Those who invested in MedMira (CVE:MIR) three years ago are up 800%

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is MedMira Inc. (CVE:MIR), which saw its share price soar 800% in three years. Better yet, the share price has risen 8.0% in the last week. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Anyone who held for that rewarding ride would probably be keen to talk about it.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for MedMira

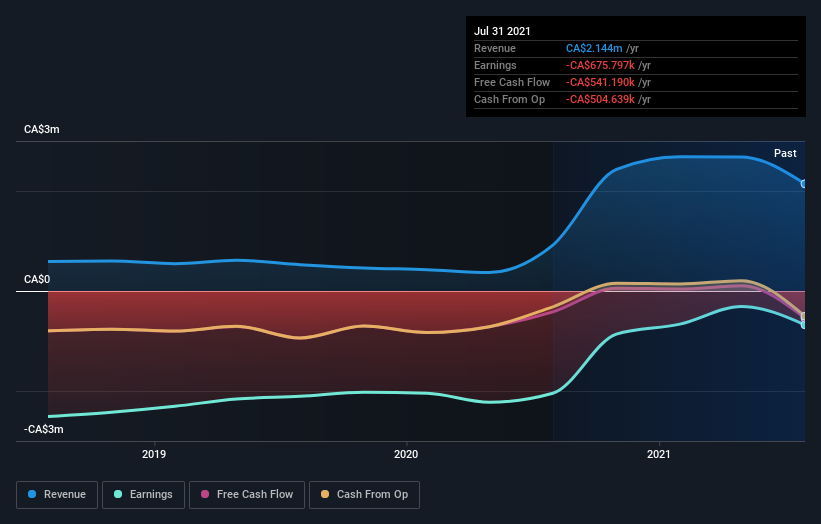

MedMira wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

MedMira's revenue trended up 66% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 108% per year, over the same period. Despite the strong run, top performers like MedMira have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on MedMira's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MedMira shareholders are down 48% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 35% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that MedMira is showing 5 warning signs in our investment analysis , and 2 of those are significant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.