Thor Explorations (CVE:THX) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Thor Explorations (CVE:THX). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Thor Explorations

Thor Explorations' Improving Profits

Over the last three years, Thor Explorations has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Thor Explorations has grown its trailing twelve month EPS from US$0.032 to US$0.034, in the last year. That's a modest gain of 5.4%.

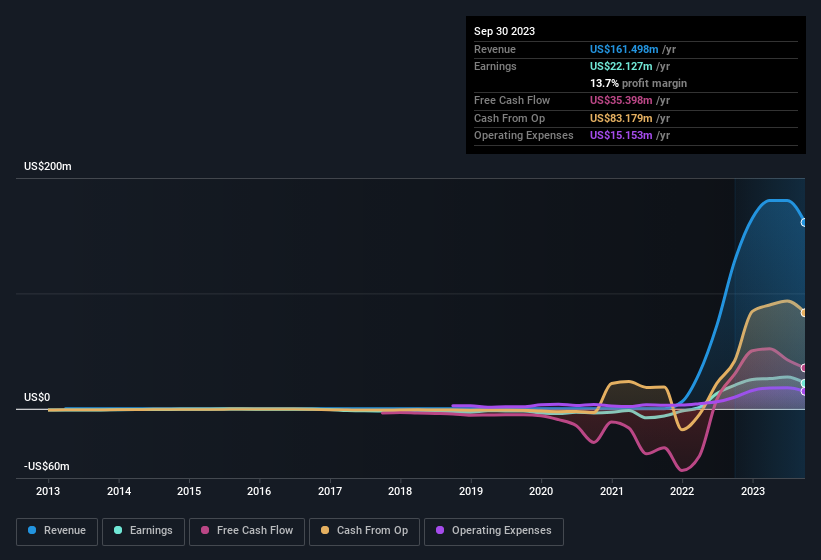

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Thor Explorations remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 26% to US$161m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Thor Explorations isn't a huge company, given its market capitalisation of CA$151m. That makes it extra important to check on its balance sheet strength.

Are Thor Explorations Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Thor Explorations is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Specifically, the President, Olusegun Lawson, accumulated US$1.9m worth of shares at a price of US$0.29. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

Is Thor Explorations Worth Keeping An Eye On?

As previously touched on, Thor Explorations is a growing business, which is encouraging. Not every business can grow its EPS, but Thor Explorations certainly can. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Thor Explorations is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Thor Explorations, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.