Those who invested in Tile Shop Holdings (NASDAQ:TTSH) three years ago are up 151%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the Tile Shop Holdings, Inc. (NASDAQ:TTSH) share price is 131% higher than it was three years ago. Most would be happy with that. It's also good to see the share price up 19% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Tile Shop Holdings

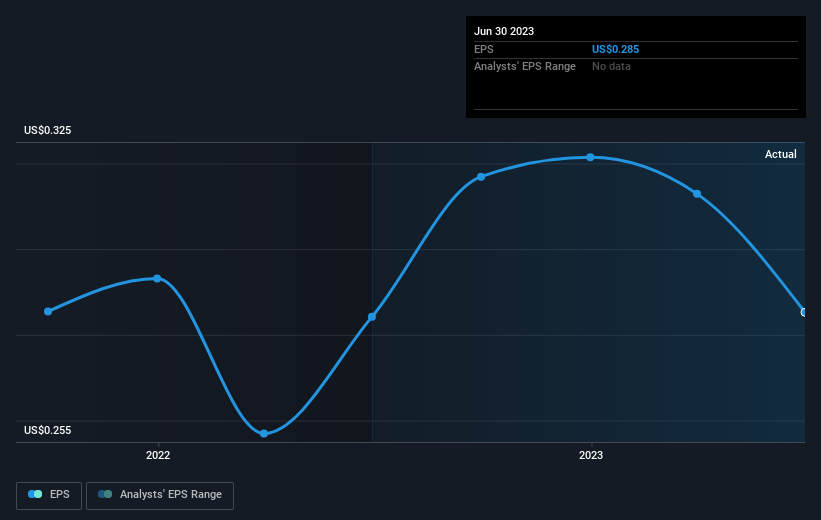

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Tile Shop Holdings became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Tile Shop Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tile Shop Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Tile Shop Holdings' TSR of 151% over the last 3 years is better than the share price return.

A Different Perspective

It's nice to see that Tile Shop Holdings shareholders have received a total shareholder return of 48% over the last year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how Tile Shop Holdings scores on these 3 valuation metrics.

Of course Tile Shop Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.