Thor Industries Inc's Dividend Analysis

Insights into Thor Industries Inc's Dividend Performance and Sustainability

Thor Industries Inc(NYSE:THO) recently announced a dividend of $0.48 per share, payable on 2024-01-11, with the ex-dividend date set for 2023-12-27. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Thor Industries Inc's dividend performance and assess its sustainability.

What Does Thor Industries Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

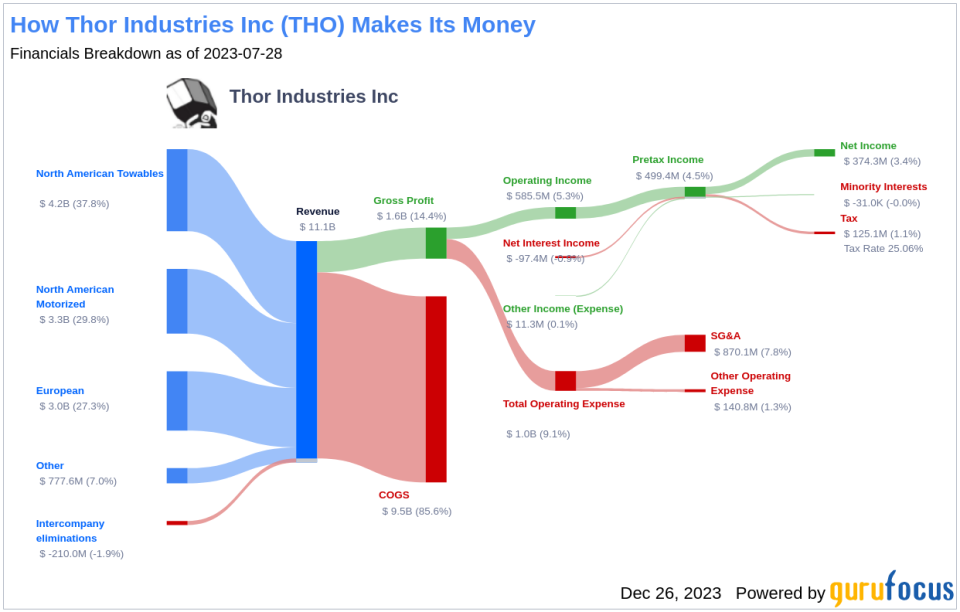

Based in Elkhart, Indiana, Thor Industries manufactures a broad range of recreational vehicles (RVs), including Class A, B, and C motorhomes, travel trailers, and fifth wheel towables across over 30 brands. The acquisition of Erwin Hymer in 2019 expanded Thor Industries Inc's global presence, enabling it to cater to the European market with a variety of RV-related products and services. Additionally, the acquisition of Airxcel in 2021 has allowed Thor Industries Inc to venture into the aftermarket component parts sector, although it currently represents a smaller portion of the company's overall sales. In fiscal 2023, Thor Industries Inc wholesaled 187,015 units and generated over $11.1 billion in revenue.

A Glimpse at Thor Industries Inc's Dividend History

Thor Industries Inc has maintained a consistent dividend payment record since 1987, with dividends distributed quarterly. The company has achieved the prestigious status of a dividend aristocrat by increasing its dividend annually since 1988a testament to its commitment to returning value to shareholders for over 35 years. Below is a chart showing annual Dividends Per Share to track historical trends.

Breaking Down Thor Industries Inc's Dividend Yield and Growth

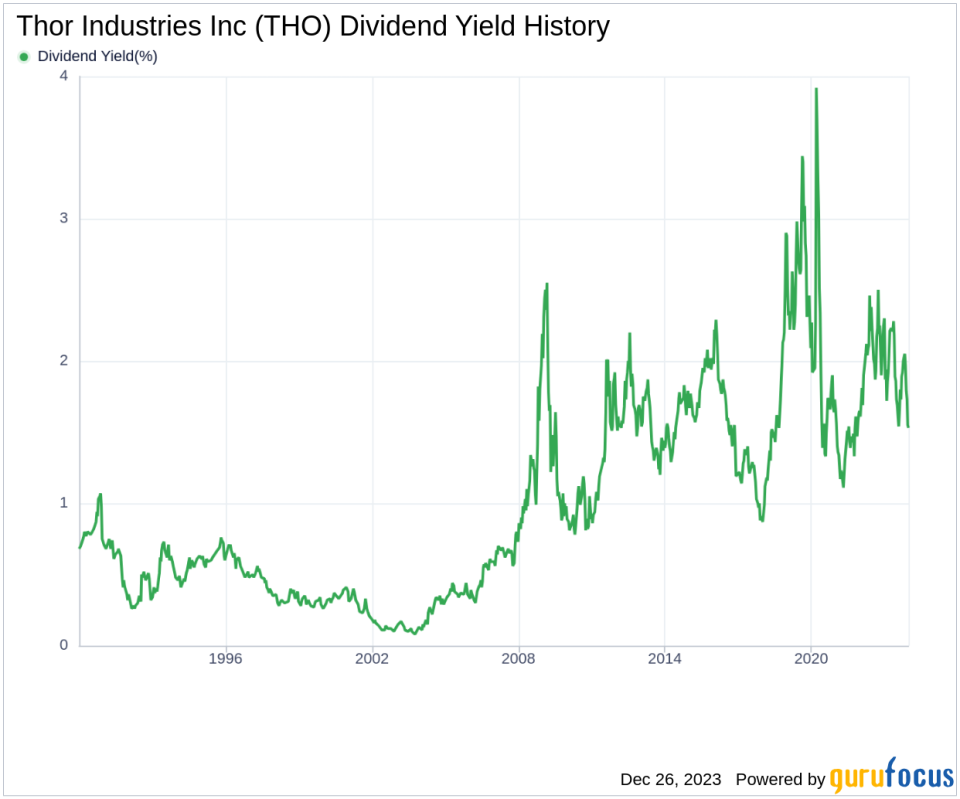

As of today, Thor Industries Inc boasts a 12-month trailing dividend yield of 1.53% and a forward dividend yield of 1.61%, indicating anticipated growth in dividend payments over the next year. Over the past three years, the annual dividend growth rate was 4.00%, which decreased slightly to 3.80% over a five-year period. However, looking at the past decade, Thor Industries Inc's dividends per share have grown at an annual rate of 8.60%. As of today, the 5-year yield on cost for Thor Industries Inc stock is approximately 1.84%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is crucial for evaluating dividend sustainability. Thor Industries Inc's dividend payout ratio stands at 0.34 as of 2023-10-31, indicating a healthy balance between distributing earnings and retaining funds for growth and stability. Thor Industries Inc's profitability rank is an impressive 9 out of 10, reflecting strong earnings potential compared to its peers. The company has also consistently reported positive net income over the past decade, solidifying its robust profitability.

Growth Metrics: The Future Outlook

Thor Industries Inc's growth rank of 9 out of 10 points to a favorable growth trajectory. The company's revenue per share and 3-year revenue growth rate signify a potent revenue model, with an average annual increase of 11.90%, outperforming approximately 67.86% of global competitors. Thor Industries Inc's 3-year EPS growth rate of 18.60% per year and 5-year EBITDA growth rate of 15.90% further demonstrate its capacity for earnings growth, outperforming 62.21% and 74.69% of global competitors, respectively.

Engaging Conclusion: Dividend Prospects and Investment Considerations

Thor Industries Inc's consistent dividend growth, prudent payout ratio, strong profitability, and solid growth metrics paint a promising picture for investors seeking reliable dividend income. The company's ability to increase dividends while investing in future growth indicates a sustainable dividend policy that can appeal to value investors. As Thor Industries Inc continues to navigate the dynamic RV market, its financial health and strategic initiatives suggest it is well-positioned to maintain its dividend aristocrat status. For investors, the question remains: will Thor Industries Inc's robust dividend performance continue to drive shareholder value in the evolving economic landscape?

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.