Those who invested in scPharmaceuticals (NASDAQ:SCPH) five years ago are up 62%

scPharmaceuticals Inc. (NASDAQ:SCPH) shareholders might be concerned after seeing the share price drop 23% in the last quarter. But the silver lining is the stock is up over five years. However we are not very impressed because the share price is only up 62%, less than the market return of 92%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 45% decline over the last twelve months.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for scPharmaceuticals

Given that scPharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years scPharmaceuticals saw its revenue grow at 101% per year. Even measured against other revenue-focussed companies, that's a good result. It's nice to see shareholders have made a profit, but the gain of 10% over the period isn't that impressive compared to the overall market. You could argue the market is still pretty skeptical, given the growing revenues. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

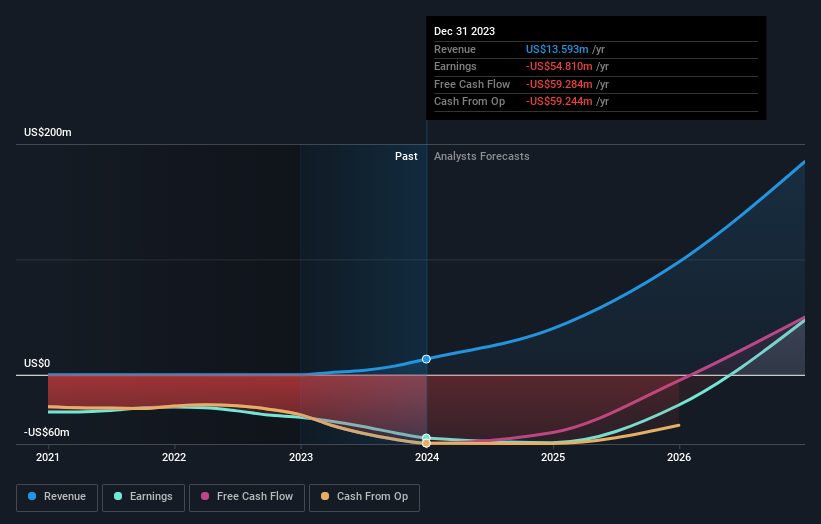

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at scPharmaceuticals' financial health with this free report on its balance sheet.

A Different Perspective

Investors in scPharmaceuticals had a tough year, with a total loss of 45%, against a market gain of about 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.