Those who invested in BrightSpire Capital (NYSE:BRSP) a year ago are up 119%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the BrightSpire Capital, Inc. (NYSE:BRSP) share price has soared 110% return in just a single year. Meanwhile the share price is 1.2% higher than it was a week ago. In contrast, the longer term returns are negative, since the share price is 53% lower than it was three years ago.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for BrightSpire Capital

BrightSpire Capital wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year BrightSpire Capital saw its revenue shrink by 41%. So we would not have expected the share price to rise 110%. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

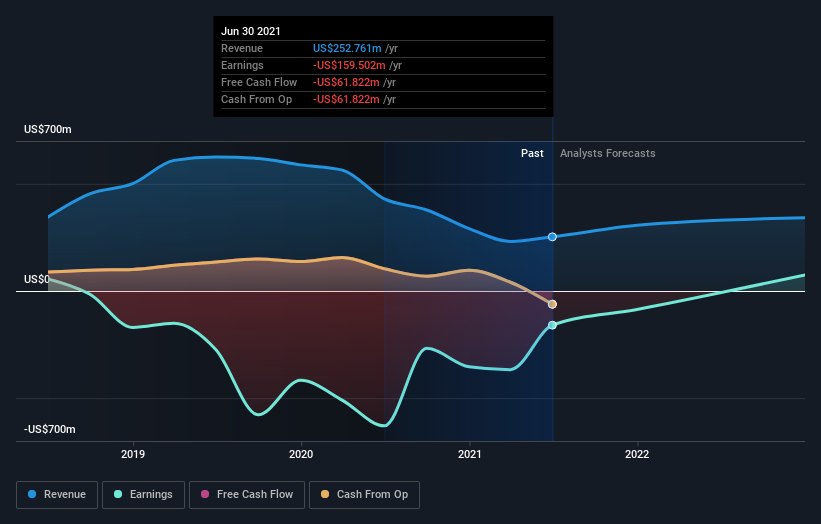

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on BrightSpire Capital

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, BrightSpire Capital's TSR for the last 1 year was 119%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that BrightSpire Capital shareholders have gained 119% (in total) over the last year. That includes the value of the dividend. What is absolutely clear is that is far preferable to the dismal 12% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand BrightSpire Capital better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with BrightSpire Capital .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.