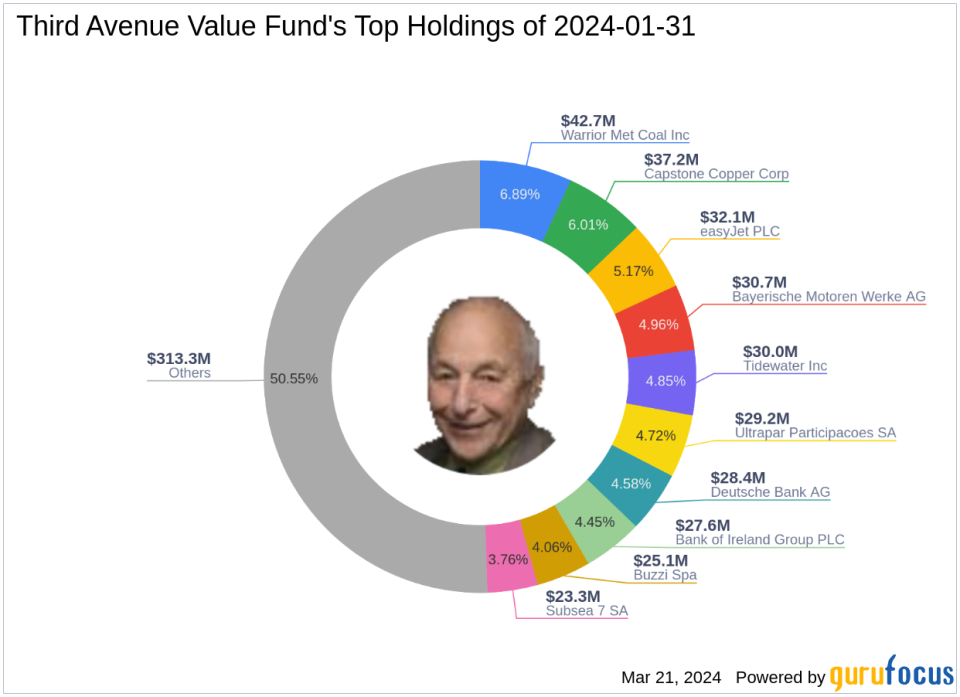

As of the first quarter of 2024, Third Avenue Value Fund (Trades, Portfolio)'s portfolio comprises 29 stocks. The top holdings include 6.89% in Warrior Met Coal Inc (NYSE:HCC), 6.01% in Capstone Copper Corp (TSX:CS), 5.17% in easyJet PLC (LSE:EZJ), 4.96% in Bayerische Motoren Werke AG (XTER:BMW), and 4.85% in Tidewater Inc (NYSE:TDW).

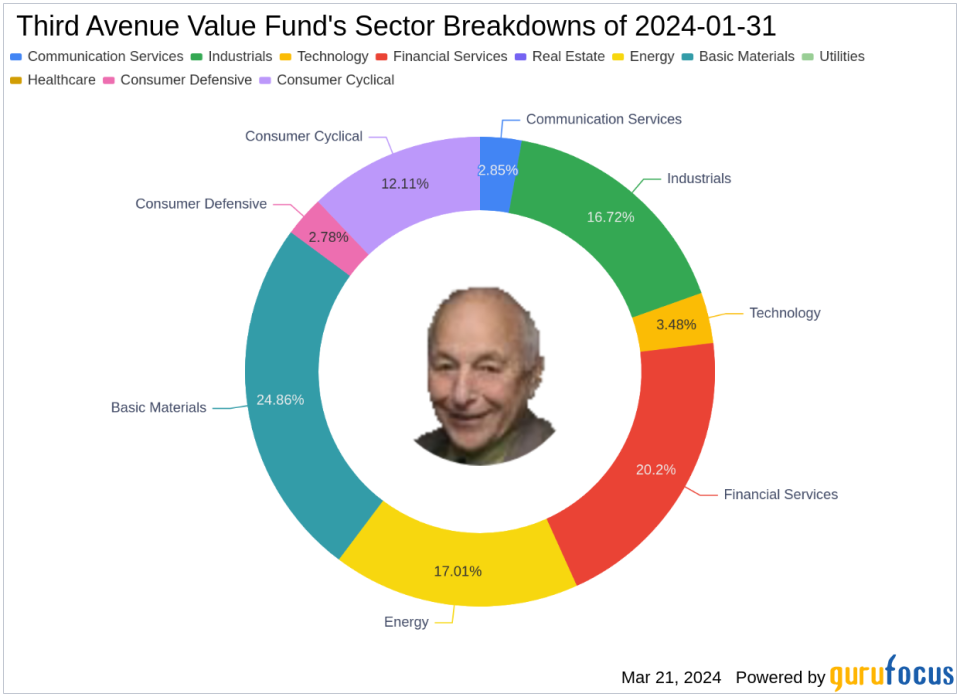

The fund's investments are primarily concentrated in eight industries out of the eleven total sectors: Basic Materials, Financial Services, Energy, Industrials, Consumer Cyclical, Technology, Communication Services, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.