Third Coast Bancshares Inc (TCBX) Reports Record 2023 Earnings, Net Income Surges 79%

Total Assets: Increased by 16.5% to $4.40 billion as of December 31, 2023.

Gross Loans: Grew by 17.1% to $3.64 billion as of December 31, 2023.

Deposits: Increased by 17.5% to $3.80 billion as of December 31, 2023.

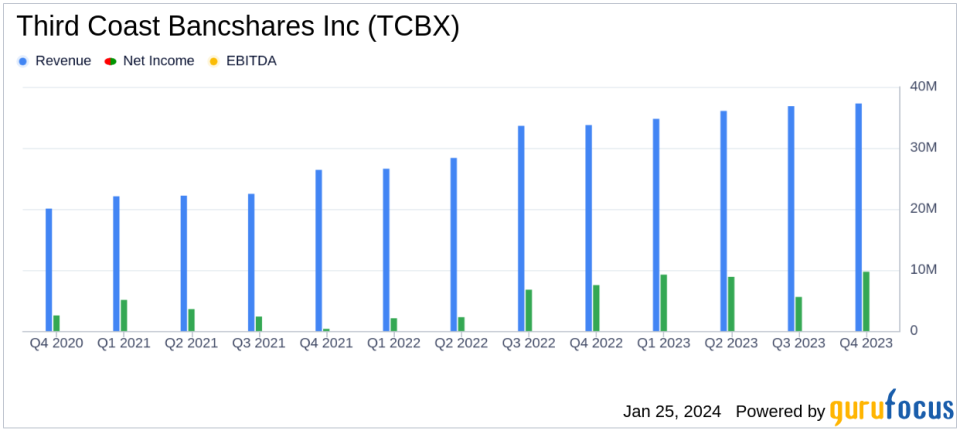

Net Income: Totaled $33.4 million for the year ended December 31, 2023, up 79% from the previous year.

Earnings Per Share (EPS): $1.98 per diluted share for the year ended December 31, 2023, compared to $1.25 per diluted share for 2022.

On January 25, 2024, Third Coast Bancshares Inc (NASDAQ:TCBX) released its 8-K filing, detailing a record financial performance for the fourth quarter and full year of 2023. The bank holding company, which operates primarily in Texas' largest metropolitan areas, reported significant growth in assets, loans, and deposits, alongside a substantial increase in net income.

Third Coast Bancshares Inc is a bank holding company that provides commercial banking solutions to small and medium-sized businesses and professionals. With a network of branches across the Greater Houston, Dallas-Fort Worth, and Austin-San Antonio markets, the company has established a strong presence in the region.

Financial Performance and Challenges

The company's performance in 2023 was marked by a 9.7% increase in tangible book value and a 9.0% growth in year-over-year book value. Despite challenges such as a sluggish economy and continuous interest rate hikes, Third Coast Bancshares Inc managed to enhance operational efficiencies and manage expenses effectively, leading to a record 79% increase in net income over the previous year.

These achievements are particularly noteworthy for a bank of Third Coast's size and market focus, as they demonstrate the company's ability to navigate economic headwinds and capitalize on growth opportunities within the banking industry.

Key Financial Metrics

Third Coast Bancshares Inc's balance sheet reflects robust growth, with total assets reaching $4.40 billion, an increase of 16.5% compared to the previous year. Gross loans saw a 17.1% increase to $3.64 billion, and deposits grew by 17.5% to $3.80 billion. The company's net interest margin for the fourth quarter stood at 3.61%, with a net interest income of $37.3 million, marking a 16.1% increase from the same quarter in 2022.

Net income for the fourth quarter was reported at $9.7 million, or $0.57 per diluted share, compared to $5.6 million, or $0.32 per diluted share, for the third quarter of 2023. For the full year, net income reached $33.4 million, or $1.98 per diluted share, representing a significant increase from the $18.7 million, or $1.25 per diluted share, recorded in 2022.

"We are very pleased with our fourth quarter and full year 2023 results," said Bart Caraway, Chairman, President, and CEO of Third Coast. "Despite headwinds that included a lackluster economy and persistent interest rate hikes, the Third Coast team worked diligently to boost profitability by managing expenses and enhancing operational efficiencies. These efforts resulted in record performance, particularly, a 79% increase in net income over 2022."

Noninterest income for the fourth quarter of 2023 totaled $2.2 million, while noninterest expense decreased to $26.4 million from $27.5 million in the previous quarter. The efficiency ratio improved to 66.89% for the fourth quarter of 2023, compared to 74.07% for the third quarter.

Analysis of Company's Performance

Third Coast Bancshares Inc's performance in 2023 underscores the company's resilience and strategic focus on growth. The significant increase in net income and the growth in key balance sheet metrics reflect the company's ability to leverage its market position and operational strengths to deliver value to shareholders. The company's focus on innovation and customer service is expected to continue driving growth and profitability in the coming year.

For more detailed information on Third Coast Bancshares Inc's financial results, including the full income statement and balance sheet, investors are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Third Coast Bancshares Inc for further details.

This article first appeared on GuruFocus.